Answered step by step

Verified Expert Solution

Question

1 Approved Answer

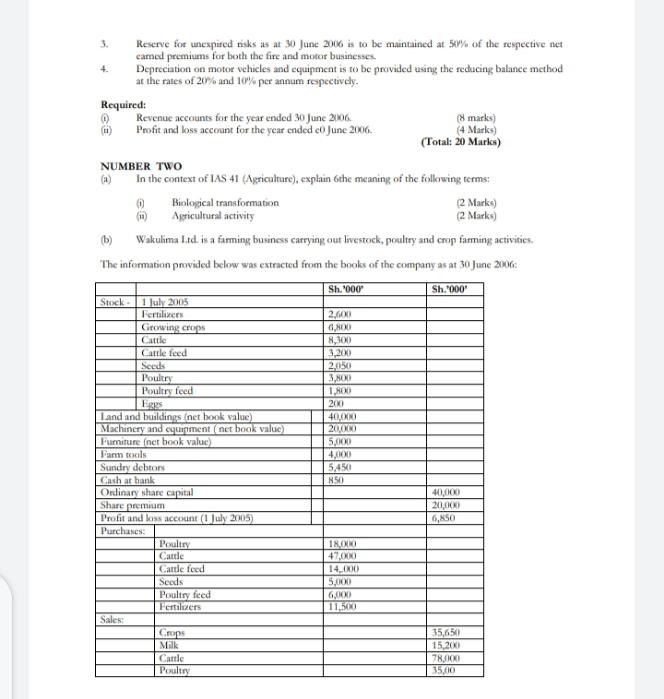

3. Reserve for unexpired risks as at 30 June 2006 is to be maintained at 50% of the respective net camned premiums for both

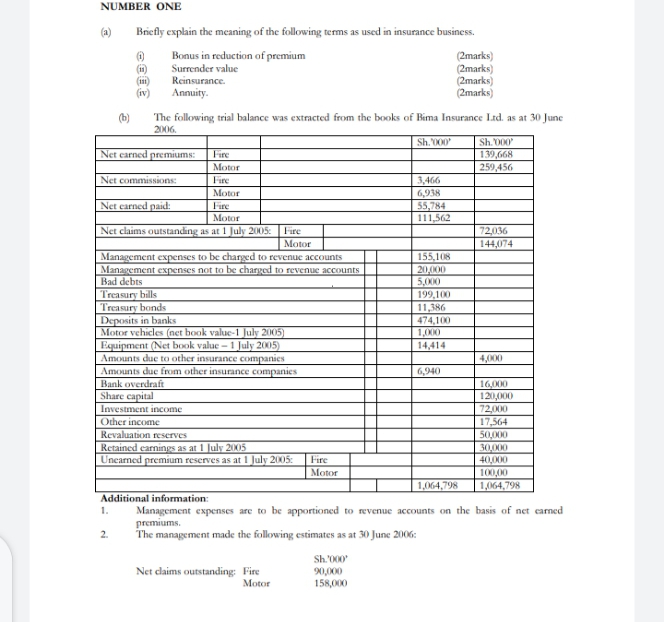

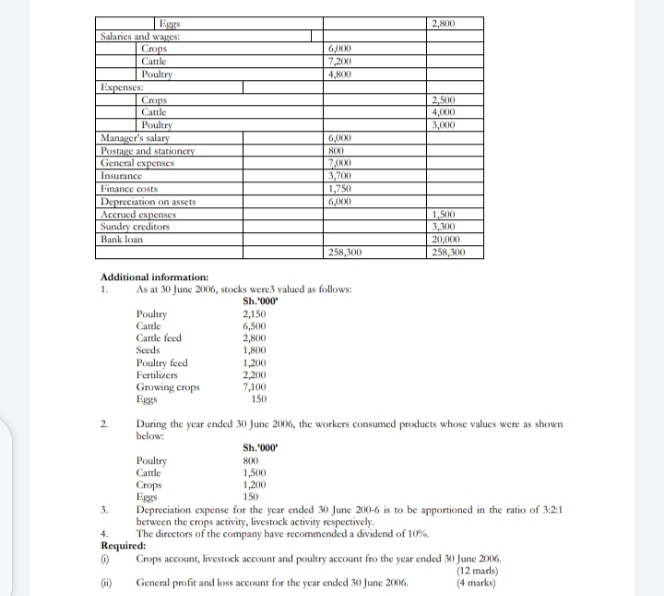

3. Reserve for unexpired risks as at 30 June 2006 is to be maintained at 50% of the respective net camned premiums for both the fire and motor businesses. 4. Depreciation on motor vehicles and equipment is to be provided using the reducing balance method at the rates of 20% and 10% per annum respectively. Required: (ii) Revenue accounts for the year ended 30 June 2006. Profit and loss account for the year ended e0 June 2006. (8 marks) (4 Marks) (Total: 20 Marks) NUMBER TWO In the context of IAS 41 (Agriculture), explain 6the meaning of the following terms: (a) (6) Biological transformation (15) Agricultural activity (2 Marks) (2 Marks) (b) Wakulima Ltd. is a farming business carrying out livestock, poultry and crop farming activities. The information provided below was extracted from the books of the company as at 30 June 2006: Sh.'000' Sh.'000' Stock- 1 July 2005 Fertilizers Growing crops Cattle Cattle feed Seeds Poultry Poultry feed Eggs 2,600 6,800 8,300 3,200 2,050 3,800 1,800 200 Land and buildings (net book value) Machinery and equipment (net book value) Furniture (net book value) 40,000 20,000 5,000 Farm tools Sundry debtors Cash at bank Ordinary share capital Share premium 4,000 5,450 850 40,000 20,000 Profit and loss account (1 July 2005) Purchases: 6,850 Poultry 18,000 Cattle 47,000 Cattle feed 14,000 Seeds 5,000 Poultry feed 6,000 Fertilizers 11,500 Sales: Crops 35,650 Milk Cattle Poultry 15,200 78,000 35,00 NUMBER ONE (a) Briefly explain the meaning of the following terms as used in insurance business. (i) Bonus in reduction of premium (2marks) (11) Surrender value (2marks) (111) Reinsurance. (2marks) (iv) Annuity. (2marks) (b) The following trial balance was extracted from the books of Bima Insurance Ltd. as at 30 June 2006. Sh.'000' Sh.'000' Net earned premiums: Fire 139,668 Motor 259,456 Net commissions: Fire 3,466 Motor 6,938 Net earned paid: Fire 55,784 Motor 111,562 Net claims outstanding as at 1 July 2005: Fire Management expenses to be charged to revenue accounts Management expenses not to be charged to revenue accounts Bad debts Treasury bills 72,036 Motor 144,074 155,108 20,000 5,000 199,100 Treasury bonds 11,386 Deposits in banks | Motor vehicles (net book value-1 July 2005) Equipment (Net book value - 1 July 2005) Amounts due to other insurance companies Amounts due from other insurance companies Bank overdraft 474,100 1,000 14,414 4,000 6,940 16,000 Share capital Investment income Other income Revaluation reserves Retained earnings as at 1 July 2005 Unearned premium reserves as at 1 July 2005: Fire Motor 120,000 72,000 17,564 50,000 30,000 40,000 100,00 1,064,798 1,064,798 1. Additional information: Management expenses are to be apportioned to revenue accounts on the basis of net carned premiums. 2. The management made the following estimates as at 30 June 2006: Sh.'000' Net claims outstanding: Fire 90,000 Motor 158,000 Eggs 2,800 Salaries and wages: Crops Cattle Poultry Expenses: Crops Cattle Poultry 6,000 7,200 4,800 2,500 4,000 3,000 Manager's salary Postage and stationery 6,000 800 General expenses 7,000 Insurance 3,700 Finance costs 1,750 Depreciation on assets 6,000 Accrued expenses 1,500 Sundry creditors 3,300 Bank loan 20,000 258,300 258,300 Additional information: 1. As at 30 June 2006, stocks were3 valued as follows: Sh.'000' Poultry 2,150 Cattle 6,500 Cattle feed 2,800 Seeds 1,800 Poultry feed 1,200 Fertilizers 2,200 Growing crops 7,100 Eggs 150 2. During the year ended 30 June 2006, the workers consumed products whose values were as shown below: Poultry Cattle Crops Sh.'000' 800 1,500 1,200 150 3. 4. Eggs Depreciation expense for the year ended 30 June 200-6 is to be apportioned in the ratio of 3:2:1 between the crops activity, livestock activity respectively. The directors of the company have recommended a dividend of 10%. Required: Crops account, livestock account and poultry account fro the year ended (ii) General profit and loss account for the year ended 30 June 2006. 30 June 2006. (12 marls) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started