Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the attached grid to calculate the NPV for the project and answer the following questions NPV Superswift Fleets Superswift Fleets is considering investing in

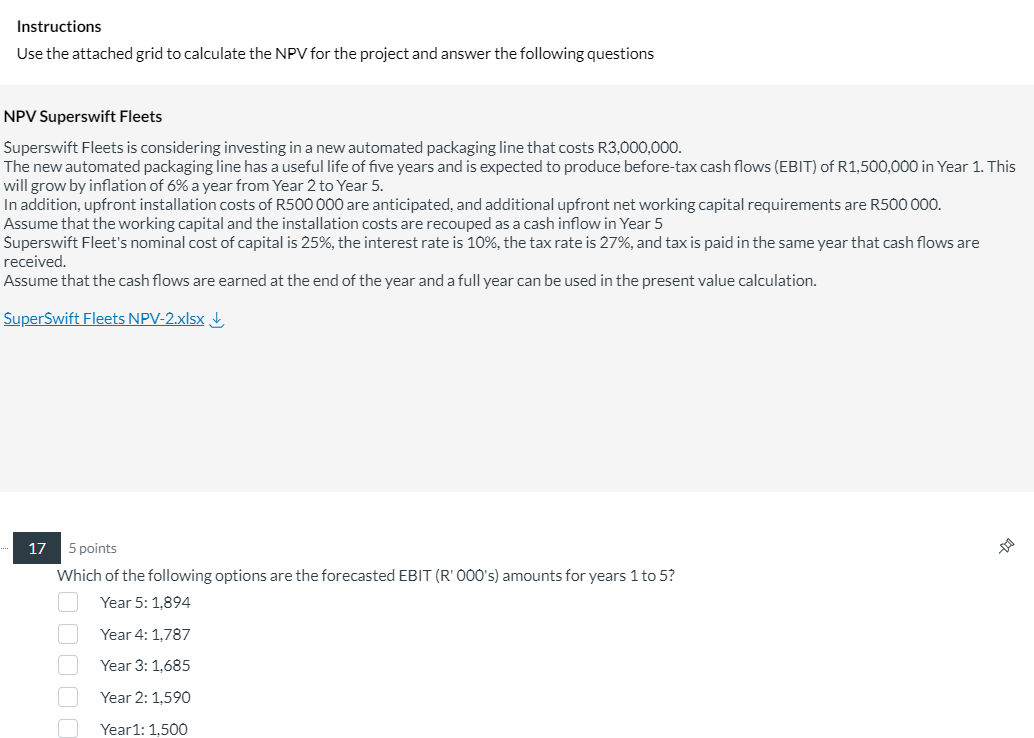

Use the attached grid to calculate the NPV for the project and answer the following questions

NPV Superswift Fleets

Superswift Fleets is considering investing in a new automated packaging line that costs R

The new automated packaging line has a useful life of five years and is expected to produce beforetax cash flows EBIT of R in Year This

will grow by inflation of a year from Year to Year

In addition, upfront installation costs of R are anticipated, and additional upfront net working capital requirements are R

Assume that the working capital and the installation costs are recouped as a cash inflow in Year

Superswift Fleet's nominal cost of capital is the interest rate is the tax rate is and tax is paid in the same year that cash flows are

received.

Assume that the cash flows are earned at the end of the year and a full year can be used in the present value calculation.

SuperSwift Fleets NPVxlsx darr

Question

Which of the following options are the forecasted EBIT Rs amounts for years to

A Year :

B Year :

C Year :

D Year :

E Year:

Question

What is the depreciation amount R s for each year of the forecast?

A

B

C

D

Question

What is the free cash flow in Year

A

B

C

D

Question

What is the free cash flow for Year

A

B

C

D

Question

What is the NPV for the project?

A

B

C

D

Question

Which option is the correct course of action Superswift Fleets?

A Accept the project because the NPV is positive

B Reject the project because the NPV is positive

C Reject the project because the NPV is negative

D Accept the project because the NPV is negative

Question

Adjust the EBITDA in Year until your NPV becomes zero. You can use the Goal Seek function in Excel to help you.

A

B

C

D Superswift Fleets will depreciate the asset over four years at a year on a straight line basis for tax purposes.

In addition, installation costs of R are anticipated and additional upfront net working capital requirements for the line of R are expected.

Assume that the working capital is recouped as a cash inflow in Year

Superswift Fleets nominal cost of capital is the interest rate is the tax rate is and tax is paid in the same year that cash flows are received.

a Advise the directors whether to accept or reject the project.

b What is the minimum EBITDA in Year required to make the project viable?

HINTS:

Calculate NOPAT EBIT Tax

Assume that the cashflows are earned at the end of the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started