Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the attached bank balance sheet and income statement to answer the following questions. 1. Analyze the bank's financial performance by answering the following

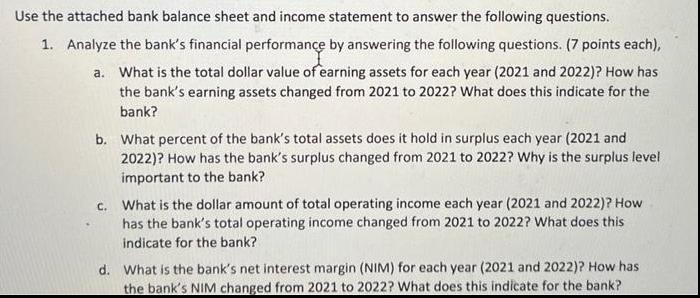

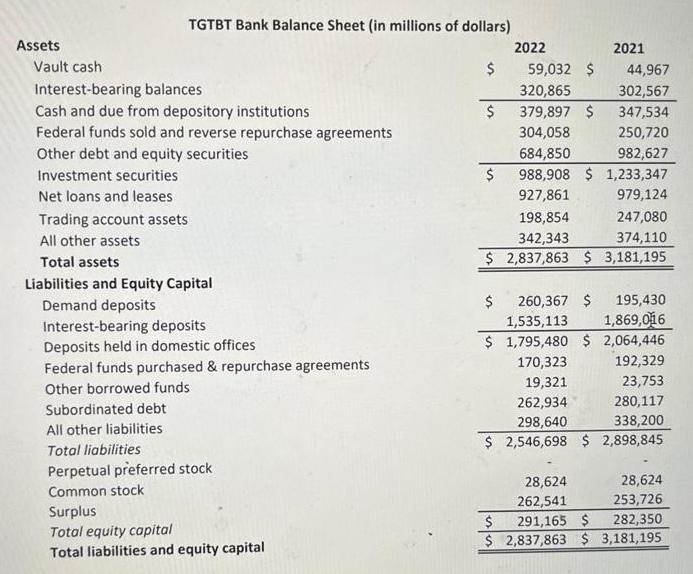

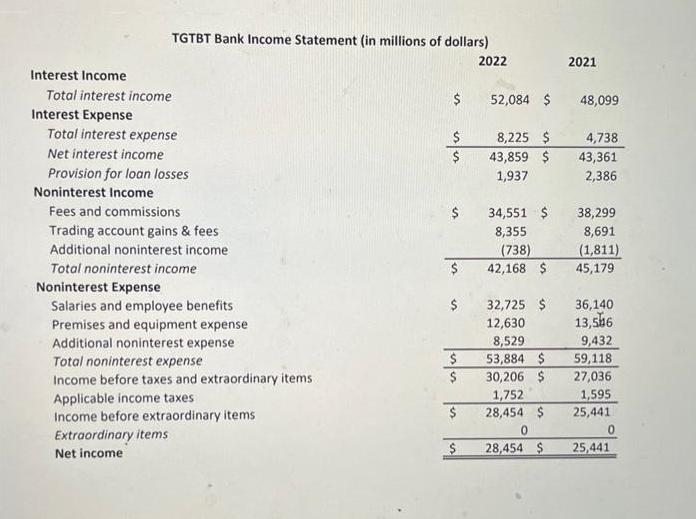

Use the attached bank balance sheet and income statement to answer the following questions. 1. Analyze the bank's financial performance by answering the following questions. (7 points each), a. What is the total dollar value of earning assets for each year (2021 and 2022)? How has the bank's earning assets changed from 2021 to 2022? What does this indicate for the bank? b. What percent of the bank's total assets does it hold in surplus each year (2021 and 2022)? How has the bank's surplus changed from 2021 to 2022? Why is the surplus level important to the bank? c. What is the dollar amount of total operating income each year (2021 and 2022)? How has the bank's total operating income changed from 2021 to 2022? What does this indicate for the bank? d. What is the bank's net interest margin (NIM) for each year (2021 and 2022)? How has the bank's NIM changed from 2021 to 2022? What does this indicate for the bank? Assets Vault cash Interest-bearing balances Cash and due from depository institutions Federal funds sold and reverse repurchase agreements Other debt and equity securities Investment securities Net loans and leases TGTBT Bank Balance Sheet (in millions of dollars) Trading account assets All other assets Total assets Liabilities and Equity Capital Demand deposits Interest-bearing deposits Deposits held in domestic offices Federal funds purchased & repurchase agreements Other borrowed funds Subordinated debt All other liabilities Total liabilities Perpetual preferred stock Common stock Surplus Total equity capital Total liabilities and equity capital $ $ $ 2022 59,032 $ $ 2021 44,967 302,567 347,534 250,720 982,627 320,865 379,897 $ 304,058 684,850 988,908 $1,233,347 927,861 979,124 247,080 374,110 198,854 342,343 $ 2,837,863 $3,181,195 260,367 $ 195,430 1,535,113 1,869,016 $ 1,795,480 $ 2,064,446 170,323 192,329 19,321 23,753 262,934 280,117 298,640 338,200 $ 2,546,698 $ 2,898,845 28,624 253,726 282,350 28,624 262,541 $ 291,165 $ $ 2,837,863 $3,181,195 Interest Income Total interest income Interest Expense TGTBT Bank Income Statement (in millions of dollars) 2022 Total interest expense Net interest income Provision for loan losses Noninterest Income Fees and commissions Trading account gains & fees Additional noninterest income Total noninterest income Noninterest Expense Salaries and employee benefits Premises and equipment expense Additional noninterest expense Total noninterest expense Income before taxes and extraordinary items. Applicable income taxes Income before extraordinary items Extraordinary items Net income $ $ $ $ $ $ 52,084 $ $ 8,225 $ 43,859 $ 1,937 $ 34,551 $ 38,299 8,355 8,691 (1,811) 45,179 (738) 42,168 $ 2021 32,725 $ 12,630 8,529 53,884 $ 30,206 $ 1,752 28,454 $ 0 28,454 $ 48,099 4,738 43,361 2,386 36,140 13,506 9,432 59,118 27,036 1,595 25,441 0 25,441

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the banks financial performance using the provided information lets answer each question one by one a What is the total dollar value of earning assets for each year 2021 and 2022 How has th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started