Answered step by step

Verified Expert Solution

Question

1 Approved Answer

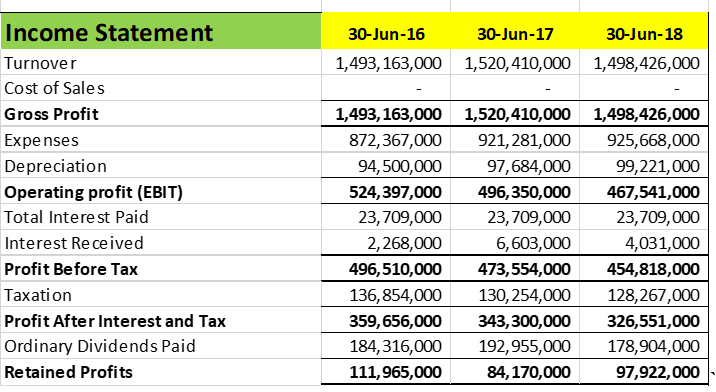

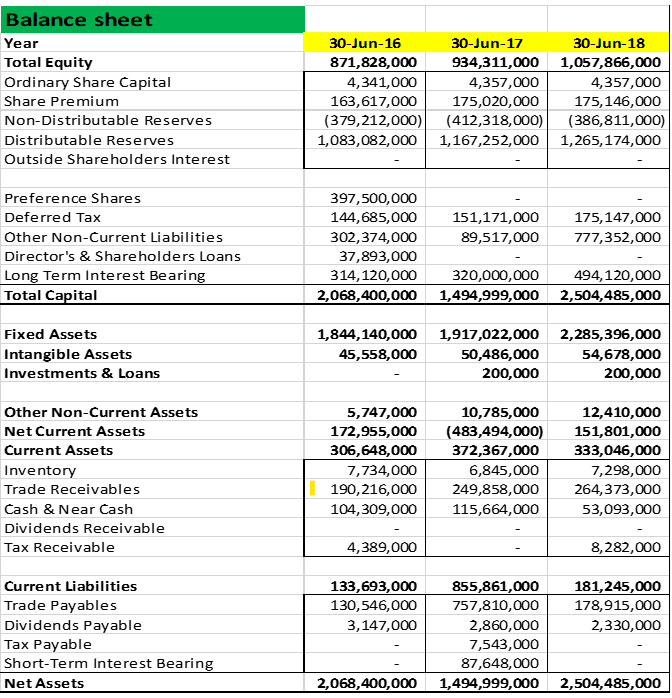

Use the attached financial statement for Justyne Pty Ltd Question: Discuss the performance of Justyne over the years 2016, 2017 and 2018. Assume that shareholders

Use the attached financial statement for Justyne Pty Ltd

Question: Discuss the performance of Justyne over the years 2016, 2017 and 2018. Assume that shareholders are expecting a minimum Return on Equity of 18% per annum. Calculate the ratios that you think you need to use to make this determination.

\begin{tabular}{|l|r|r|r|} \hline Income Statement & \multicolumn{1}{c|}{30Jun16} & 30Jun17 & \multicolumn{1}{c|}{30Jun18} \\ \hline Turnover & 1,493,163,000 & 1,520,410,000 & 1,498,426,000 \\ \hline Cost of Sales & - & - & - \\ \hline Gross Profit & 1,493,163,000 & 1,520,410,000 & 1,498,426,000 \\ \hline Expenses & 872,367,000 & 921,281,000 & 925,668,000 \\ \hline Depreciation & 94,500,000 & 97,684,000 & 99,221,000 \\ \hline Operating profit (EBIT) & 524,397,000 & 496,350,000 & 467,541,000 \\ \hline Total Interest Paid & 23,709,000 & 23,709,000 & 23,709,000 \\ \hline Interest Received & 2,268,000 & 6,603,000 & 4,031,000 \\ \hline Profit Before Tax & 496,510,000 & 473,554,000 & 454,818,000 \\ \hline Taxation & 136,854,000 & 130,254,000 & 128,267,000 \\ \hline Profit After Interest and Tax & 359,656,000 & 343,300,000 & 326,551,000 \\ \hline Ordinary Dividends Paid & 184,316,000 & 192,955,000 & 178,904,000 \\ \hline Retained Profits & 111,965,000 & 84,170,000 & 97,922,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Income Statement & \multicolumn{1}{c|}{30Jun16} & 30Jun17 & \multicolumn{1}{c|}{30Jun18} \\ \hline Turnover & 1,493,163,000 & 1,520,410,000 & 1,498,426,000 \\ \hline Cost of Sales & - & - & - \\ \hline Gross Profit & 1,493,163,000 & 1,520,410,000 & 1,498,426,000 \\ \hline Expenses & 872,367,000 & 921,281,000 & 925,668,000 \\ \hline Depreciation & 94,500,000 & 97,684,000 & 99,221,000 \\ \hline Operating profit (EBIT) & 524,397,000 & 496,350,000 & 467,541,000 \\ \hline Total Interest Paid & 23,709,000 & 23,709,000 & 23,709,000 \\ \hline Interest Received & 2,268,000 & 6,603,000 & 4,031,000 \\ \hline Profit Before Tax & 496,510,000 & 473,554,000 & 454,818,000 \\ \hline Taxation & 136,854,000 & 130,254,000 & 128,267,000 \\ \hline Profit After Interest and Tax & 359,656,000 & 343,300,000 & 326,551,000 \\ \hline Ordinary Dividends Paid & 184,316,000 & 192,955,000 & 178,904,000 \\ \hline Retained Profits & 111,965,000 & 84,170,000 & 97,922,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started