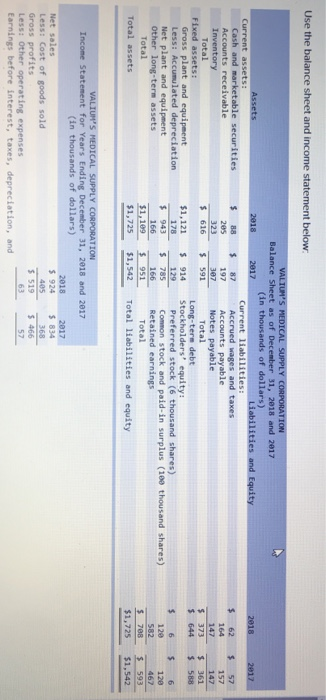

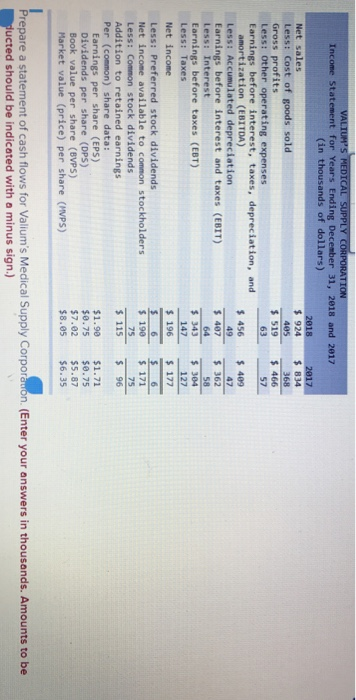

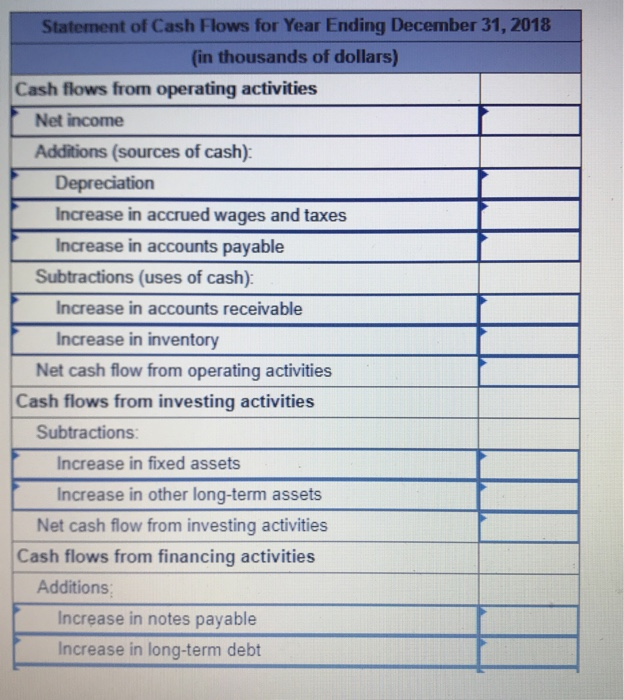

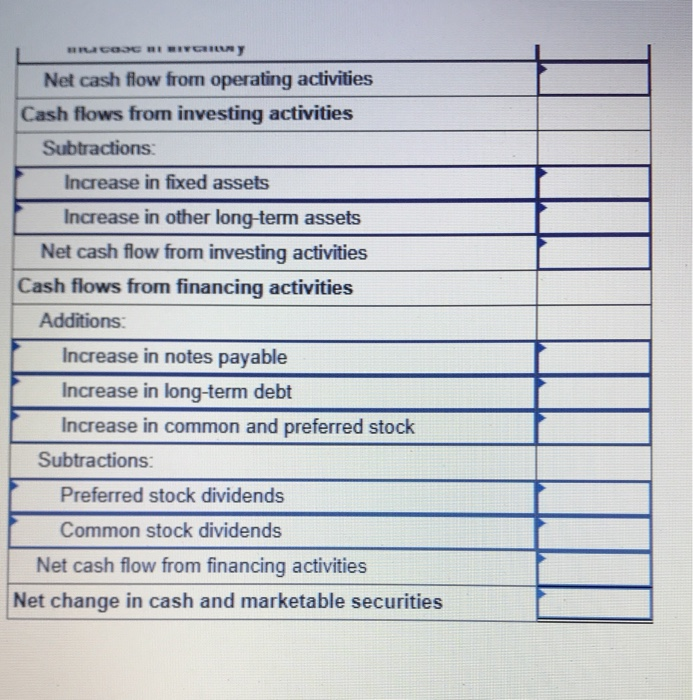

Use the balance sheet and income statement below Balance Sheet as of December 31, 2018 and 20127 (in thousands of dollars) Cash and marketable securities Accounts receivable Inventory 6257 164 147 373 361 87 197 Accrued wages and taxes Accounts payable 157 205 323 Total Fixed assets: 616 591 Total Long-term debt 914 Stockholders' equity 5 644 $ 588 Less: Accumulated depreciation Net plant and equipment other long-term assets $1,121 943 1,109 Preferred stock (6 thousand shares) 785 Common stock and paid-in surplus (189 thousand shares) 120 120 166 951 Total Total -S1,542. Total liabilities and equity $1,725 $1,542 Income Statement for Years Ending December 31, 2018 and 2817 (in thousands of dollars) 2018 Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses Earnings before interest, taxes, depreciation, and 924$834 368 405 568 519 466 Income Statement for Years Ending December 31, 2018 and 2017 (in thousands of dollars) Net sales Less: Cost of goods sold Gross profits Less: other operating expenses Earnings before interest, taxes, depreciation, and 924 834 368 519 466 6357 405 amortization (EBITDA) Less: Accumulated depreciation 456 409 Earnings before interest and taxes (EBIT) 407 S 362 Earnings before taxes (EBT) 343 304 147 127 196 177 Net income Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends Addition to retained earnings Per (common) share data: $ 190 171 s 115 $ 96 Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (HVPS) $1.98$1.71 $0.75 $0.75 57.02 $5.87 $8.05 $6.35 Prepare a statement of cash flows for Valium's Medical Supply Corporauon. (Enter your answers in thousands. Amounts to be ucted should be indicated with a minus sign.) Statement of Cash Flows for Year Ending December 31, 2018 (in thousands of dollars) Cash flows from operating activities Net income Additions (sources of cash) Depreciation Increase in accrued wages and taxes Increase in accounts payable Subtractions (uses of cash) Increase in accounts receivable Increase in inventory Net cash flow from operating activities Cash flows from investing activities Subtractions Increase in fixed assets Increase in other long-term assets Net cash flow from investing activities Cash flows from financing activities Additions Increase in notes payable Increase in long-term debt Net cash flow from operating activities Cash flows from investing activities Subtractions Increase in fixed assets Increase in other long-term assets Net cash flow from investing activities Cash flows from financing activities Additions: Increase in notes payable Increase in long-term debt Increase in common and preferred stock Subtractions Preferred stock dividends Common stock dividends Net cash flow from financing activities Net change in cash and marketable securities