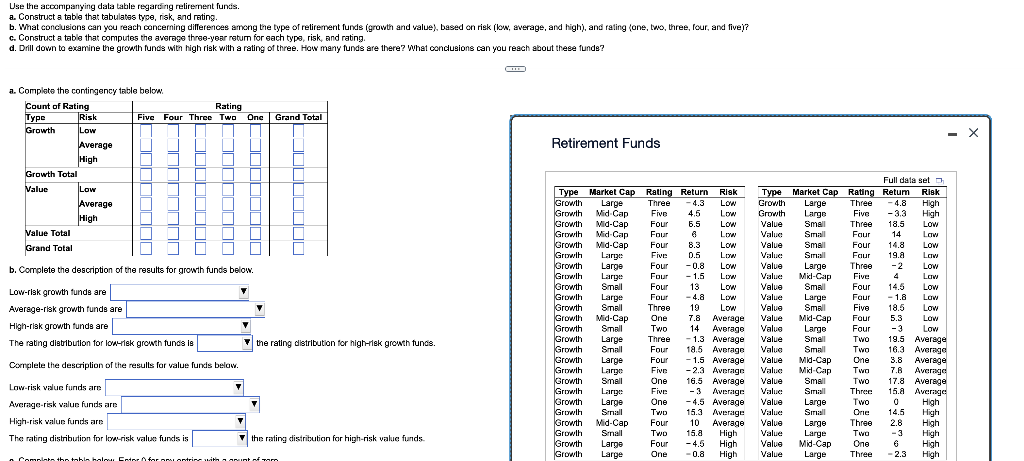

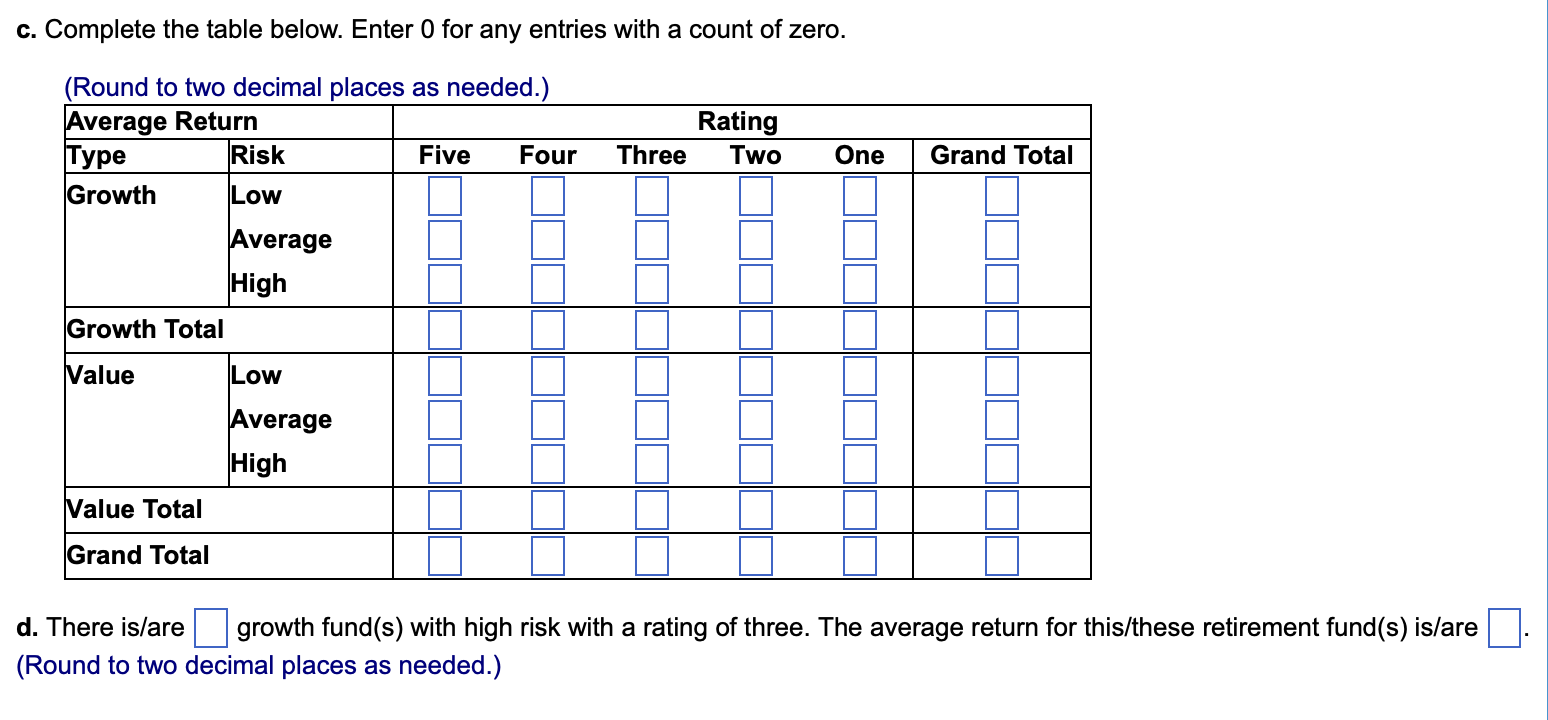

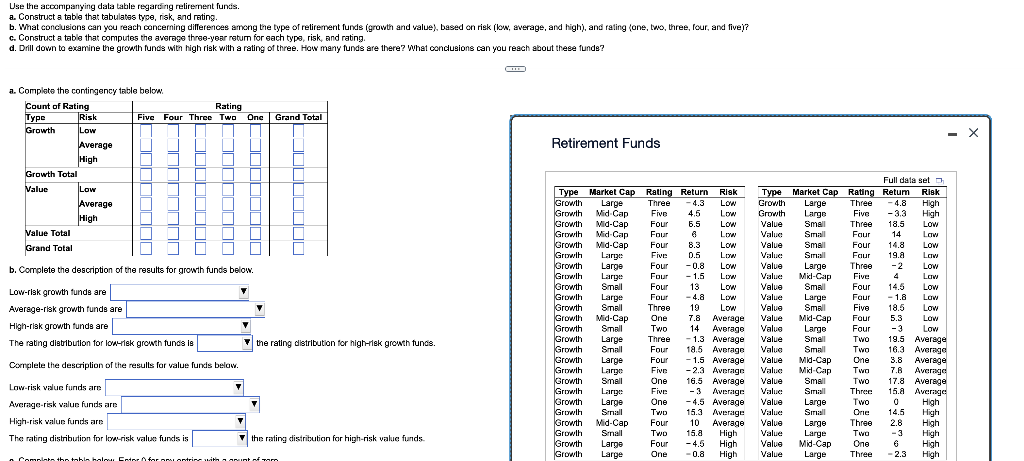

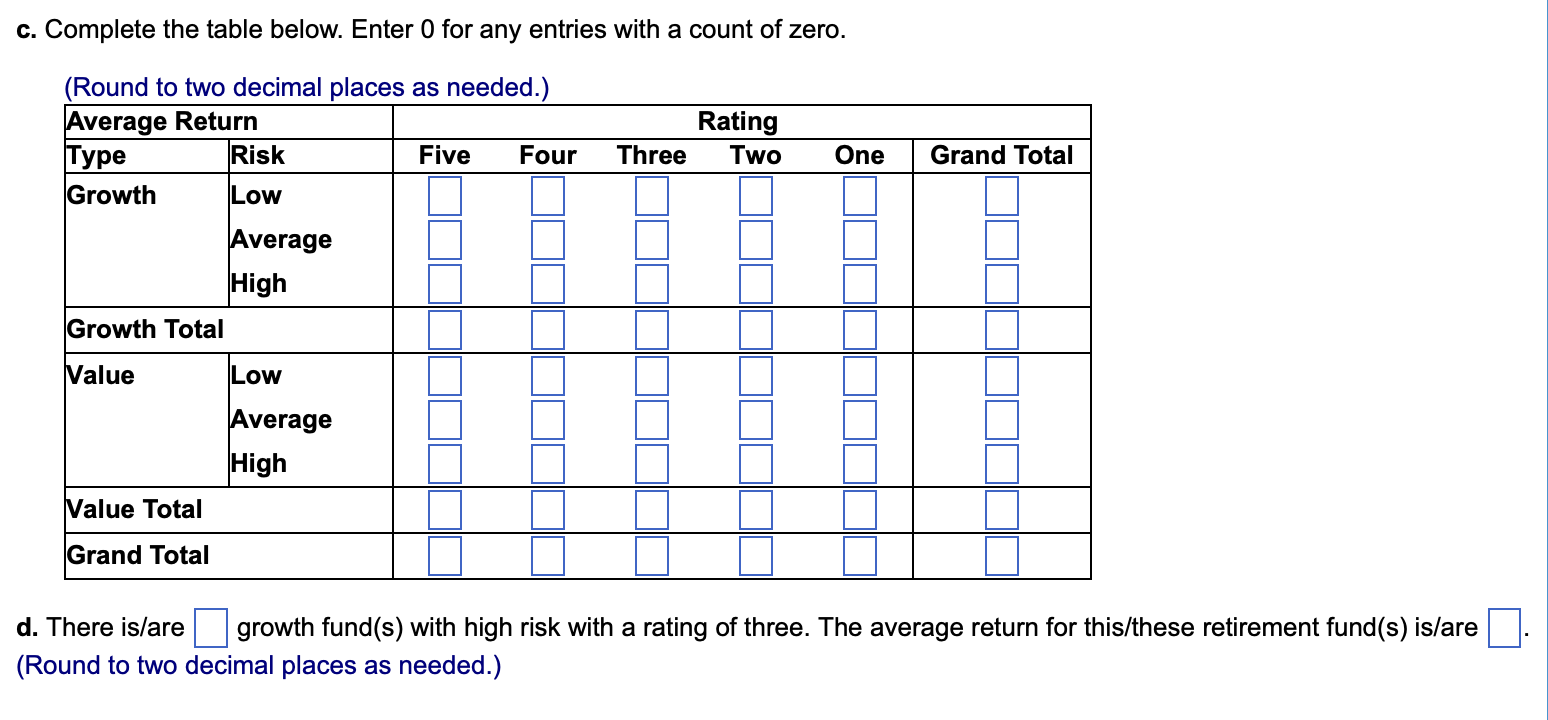

Use the acoompanying dala table regarding relirement funds. a. Construct a tabli that tabulates type, risk, end reting. b. What conclusions can you reach concerning differences ameng the type of retirement funds (growth and value), based on risk (bew, average, and high), and fating (ane, two, three, four, and five)? c. Conistrut a table that computes the averege three-year retum for each type, risk, and rating. d. Drill down to examine the growth funds witn high risk with a rating of three. How many funds are there? what conctusions can you reach about theee funde? a. Complate the contingency table below. Retirement Funds b. Complete the description of the results for growth funds beiow. Low-rlsk growth funds are Aversge-rlsk growth funde a High-rlsk growth funds are The rating distibution for lon-riek growth funds is the rating dlstribution for high-risk growth funcs. Complete the descriplion of the resulls for value funds below. Low-risk valuc funds are Average-risk value funds a High-risk value funds are The rating distribution for leen-risk value funds is the rating distritbution for high-risk value funds. c. Complete the table below. Enter 0 for any entries with a count of zero. (Round to two decimal nlaces as needed.) d. There is/are growth fund(s) with high risk with a rating of three. The average return for this/these retirement fund(s) is/are (Round to two decimal places as needed.) Use the acoompanying dala table regarding relirement funds. a. Construct a tabli that tabulates type, risk, end reting. b. What conclusions can you reach concerning differences ameng the type of retirement funds (growth and value), based on risk (bew, average, and high), and fating (ane, two, three, four, and five)? c. Conistrut a table that computes the averege three-year retum for each type, risk, and rating. d. Drill down to examine the growth funds witn high risk with a rating of three. How many funds are there? what conctusions can you reach about theee funde? a. Complate the contingency table below. Retirement Funds b. Complete the description of the results for growth funds beiow. Low-rlsk growth funds are Aversge-rlsk growth funde a High-rlsk growth funds are The rating distibution for lon-riek growth funds is the rating dlstribution for high-risk growth funcs. Complete the descriplion of the resulls for value funds below. Low-risk valuc funds are Average-risk value funds a High-risk value funds are The rating distribution for leen-risk value funds is the rating distritbution for high-risk value funds. c. Complete the table below. Enter 0 for any entries with a count of zero. (Round to two decimal nlaces as needed.) d. There is/are growth fund(s) with high risk with a rating of three. The average return for this/these retirement fund(s) is/are (Round to two decimal places as needed.)