Answered step by step

Verified Expert Solution

Question

1 Approved Answer

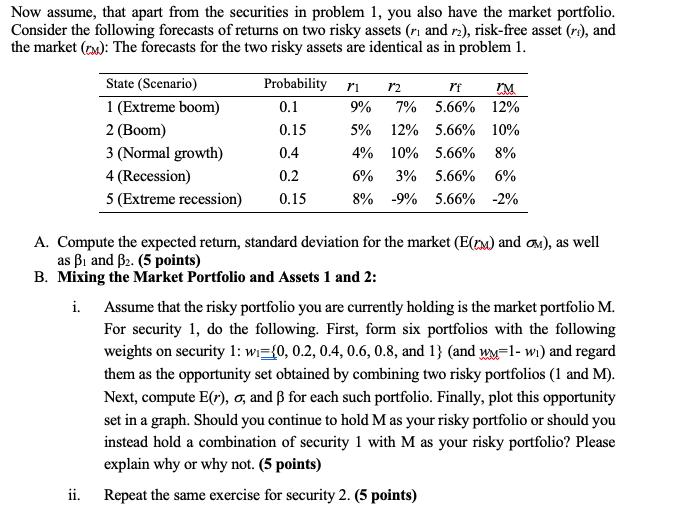

Now assume, that apart from the securities in problem 1, you also have the market portfolio. Consider the following forecasts of returns on two

Now assume, that apart from the securities in problem 1, you also have the market portfolio. Consider the following forecasts of returns on two risky assets (r and r2), risk-free asset (r), and the market (): The forecasts for the two risky assets are identical as in problem 1. State (Scenario) 1 (Extreme boom) 2 (Boom) Probability 0.1 0.15 3 (Normal growth) 0.4 4 (Recession) 0.2 5 (Extreme recession) 0.15 ii. ri 12 rf KM 9% 7% 5.66% 12% 5% 12% 5.66% 10% 10% 5.66% 8% 4% 6% 3% 5.66% 6% 8% -9% 5.66% -2% A. Compute the expected return, standard deviation for the market (E(M) and M), as well as B and 3. (5 points) B. Mixing the Market Portfolio and Assets 1 and 2: i. Assume that the risky portfolio you are currently holding is the market portfolio M. For security 1, do the following. First, form six portfolios with the following weights on security 1: w-10, 0.2, 0.4, 0.6, 0.8, and 1} (and WM-1-wi) and regard them as the opportunity set obtained by combining two risky portfolios (1 and M). Next, compute E(r), o, and for each such portfolio. Finally, plot this opportunity set in a graph. Should you continue to hold M as your risky portfolio or should you instead hold a combination of security 1 with M as your risky portfolio? Please explain why or why not. (5 points) Repeat the same exercise for security 2. (5 points)

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

solution EB B Na KR Page 1 ER EB B ER A first we compute expected return with the help o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started