Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use style analysis to examine the performance of the following portfolio from (1/1/2008-1/1/2018) using monthly data: T. Rowe Price Diversified Small-Cap Growth (PRDSX) When

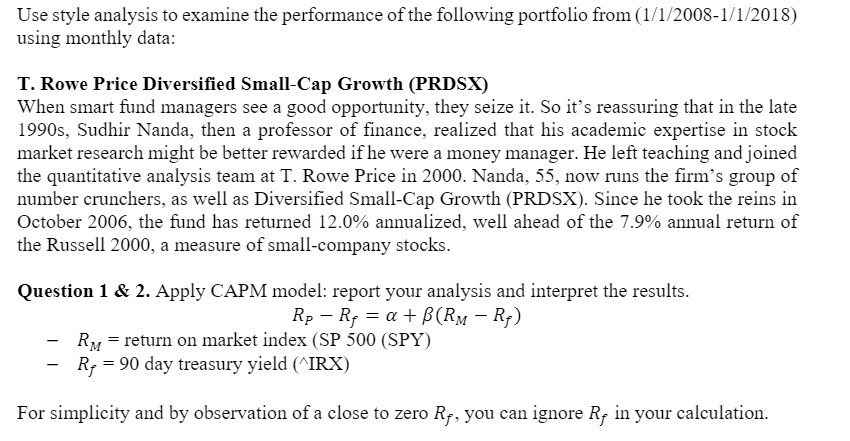

Use style analysis to examine the performance of the following portfolio from (1/1/2008-1/1/2018) using monthly data: T. Rowe Price Diversified Small-Cap Growth (PRDSX) When smart fund managers see a good opportunity, they seize it. So it's reassuring that in the late 1990s, Sudhir Nanda, then a professor of finance, realized that his academic expertise in stock market research might be better rewarded if he were a money manager. He left teaching and joined the quantitative analysis team at T. Rowe Price in 2000. Nanda, 55, now runs the firm's group of number crunchers, as well as Diversified Small-Cap Growth (PRDSX). Since he took the reins in October 2006, the fund has returned 12.0% annualized, well ahead of the 7.9% annual return of the Russell 2000, a measure of small-company stocks. Question 1 & 2. Apply CAPM model: report your analysis and interpret the results. Rp Ra(RM - Rf) - RM = return on market index (SP 500 (SPY) Rf = 90 day treasury yield (^IRX) For simplicity and by observation of a close to zero Rf, you can ignore Rf in your calculation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the performance of the T Rowe Price Diversified SmallCap Growth PRDSX fund using the CAPM ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started