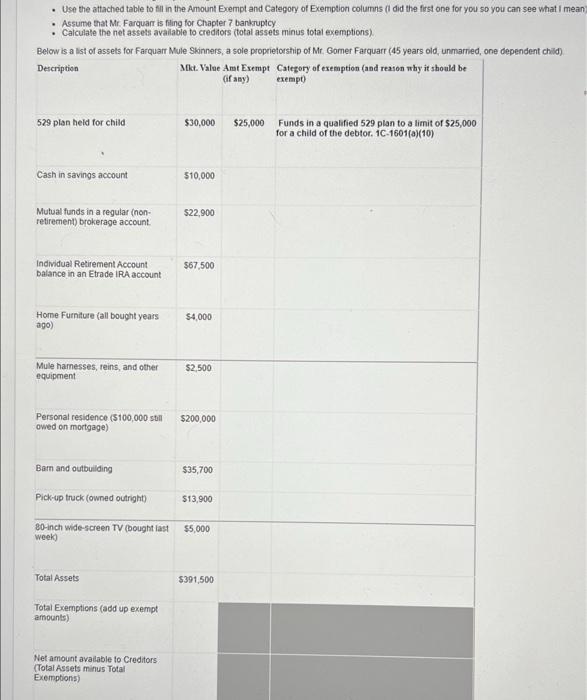

. Use the attached table to fill in the Amount Exempt and Category of Exemption columns (I did the first one for you so you can see what I mean Assume that Mr. Farquarris filing for Chapter 7 bankruptcy Calculate the net assets available to creditors (total assets minus total exemptions) Below is a list of assets for Farquart Mule Skinners, a sole proprietorship of Mr. Gomer Farquart (45 years old, unmarried, one dependent child) Description Mkt. Value Amt Exempt Category of exemption (and reason why it should be (if any) exempo a 529 plan held for child $30,000 $25,000 Funds in a qualified 529 plan to a limit of $25,000 for a child of the debtor. 1C-1601(a)(10) Cash in savings account $10,000 Mutual funds in a regular (non retirement) brokerage account $22,900 Individual Retirement Account balance in an Etrade IRA account $67,500 Home Furniture (all bought years ago) $4,000 Mule harnesses, reins, and other equipment $2.500 Personal residence (5100,000 st owed on mortgage) $200,000 Barn and outbuilding $35,700 Pick-up truck (owned outright) $13,900 80-inch wide-screen TV (bought last $5,000 week) Total Assets $391,500 Total Exemptions (add up exempt amounts) Net amount available to Creditors (Total Assets minus Total Exemptions) . Use the attached table to fill in the Amount Exempt and Category of Exemption columns (I did the first one for you so you can see what I mean Assume that Mr. Farquarris filing for Chapter 7 bankruptcy Calculate the net assets available to creditors (total assets minus total exemptions) Below is a list of assets for Farquart Mule Skinners, a sole proprietorship of Mr. Gomer Farquart (45 years old, unmarried, one dependent child) Description Mkt. Value Amt Exempt Category of exemption (and reason why it should be (if any) exempo a 529 plan held for child $30,000 $25,000 Funds in a qualified 529 plan to a limit of $25,000 for a child of the debtor. 1C-1601(a)(10) Cash in savings account $10,000 Mutual funds in a regular (non retirement) brokerage account $22,900 Individual Retirement Account balance in an Etrade IRA account $67,500 Home Furniture (all bought years ago) $4,000 Mule harnesses, reins, and other equipment $2.500 Personal residence (5100,000 st owed on mortgage) $200,000 Barn and outbuilding $35,700 Pick-up truck (owned outright) $13,900 80-inch wide-screen TV (bought last $5,000 week) Total Assets $391,500 Total Exemptions (add up exempt amounts) Net amount available to Creditors (Total Assets minus Total Exemptions)