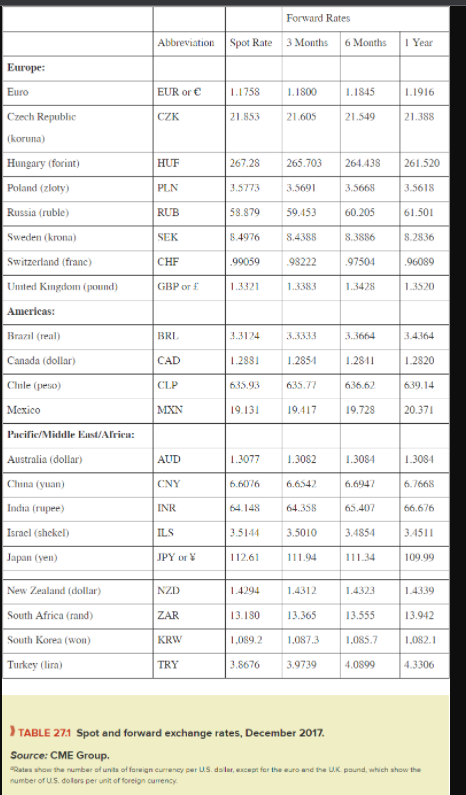

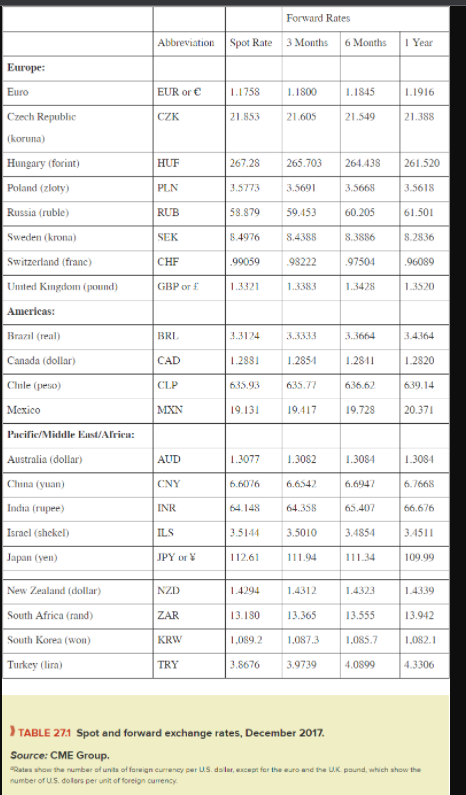

Use Table 27.1 to answer the following questions: a. How many Japanese yen do you get for your dollar? (Round your answer to 2 decimal places.) b. What is the three-month forward rate for yen? (Round your answer to 2 decimal places.) c. Is the yen at a forward discount or premium on the dollar? d. Use the one-year forward rate to calculate the annual percentage discount or premium on yen. (Enter your answer as a positive value. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) e. If the one-year interest rate on dollars is 2.5% annually compounded, what do you think is the one-year interest rate on yen? (Do not round intermediate calculations. Enter your answer as a percent rounded to 4 decimal places.) f. According to the expectations theory, what is the expected spot rate for yen in three months' time? (Round your answer to 2 decimal places.) g. According to purchasing power parity theory, what then is the expected difference in the three-month rate of price inflation in the United States and Japan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places. Enter your answer as a positive value.) * a Amount b. Forward rate c. Yen is at a forward 112.61 111.94 premium on the dollar d. Annual percentage premium % e Interest rate % f. Expected spot rate g. Inflation in Japan over the 3 months is expected to be % less than the United States. Forward Rates Spot Rate 3 Months 6 Months Abbreviation 1 Year Europe: Euro EUR or 1.1758 1.1800 1.1845 1.1916 21.388 CZK 21.853 21.605 21.549 HUF 267.28 265.703 264.438 261.520 PLN 3.5773 3.5691 3.5668 3.5618 RUB 58.879 59.453 60.205 61.501 SEK 8.4976 8.4388 8.3886 8.2836 Czech Republic (koruna) Hungary (forint) Poland (zloty) Russia (ruble) Sweden (krona) Switzerland (franc) United Kingdom (pound) Americas: Brazil (real) Canada (dollar) Chile (peso) CHF 99059 98222 97504 96089 GBP or 1.3321 1.3383 1.3428 1.3520 BRL 3.3124 3.3333 3.3664 3.4364 CAD 1.2881 1.2851 1.2811 1.2820 CLP 635.93 635.77 636.62 639.14 Mexico MXN 19.131 19.417 19.728 20.371 Pacific/Middle East/Alrica: AUD 1.3077 1.3082 1.3084 1.3084 Australia (dollar) China (yuan) India (rupee) CNY 6.6076 6.6542 6.6947 6.7668 INR 64.148 64.358 65,407 66.676 Israel (shekel ILS 3.5144 3.5010 3.4854 3.4511 Japan (yen) JPY Or 112.61 111.94 111.34 109.99 NZD 1.4294 1.4312 1.4323 1.4339 ZAR 13.180 13.365 13.555 13.942 New Zealand dollar) South Africa (rand) South Korea (won) Turkey (lira) KRW 1.089.2 1,087.3 1,085.7 1,082.1 TRY 3.8676 3.9739 4.0899 4.3306 ) TABLE 271 Spot and forward exchange rates, December 2017. Source: CME Group Retea show the number of units of foreign currency per u.s. doler, exceer fer the euro and the UK, pound, which show the number of U.S. dolors per unit of foreign currency Use Table 27.1 to answer the following questions: a. How many Japanese yen do you get for your dollar? (Round your answer to 2 decimal places.) b. What is the three-month forward rate for yen? (Round your answer to 2 decimal places.) c. Is the yen at a forward discount or premium on the dollar? d. Use the one-year forward rate to calculate the annual percentage discount or premium on yen. (Enter your answer as a positive value. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) e. If the one-year interest rate on dollars is 2.5% annually compounded, what do you think is the one-year interest rate on yen? (Do not round intermediate calculations. Enter your answer as a percent rounded to 4 decimal places.) f. According to the expectations theory, what is the expected spot rate for yen in three months' time? (Round your answer to 2 decimal places.) g. According to purchasing power parity theory, what then is the expected difference in the three-month rate of price inflation in the United States and Japan? (Do not round intermediate calculations. Enter your answer as a percent rounded to 3 decimal places. Enter your answer as a positive value.) * a Amount b. Forward rate c. Yen is at a forward 112.61 111.94 premium on the dollar d. Annual percentage premium % e Interest rate % f. Expected spot rate g. Inflation in Japan over the 3 months is expected to be % less than the United States. Forward Rates Spot Rate 3 Months 6 Months Abbreviation 1 Year Europe: Euro EUR or 1.1758 1.1800 1.1845 1.1916 21.388 CZK 21.853 21.605 21.549 HUF 267.28 265.703 264.438 261.520 PLN 3.5773 3.5691 3.5668 3.5618 RUB 58.879 59.453 60.205 61.501 SEK 8.4976 8.4388 8.3886 8.2836 Czech Republic (koruna) Hungary (forint) Poland (zloty) Russia (ruble) Sweden (krona) Switzerland (franc) United Kingdom (pound) Americas: Brazil (real) Canada (dollar) Chile (peso) CHF 99059 98222 97504 96089 GBP or 1.3321 1.3383 1.3428 1.3520 BRL 3.3124 3.3333 3.3664 3.4364 CAD 1.2881 1.2851 1.2811 1.2820 CLP 635.93 635.77 636.62 639.14 Mexico MXN 19.131 19.417 19.728 20.371 Pacific/Middle East/Alrica: AUD 1.3077 1.3082 1.3084 1.3084 Australia (dollar) China (yuan) India (rupee) CNY 6.6076 6.6542 6.6947 6.7668 INR 64.148 64.358 65,407 66.676 Israel (shekel ILS 3.5144 3.5010 3.4854 3.4511 Japan (yen) JPY Or 112.61 111.94 111.34 109.99 NZD 1.4294 1.4312 1.4323 1.4339 ZAR 13.180 13.365 13.555 13.942 New Zealand dollar) South Africa (rand) South Korea (won) Turkey (lira) KRW 1.089.2 1,087.3 1,085.7 1,082.1 TRY 3.8676 3.9739 4.0899 4.3306 ) TABLE 271 Spot and forward exchange rates, December 2017. Source: CME Group Retea show the number of units of foreign currency per u.s. doler, exceer fer the euro and the UK, pound, which show the number of U.S. dolors per unit of foreign currency