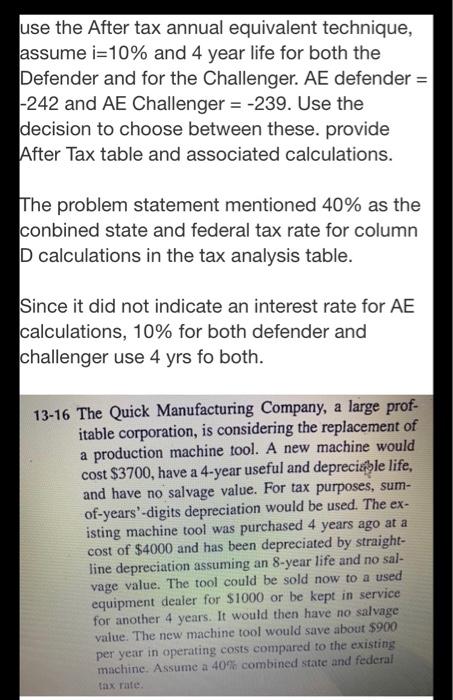

use the After tax annual equivalent technique, assume i=10% and 4 year life for both the Defender and for the Challenger. AE defender = -242 and AE Challenger = -239. Use the decision to choose between these. provide After Tax table and associated calculations. The problem statement mentioned 40% as the conbined state and federal tax rate for column D calculations in the tax analysis table. Since it did not indicate an interest rate for AE calculations, 10% for both defender and challenger use 4 yrs fo both. 13-16 The Quick Manufacturing Company, a large prof- itable corporation, is considering the replacement of a production machine tool. A new machine would cost $3700, have a 4-year useful and depreciable life, and have no salvage value. For tax purposes, sum- of-years-digits depreciation would be used. The ex- isting machine tool was purchased 4 years ago at a cost of $4000 and has been depreciated by straight- line depreciation assuming an 8-year life and no sal- vage value. The tool could be sold now to a used equipment dealer for $1000 or be kept in service for another 4 years. It would then have no salvage value. The new machine tool would save about $900 per year in operating costs compared to the existing machine. Assume a 40% combined state and federal tax rate use the After tax annual equivalent technique, assume i=10% and 4 year life for both the Defender and for the Challenger. AE defender = -242 and AE Challenger = -239. Use the decision to choose between these. provide After Tax table and associated calculations. The problem statement mentioned 40% as the conbined state and federal tax rate for column D calculations in the tax analysis table. Since it did not indicate an interest rate for AE calculations, 10% for both defender and challenger use 4 yrs fo both. 13-16 The Quick Manufacturing Company, a large prof- itable corporation, is considering the replacement of a production machine tool. A new machine would cost $3700, have a 4-year useful and depreciable life, and have no salvage value. For tax purposes, sum- of-years-digits depreciation would be used. The ex- isting machine tool was purchased 4 years ago at a cost of $4000 and has been depreciated by straight- line depreciation assuming an 8-year life and no sal- vage value. The tool could be sold now to a used equipment dealer for $1000 or be kept in service for another 4 years. It would then have no salvage value. The new machine tool would save about $900 per year in operating costs compared to the existing machine. Assume a 40% combined state and federal tax rate