Answered step by step

Verified Expert Solution

Question

1 Approved Answer

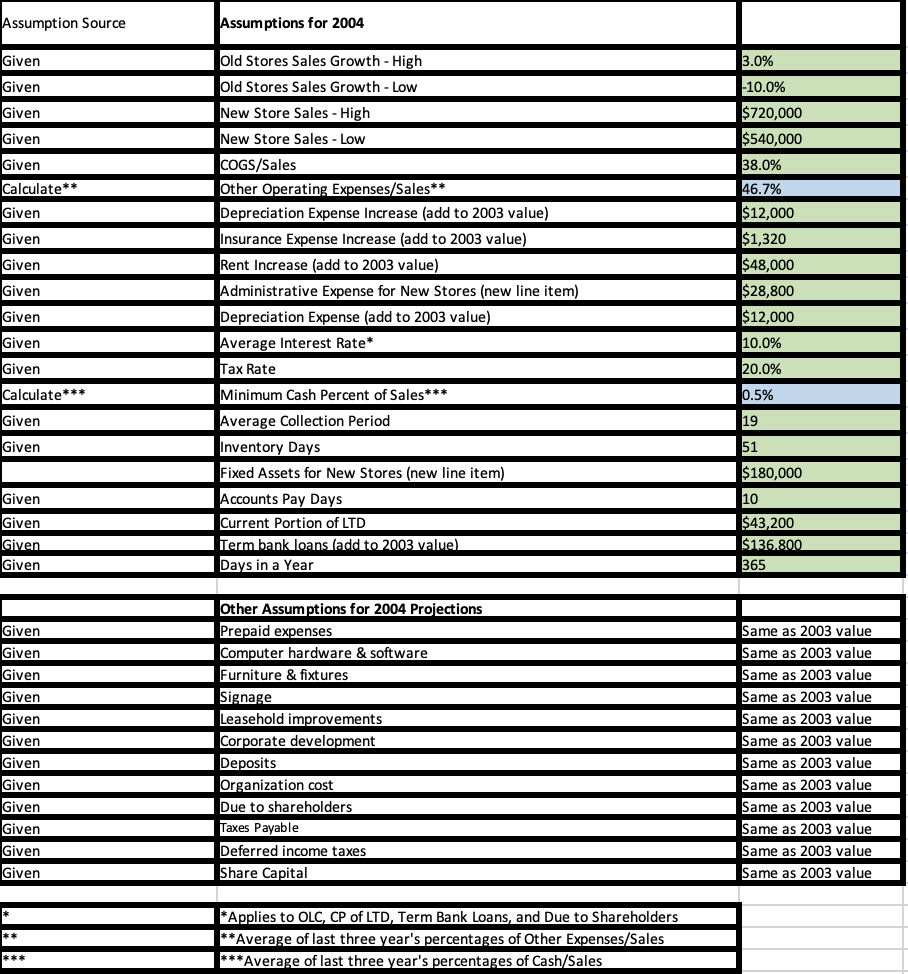

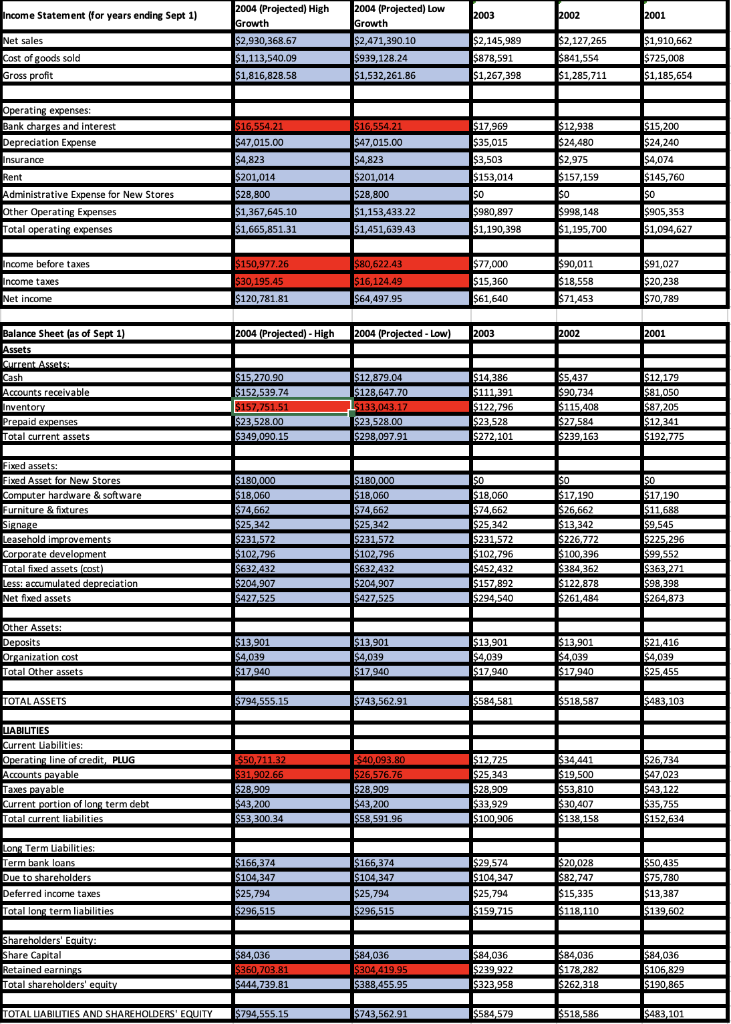

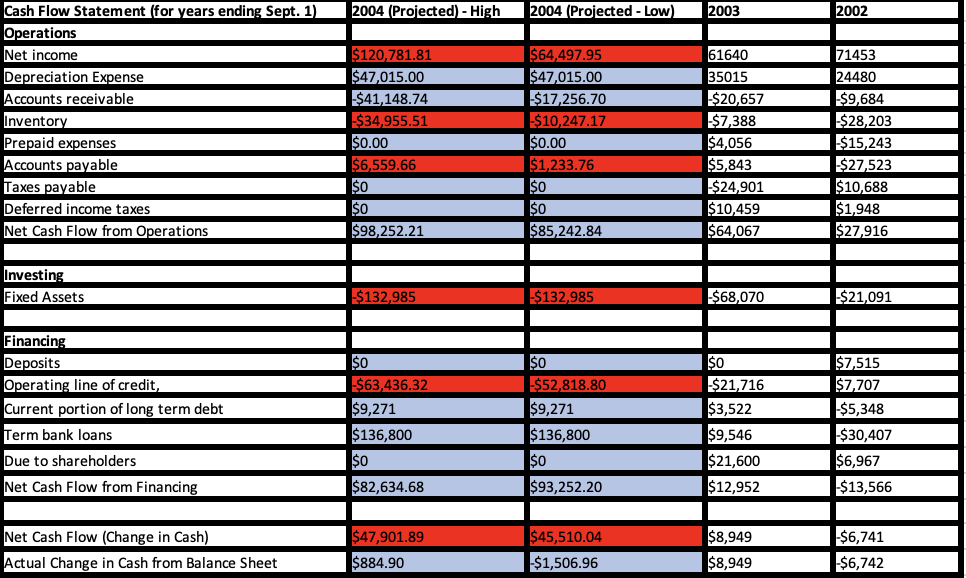

Use the assumptions given above to calculate the financial statements (the ones highlighted in red) Cash Flow Statement (for years ending Sept. 1) 2004 (Projected)

Use the assumptions given above to calculate the financial statements (the ones highlighted in red)

Cash Flow Statement (for years ending Sept. 1) 2004 (Projected) - High 2004 (Projected - Low) 2003 2002 Operations Net income $120,781.81 $64,497.95 61640 71453 Depreciation Expense $47,015.00 35015 Accounts receivable 24480 Inventory $34,955.51 $10,247.17 $7,388 Prepaid expenses $6,559.66 $1,233.76 $4,056$5,843$15,243$27,523 Accounts payable Deferred income taxes $0 $0 $24,901$10,459$10,688$1,948 Net Cash Flow from Operations $98,252.21 $0 Investing Fixed Assets $132,985 $132,985 \begin{tabular}{l|l} \hline$64,067 & $27,916 \\ \hline & \\ \hline$68,070 & $21,091 \end{tabular} Financing Deposits $7,515 Cash Flow Statement (for years ending Sept. 1) 2004 (Projected) - High 2004 (Projected - Low) 2003 2002 Operations Net income $120,781.81 $64,497.95 61640 71453 Depreciation Expense $47,015.00 35015 Accounts receivable 24480 Inventory $34,955.51 $10,247.17 $7,388 Prepaid expenses $6,559.66 $1,233.76 $4,056$5,843$15,243$27,523 Accounts payable Deferred income taxes $0 $0 $24,901$10,459$10,688$1,948 Net Cash Flow from Operations $98,252.21 $0 Investing Fixed Assets $132,985 $132,985 \begin{tabular}{l|l} \hline$64,067 & $27,916 \\ \hline & \\ \hline$68,070 & $21,091 \end{tabular} Financing Deposits $7,515

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started