Answered step by step

Verified Expert Solution

Question

1 Approved Answer

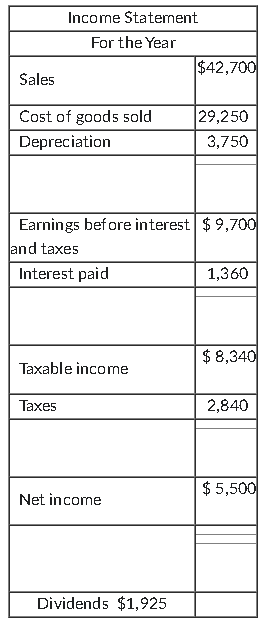

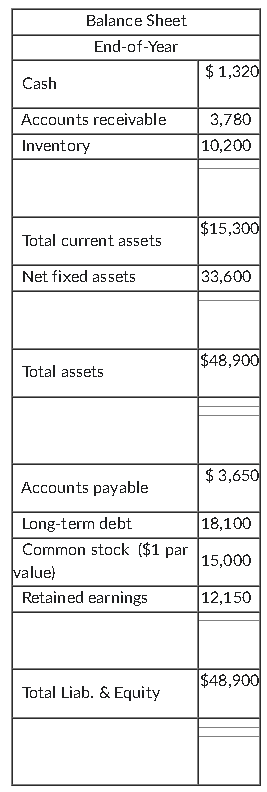

Use the below information to answer the following question. This firm is currently operating at full capacity. The profit margin and the dividend payout ratio

| Use the below information to answer the following question. |

| This firm is currently operating at full capacity. The profit margin and the dividend payout ratio are held constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 11 percent. What is the external financing needed? |

|

|

| |

| ||

|

|

| |

|

|

| |

|

|

|

The correct answer was 1646, but I have no idea how to get that answer. Please write out the solution to this problem with the formulas used to solve it so that I may learn how to solve similar problems in the future.

\begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Balance Sheet } \\ \hline \multicolumn{2}{|c|}{ End-of-Year } \\ \hline Cash & $1,320 \\ \hline Accounts receivable & 3,780 \\ \hline Inventory & 10,200 \\ \hline & \\ \hline \multirow{3}{*}{ Total current assets } & $15,300 \\ \hline Net fixed assets & 33,600 \\ \hline \multirow{3}{*}{ Total assets } & \\ \hline & $48,900 \\ \hline \multirow{3}{*}{ Total Liab. \& Equity } & $48,900 \\ \hline Accounts payable & $3,650 \\ \hline Long-term debt & 18,100 \\ \hline Common stock ($1 par & 15,000 \\ \hline value & 12,150 \\ \hline Retained earnings & \\ \hline & \\ \hline & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started