Answered step by step

Verified Expert Solution

Question

1 Approved Answer

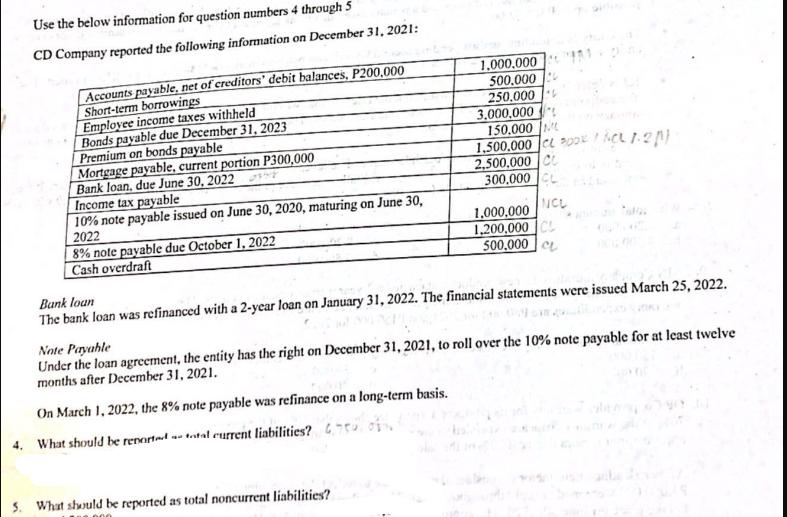

Use the below information for question numbers 4 through 5 CD Company reported the following information on December 31, 2021: Accounts payable, net of

Use the below information for question numbers 4 through 5 CD Company reported the following information on December 31, 2021: Accounts payable, net of creditors' debit balances, P200,000 Short-term borrowings Employee income taxes withheld Bonds payable due December 31, 2023 Premium on bonds payable Mortgage payable, current portion P300,000 1.000.000 500.000 250,000 3,000,000 150.000 1,500,000 CL PODE 1.2) Bank loan, due June 30, 2022 Income tax payable 10% note payable issued on June 30, 2020, maturing on June 30, 2022 8% note payable due October 1, 2022 Cash overdraft Bank loan 2,500,000 CL 300.000 CL NCL 1,000,000 1,200,000 CL 500,000 CL The bank loan was refinanced with a 2-year loan on January 31, 2022. The financial statements were issued March 25, 2022. Note Payable Under the loan agreement, the entity has the right on December 31, 2021, to roll over the 10% note payable for at least twelve months after December 31, 2021. On March 1, 2022, the 8% note payable was refinance on a long-term basis. 4. What should be reported total current liabilities? 5. What should be reported as total noncurrent liabilities?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

4 To determine the current liabilities we need to identify the liabilities that are due within one y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e5a3639c07_957635.pdf

180 KBs PDF File

663e5a3639c07_957635.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started