Use the balance sheet and income statement data you gathered to complete this section for both Armcor PLC and Sealed Air PLC.

a. Complete a simple financial statement analysis of the two companies (calculating and discussing at least two ratios under each Liquidity, Profitability, Leverage, Market/Investment and Efficiency ratios).

b. Discussing by comparing the two companies results. Discuss the changes in relation to the ratio categories discussed.

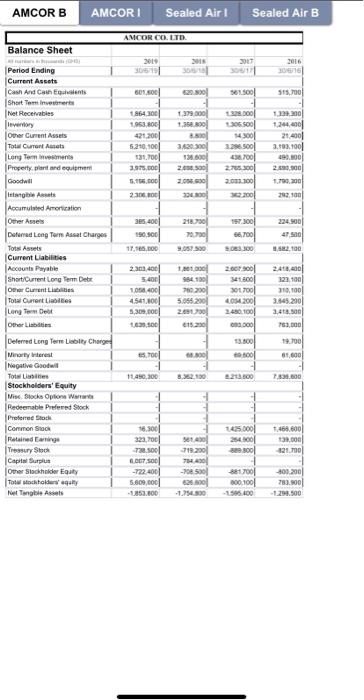

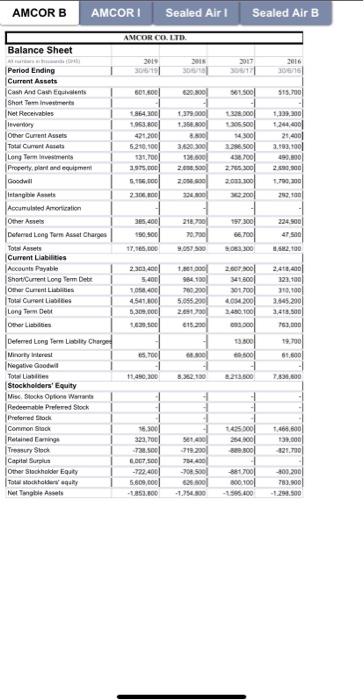

AMCORB AMCORI Sealed Air 1 Sealed Air B AMCOR CO. LTD Balance Sheet 2012 30 Period Ending Current Ascots Cash And Cangas Short Termine Net Receivables 601.00 Sool 55,700 Other Current Assets Total Curront sets Long Termine Property plant and eum Goodwill 1864 300 1953,800 421.200 5.240,100 131,700 3.975.CO 5.15.00 1.379.00 1,358.800 2.300 3.420300 13600 2.000 500 18.00 06.00 143001 3.28.500 450.00 2.765.300 2003.100 2001 1.13,300 124.00 21.400 3.193.1001 1923.00 2.690.000 1.790,00 2306 00 283.100 21.30 385 4001 150.00 7.300 66700 224.900 4 500 17.10.00 9.057.500 S300 52100 Accumulated Artrition Other Assen Deferred Long Term Asset Charges Totes Assets Current Liabilities Accounts Payabile ShortCurrent Long Term Debe Other Currentes Total Current Les Long Term Der 23.400 5.400 105.400 4541.000 5.30 1,001000 964150 700200 5.066 200 2.607.00 1800 301700 4.04.2001 2450 1001 2,416,00 123.100 110,00 3.845.2001 3.41.500 10.00 15200 3000 7536 19.700 13.00 ol TO 800 61,000 11.490,00 6213500 7.530,600 - - Deferred Long Term Liability Charge Minor Werest Negative Goodwill Totabile Stockholders' Equity Misc Stocks Options Warrant Redeemable Prefered Stock Preferred Stock Common Stock Retired Eige Treasury Stock Capital Surplus Other Stockholder Egaty Toto ochoregay Net Tinable Assets 145.000 25400 29.500 1.460.600 13,000 21.700 16.300 320,00 722 0.00700 -722.400 5.809,000 -1853.00 5614 719200 737200 -708 500 626.900 -125000 887001 3001001 -15.00 03.2001 7), wol - 500 AMCORB AMCORI Sealed Air 1 Sealed Air B AMCOR CO, LTD Balance Sheet 07 2016 2012 SOS SOLO 20.00 1.500 515.700 1.379.000 1864 300 1953,800 421.200 5.210,100 131.700 3975,00 5.1. 230 8.50 3.620.00 13.00 2.000.00 2.000.00 36.00 132.000 0.00 143001 32865001 57001 2.765300 2001.100 2001 1,333,000 1.24.2001 21,400 3.193.1001 93.0 2.100 1.790.200 252.100 35.400 150.00 218.730 7070 197 3001 66700 224.500 4 500 17.10.000 9.057530 300 2.100 Period Ending Current Assets Cash And Cases Short Termine Net Receivables evertory Other Current Assets Total Current Assets Long Termine Property, plant and equiem Goodwill Intangibles Accumulated Artrition Other Assets Deferred Long Tun Asset Charges Totes Assets Current Liabilities Accounts Payable Short Current Long Term Debt Other Current Total Current Liabies Long Other Liebe Deferred Long Term Liably Charge Minority interest Negative Goodwill Tot Line Stockholders' Equity Misc Stocks Options Warrante Redeemable Preferred Stock Preferred Stock Common Stock Retained ringe Treasury Stock Capital Surplus Other Stockholder Ety Towsocktoweguy Net Table Assets 2363 400 5.400 10.00 4541.000 3.300.000 1.000 954.100 700200 5.05.200 2.690.00 2.000 1300 301700 4054 2001 2.416,00 123.100 10.100 3.645.2001 1.450.100 3,4,500 100 615200 3000 1630 13.800 ol 19.700 61.000 6.00 800 12.450,200 3.352.130 23.500 7.831.600 - 16.300 323,00 145.000 2540 2.300 1.460.600 13.000 21,70 0.067,500 -722 400 5.609,000 -U85.00 561 7197 754.400 -708 500 $26.500 -15.00 887001 3001001 1995.00 209.2001 78.ol 10 500 AMCORB AMCORI Sealed Air 1 Sealed Air B AMCOR CO. LTD Balance Sheet 2012 30 Period Ending Current Ascots Cash And Cangas Short Termine Net Receivables 601.00 Sool 55,700 Other Current Assets Total Curront sets Long Termine Property plant and eum Goodwill 1864 300 1953,800 421.200 5.240,100 131,700 3.975.CO 5.15.00 1.379.00 1,358.800 2.300 3.420300 13600 2.000 500 18.00 06.00 143001 3.28.500 450.00 2.765.300 2003.100 2001 1.13,300 124.00 21.400 3.193.1001 1923.00 2.690.000 1.790,00 2306 00 283.100 21.30 385 4001 150.00 7.300 66700 224.900 4 500 17.10.00 9.057.500 S300 52100 Accumulated Artrition Other Assen Deferred Long Term Asset Charges Totes Assets Current Liabilities Accounts Payabile ShortCurrent Long Term Debe Other Currentes Total Current Les Long Term Der 23.400 5.400 105.400 4541.000 5.30 1,001000 964150 700200 5.066 200 2.607.00 1800 301700 4.04.2001 2450 1001 2,416,00 123.100 110,00 3.845.2001 3.41.500 10.00 15200 3000 7536 19.700 13.00 ol TO 800 61,000 11.490,00 6213500 7.530,600 - - Deferred Long Term Liability Charge Minor Werest Negative Goodwill Totabile Stockholders' Equity Misc Stocks Options Warrant Redeemable Prefered Stock Preferred Stock Common Stock Retired Eige Treasury Stock Capital Surplus Other Stockholder Egaty Toto ochoregay Net Tinable Assets 145.000 25400 29.500 1.460.600 13,000 21.700 16.300 320,00 722 0.00700 -722.400 5.809,000 -1853.00 5614 719200 737200 -708 500 626.900 -125000 887001 3001001 -15.00 03.2001 7), wol - 500 AMCORB AMCORI Sealed Air 1 Sealed Air B AMCOR CO, LTD Balance Sheet 07 2016 2012 SOS SOLO 20.00 1.500 515.700 1.379.000 1864 300 1953,800 421.200 5.210,100 131.700 3975,00 5.1. 230 8.50 3.620.00 13.00 2.000.00 2.000.00 36.00 132.000 0.00 143001 32865001 57001 2.765300 2001.100 2001 1,333,000 1.24.2001 21,400 3.193.1001 93.0 2.100 1.790.200 252.100 35.400 150.00 218.730 7070 197 3001 66700 224.500 4 500 17.10.000 9.057530 300 2.100 Period Ending Current Assets Cash And Cases Short Termine Net Receivables evertory Other Current Assets Total Current Assets Long Termine Property, plant and equiem Goodwill Intangibles Accumulated Artrition Other Assets Deferred Long Tun Asset Charges Totes Assets Current Liabilities Accounts Payable Short Current Long Term Debt Other Current Total Current Liabies Long Other Liebe Deferred Long Term Liably Charge Minority interest Negative Goodwill Tot Line Stockholders' Equity Misc Stocks Options Warrante Redeemable Preferred Stock Preferred Stock Common Stock Retained ringe Treasury Stock Capital Surplus Other Stockholder Ety Towsocktoweguy Net Table Assets 2363 400 5.400 10.00 4541.000 3.300.000 1.000 954.100 700200 5.05.200 2.690.00 2.000 1300 301700 4054 2001 2.416,00 123.100 10.100 3.645.2001 1.450.100 3,4,500 100 615200 3000 1630 13.800 ol 19.700 61.000 6.00 800 12.450,200 3.352.130 23.500 7.831.600 - 16.300 323,00 145.000 2540 2.300 1.460.600 13.000 21,70 0.067,500 -722 400 5.609,000 -U85.00 561 7197 754.400 -708 500 $26.500 -15.00 887001 3001001 1995.00 209.2001 78.ol 10 500