Question

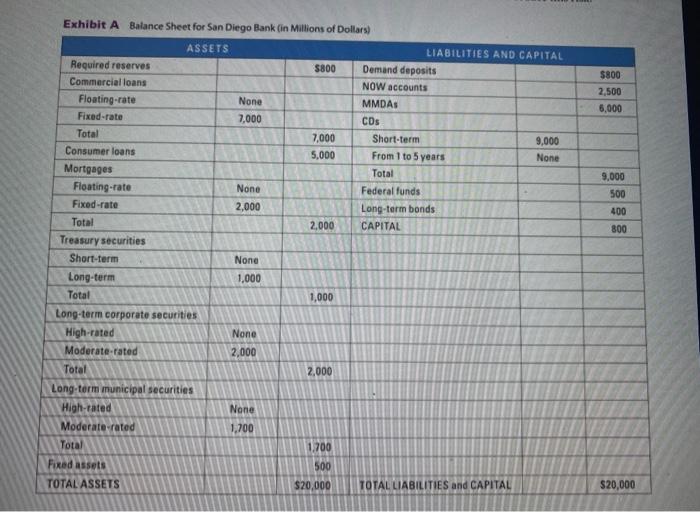

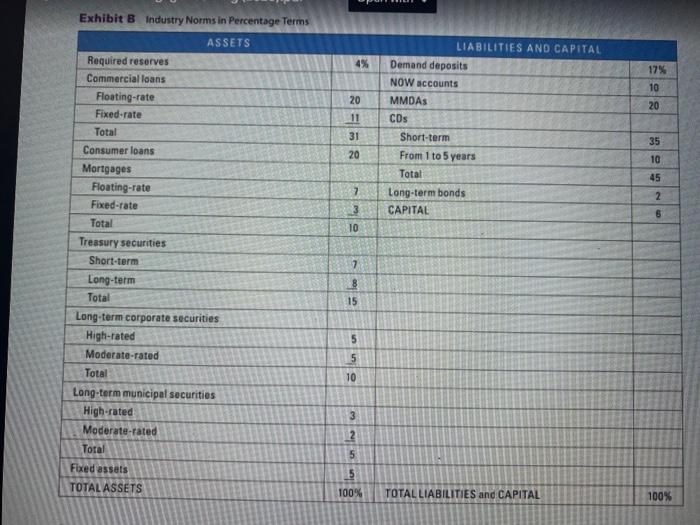

Use the balance sheet for San Diego Bank in Exhibit A and the industry norms in Exhibit B to answer the following questions. a. Estimate

Use the balance sheet for San Diego Bank in Exhibit A and the industry norms in Exhibit B to answer the following questions.

a. Estimate the gap and the gap ratio and determine how San Diego Bank would be affected by an increase in interest rates over time. b. Assess San Diegos credit risk. Does it appear high or

low relative to the industry? Would San Diego Bank per- form better or worse than other banks during a recession?

c. For any type of bank risk that appears to be higher than the industry, explain how the banks balance sheet could be restructured to reduce this risk.

(Answer these questions on a paper)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started