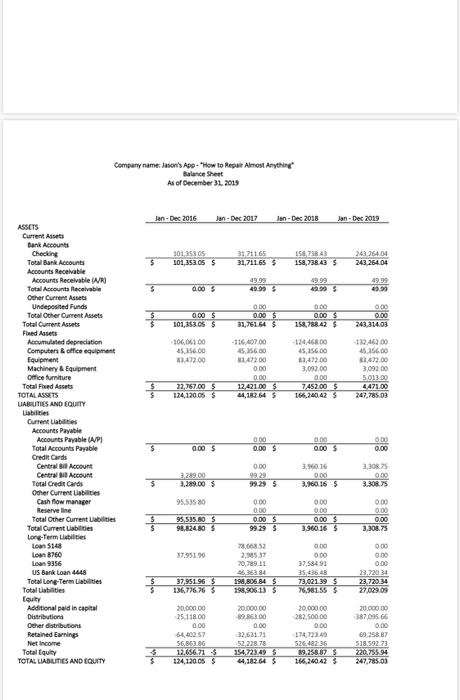

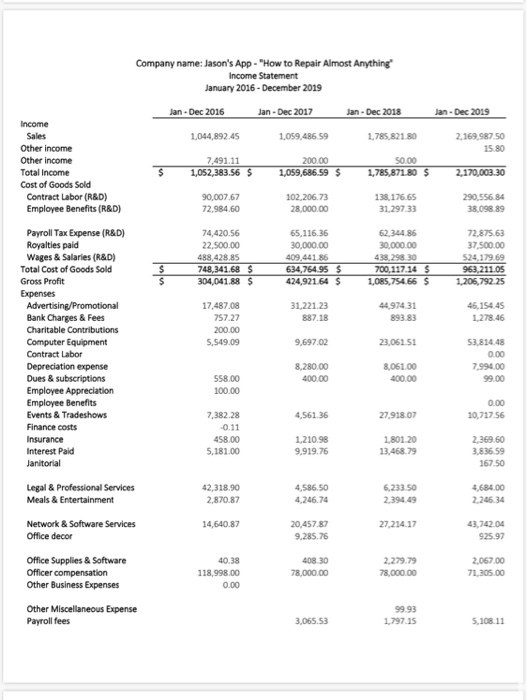

Use the attached financial statements to answer the following questions. Please use correct punctuation, spelling, and sentence format. Please create a new document for your responses (do not write your responses on this document). Note: this company makes all of it's sales by selling an App via Apple. All revenue comes from Apple, Inc 1. Calculate gross profit as a percentage of sales for each year 2016-2019. This percentage represents how much of total revenue the business still has after paying for costs of goods sold. What does the change in gross profit as a percentage of sales say about this business from year to year? 2. This business classifies a portion of wages to COGS and another portion to operating expenses. Why do you think this split is made? 3. In 2017, this company began using a subscription-based sales model. This means that customer memberships will be automatically renewed each year. Based on the financial statements, does this change seem to be working? What figures in the financials support your answer? 4. During 2017, this company had a net loss of about $52,000. The owner of this company also withdrew about $90,000 (owner distributions) throughout the year. If the company did not make a profit during the year, how does the business have enough cash to support the owner distributions? Please use detailed analysis of the balance sheet to support your answer. 5. This company does not capitalize very many fixed assets from year to year. However, the company purchases many Apple/tech products throughout the year. These products can cost anywhere between $500 to $5000. Why does the company not classify these purchases as fixed assets? 6. If sales continue to grow in the future, would you recommend that this company hire additional employees? Why or why not? 7. This company's office is in a city with a city tax based on business income generated within the city limits. Is there an argument to be made that the company should not have to pay this city tax? Is there an argument to support that they should be required to pay it? Company name: Jason's App -"How to Repair Almost Anything Balance Sheet As of December 31, 2019 Jan-Dec 2016 Jan-Dec 2017 Jan-Dec 2018 Jan-Dec 2019 $ 101 353.05 101,353.055 2171165 31,711655 158 21843 158,738.43 $ 243 264 04 243 264.04 49.99 49.99 $ 49.99 95 49.99 43.99 0.00 $ 200 0.00 $ 101,353.05$ 0.00 $ 31,761.64 $ 0.00 0.00 243, 314.00 158,788.42 $ -106,06100 45,256.00 83,472.00 -116.407.00 5.256.00 82.472.00 0.00 0.00 12,421.00 44,182.64 $ -124,468.00 45,156.00 88.472.00 3,09200 0.00 7,452.00 166.240.42 $ -12246200 45 256.00 88.472.00 3.092.00 5.013.00 4,471.00 247,785.03 22,76700 124, 1200S S 0.00 ASSETS Current Assets Bank Accounts Checking Total Bank Accounts Accounts Receivable Accounts Receivable (WR) Total Accounts receivable Other Current Assets Undeposited Funds Total Other Current Assets Total Current Assets Fred Assets Accumulated depreciation Computers & office equipment Equipment Machinery & Equipment Office furniture Total Feed Assets TOTAL ASSETS LIABILITIES AND EQUITY Liabilities Current Liabilities Accounts Payable Accounts Payable API Total Accounts Payable Credit Cards Central Bil Account Central Account Total Credit Cards Other Current Liabilities Cash flow manager Reserve line Total Other Current Liabilities Total Current Liabilides Long-Term Liabilities Loan 5148 Loan 8760 Loa 3338 US Bank Loan 4448 Total Long-Term Liabilities Total Liabilities Equity Additional paid in capital Distributions Other distributions Retained Earrings Net Income Total Equity TOTAL LIABILITIES AND EQUITY $ 0.00 0.00 $ 0.00 0.00 $ 0.00 $ 0.00 99 29 3.960.16 0.00 3.960.16 5 3.289.00 3.289.00 5 3,308.75 000 3.308.75 95.53580 0.00 0.00 0.00 $ 99.29 $ 95,535 80$ 98,824.80 $ 0.00 0.00 0.00 $ 3.960.16 $ 0.00 0.00 3.308.75 $ 37.951.96 78.668.52 2.985 37 70,789 11 46.363.84 198,806 84 $ 190,906 13 5 0.00 0.00 37,584.91 35 436 43 73.021.39 $ 76,981.55$ 0.00 0.00 0.00 23.220 23.720.34 27,029.09 $ 37,951965 136,776.765 20,000.00 -25.118.00 0.00 -64, 402.57 20,000.00 -89,863.00 0.00 -32,631.71 20,000.00 -282,500.00 0.00 174,72349 526.48236 89,258.875 166.240.42 $ 20,000.00 -387.09566 0.00 69,258.87 518.592.73 220,755.94 247,785.0) 12,656 215 124, 120.05 $ 154,72149 44,182.64 $ Company name: Jason's App - "How to Repair Almost Anything Income Statement January 2016 December 2019 Jan-Dec 2016 Jan-Dec 2017 Jan-Dec 2018 Jan-Dec 2019 1,044,892.45 1,059,486.59 1,785,821 80 2,169.987.50 15.80 Income Sales Other income Other income Total Income Cost of Goods Sold Contract Labor (R&D) Employee Benefits (R&D) 7,491.11 1,052,383.56 $ 200.00 1,059,686.59 $ 50.00 1,785,871.80 $ 2,170,003.30 90,007,67 72.984.60 102,206.73 28,000.00 138.176.65 31.297.33 290.556.84 38.098.89 74,420.56 22.500.00 488,428.85 748,341.68 $ 304,041.88 $ 65,116.36 30,000.00 409,441.86 634,764.95 $ 424,921.64 $ 62,344.86 30,000.00 433.298.30 700 117.14 $ 1,085,754.66 $ 72.875.63 37.500.00 $24.179.69 963,211.05 1,206,792.25 31,221.23 887.18 44,97431 893.83 46.154.45 1.278.46 Payroll Tax Expense (R&D) Royalties paid Wages & Salaries (R&D) Total Cost of Goods Sold Gross Profit Expenses Advertising/Promotional Bank Charges & Fees Charitable contributions Computer Equipment Contract Labor Depreciation expense Dues & subscriptions Employee Appreciation Employee Benefits Events & Tradeshows Finance costs Insurance Interest Paid Janitorial 17.487.08 757.27 200.00 5.549.09 9,697.02 8,280.00 400.00 23,06151 8,061.00 400.00 53.814.48 0.00 7,990.00 99.00 558.00 100.00 4,561.36 0.00 10,717.56 27,918.07 7,382.28 -0.11 458.00 5,181.00 1.210.98 9.919.76 1.801.20 13,468.79 2.369.60 3,836.59 167.50 42,318.90 2,870.87 4,586.50 4.246.74 6,233.50 2.394.49 4,684.00 2.246.34 14,640.87 20,457 87 9,285.76 27,234.17 43,742.04 925.97 Legal & Professional Services Meals & Entertainment Network & Software Services Office decor Office Supplies & Software Officer compensation Other Business Expenses Other Miscellaneous Expense Payroll fees 40.38 118,998.00 0.00 408.30 78,000.00 2,279.79 78,000.00 2,067.00 71,305.00 3,065.53 99.93 1.797.15 5.108.11 Payroll Tax Expense Permits & Licenses Postage 0.00 30.00 180.00 547.95 7,610.00 547,00 1,719.39 174.95 5,548.64 1.979.84 120.58 12,764.00 10,176.00 0.00 545 17 13.200.00 40.00 728 95 13.200.00 148.00 558.80 821.15 0.00 1,214.00 4.49 1,076.27 150.00 158.80 Professional Development QuickBooks Payments Fees Rent & Lease Repairs & Maintenance Shipping, Freight & Delivery Software & consumables Taxes & Licenses Telephone expense Uncategorized Expense Utilities Wages & Salaries Total Expenses Net Operating Income Other Expenses Penalties Total Other Expenses Net Other Income Net Income Travel 13,045,50 26,413.36 14.620.93 5,853.00 3,517.00 0.00 0.00 5,497.56 258,422.00 477,150.42 $ 52.228.78 $ 5.834 29 267,724.00 559.272.30 $ 526,482.36 $ 247,178.02 $ 56,863.86 $ 6.080.45 393,361,39 688,190.42 518,601.83 $ $ $ 0.00 $ 0.00 $ 56,863.86 $ 0.00 $ 0.00 $ 52,228.78 $ 0.00 $ 0.00 $ 526,482.36 $ 9.10 9.10 9.10 518,592.73 Use the attached financial statements to answer the following questions. Please use correct punctuation, spelling, and sentence format. Please create a new document for your responses (do not write your responses on this document). Note: this company makes all of it's sales by selling an App via Apple. All revenue comes from Apple, Inc 1. Calculate gross profit as a percentage of sales for each year 2016-2019. This percentage represents how much of total revenue the business still has after paying for costs of goods sold. What does the change in gross profit as a percentage of sales say about this business from year to year? 2. This business classifies a portion of wages to COGS and another portion to operating expenses. Why do you think this split is made? 3. In 2017, this company began using a subscription-based sales model. This means that customer memberships will be automatically renewed each year. Based on the financial statements, does this change seem to be working? What figures in the financials support your answer? 4. During 2017, this company had a net loss of about $52,000. The owner of this company also withdrew about $90,000 (owner distributions) throughout the year. If the company did not make a profit during the year, how does the business have enough cash to support the owner distributions? Please use detailed analysis of the balance sheet to support your answer. 5. This company does not capitalize very many fixed assets from year to year. However, the company purchases many Apple/tech products throughout the year. These products can cost anywhere between $500 to $5000. Why does the company not classify these purchases as fixed assets? 6. If sales continue to grow in the future, would you recommend that this company hire additional employees? Why or why not? 7. This company's office is in a city with a city tax based on business income generated within the city limits. Is there an argument to be made that the company should not have to pay this city tax? Is there an argument to support that they should be required to pay it? Company name: Jason's App -"How to Repair Almost Anything Balance Sheet As of December 31, 2019 Jan-Dec 2016 Jan-Dec 2017 Jan-Dec 2018 Jan-Dec 2019 $ 101 353.05 101,353.055 2171165 31,711655 158 21843 158,738.43 $ 243 264 04 243 264.04 49.99 49.99 $ 49.99 95 49.99 43.99 0.00 $ 200 0.00 $ 101,353.05$ 0.00 $ 31,761.64 $ 0.00 0.00 243, 314.00 158,788.42 $ -106,06100 45,256.00 83,472.00 -116.407.00 5.256.00 82.472.00 0.00 0.00 12,421.00 44,182.64 $ -124,468.00 45,156.00 88.472.00 3,09200 0.00 7,452.00 166.240.42 $ -12246200 45 256.00 88.472.00 3.092.00 5.013.00 4,471.00 247,785.03 22,76700 124, 1200S S 0.00 ASSETS Current Assets Bank Accounts Checking Total Bank Accounts Accounts Receivable Accounts Receivable (WR) Total Accounts receivable Other Current Assets Undeposited Funds Total Other Current Assets Total Current Assets Fred Assets Accumulated depreciation Computers & office equipment Equipment Machinery & Equipment Office furniture Total Feed Assets TOTAL ASSETS LIABILITIES AND EQUITY Liabilities Current Liabilities Accounts Payable Accounts Payable API Total Accounts Payable Credit Cards Central Bil Account Central Account Total Credit Cards Other Current Liabilities Cash flow manager Reserve line Total Other Current Liabilities Total Current Liabilides Long-Term Liabilities Loan 5148 Loan 8760 Loa 3338 US Bank Loan 4448 Total Long-Term Liabilities Total Liabilities Equity Additional paid in capital Distributions Other distributions Retained Earrings Net Income Total Equity TOTAL LIABILITIES AND EQUITY $ 0.00 0.00 $ 0.00 0.00 $ 0.00 $ 0.00 99 29 3.960.16 0.00 3.960.16 5 3.289.00 3.289.00 5 3,308.75 000 3.308.75 95.53580 0.00 0.00 0.00 $ 99.29 $ 95,535 80$ 98,824.80 $ 0.00 0.00 0.00 $ 3.960.16 $ 0.00 0.00 3.308.75 $ 37.951.96 78.668.52 2.985 37 70,789 11 46.363.84 198,806 84 $ 190,906 13 5 0.00 0.00 37,584.91 35 436 43 73.021.39 $ 76,981.55$ 0.00 0.00 0.00 23.220 23.720.34 27,029.09 $ 37,951965 136,776.765 20,000.00 -25.118.00 0.00 -64, 402.57 20,000.00 -89,863.00 0.00 -32,631.71 20,000.00 -282,500.00 0.00 174,72349 526.48236 89,258.875 166.240.42 $ 20,000.00 -387.09566 0.00 69,258.87 518.592.73 220,755.94 247,785.0) 12,656 215 124, 120.05 $ 154,72149 44,182.64 $ Company name: Jason's App - "How to Repair Almost Anything Income Statement January 2016 December 2019 Jan-Dec 2016 Jan-Dec 2017 Jan-Dec 2018 Jan-Dec 2019 1,044,892.45 1,059,486.59 1,785,821 80 2,169.987.50 15.80 Income Sales Other income Other income Total Income Cost of Goods Sold Contract Labor (R&D) Employee Benefits (R&D) 7,491.11 1,052,383.56 $ 200.00 1,059,686.59 $ 50.00 1,785,871.80 $ 2,170,003.30 90,007,67 72.984.60 102,206.73 28,000.00 138.176.65 31.297.33 290.556.84 38.098.89 74,420.56 22.500.00 488,428.85 748,341.68 $ 304,041.88 $ 65,116.36 30,000.00 409,441.86 634,764.95 $ 424,921.64 $ 62,344.86 30,000.00 433.298.30 700 117.14 $ 1,085,754.66 $ 72.875.63 37.500.00 $24.179.69 963,211.05 1,206,792.25 31,221.23 887.18 44,97431 893.83 46.154.45 1.278.46 Payroll Tax Expense (R&D) Royalties paid Wages & Salaries (R&D) Total Cost of Goods Sold Gross Profit Expenses Advertising/Promotional Bank Charges & Fees Charitable contributions Computer Equipment Contract Labor Depreciation expense Dues & subscriptions Employee Appreciation Employee Benefits Events & Tradeshows Finance costs Insurance Interest Paid Janitorial 17.487.08 757.27 200.00 5.549.09 9,697.02 8,280.00 400.00 23,06151 8,061.00 400.00 53.814.48 0.00 7,990.00 99.00 558.00 100.00 4,561.36 0.00 10,717.56 27,918.07 7,382.28 -0.11 458.00 5,181.00 1.210.98 9.919.76 1.801.20 13,468.79 2.369.60 3,836.59 167.50 42,318.90 2,870.87 4,586.50 4.246.74 6,233.50 2.394.49 4,684.00 2.246.34 14,640.87 20,457 87 9,285.76 27,234.17 43,742.04 925.97 Legal & Professional Services Meals & Entertainment Network & Software Services Office decor Office Supplies & Software Officer compensation Other Business Expenses Other Miscellaneous Expense Payroll fees 40.38 118,998.00 0.00 408.30 78,000.00 2,279.79 78,000.00 2,067.00 71,305.00 3,065.53 99.93 1.797.15 5.108.11 Payroll Tax Expense Permits & Licenses Postage 0.00 30.00 180.00 547.95 7,610.00 547,00 1,719.39 174.95 5,548.64 1.979.84 120.58 12,764.00 10,176.00 0.00 545 17 13.200.00 40.00 728 95 13.200.00 148.00 558.80 821.15 0.00 1,214.00 4.49 1,076.27 150.00 158.80 Professional Development QuickBooks Payments Fees Rent & Lease Repairs & Maintenance Shipping, Freight & Delivery Software & consumables Taxes & Licenses Telephone expense Uncategorized Expense Utilities Wages & Salaries Total Expenses Net Operating Income Other Expenses Penalties Total Other Expenses Net Other Income Net Income Travel 13,045,50 26,413.36 14.620.93 5,853.00 3,517.00 0.00 0.00 5,497.56 258,422.00 477,150.42 $ 52.228.78 $ 5.834 29 267,724.00 559.272.30 $ 526,482.36 $ 247,178.02 $ 56,863.86 $ 6.080.45 393,361,39 688,190.42 518,601.83 $ $ $ 0.00 $ 0.00 $ 56,863.86 $ 0.00 $ 0.00 $ 52,228.78 $ 0.00 $ 0.00 $ 526,482.36 $ 9.10 9.10 9.10 518,592.73