Question

Use the below information to calculate the profit or loss of a short call butterfly spread if the spot price of the underlying asset

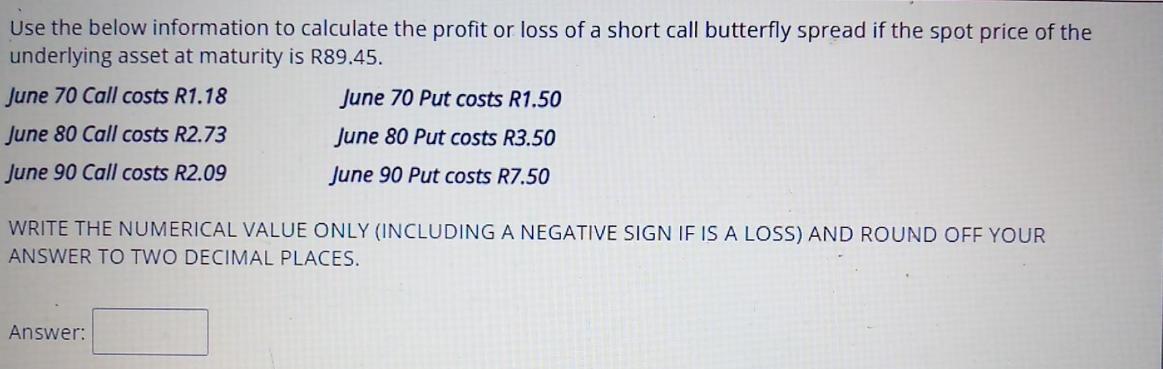

Use the below information to calculate the profit or loss of a short call butterfly spread if the spot price of the underlying asset at maturity is R89.45. June 70 Call costs R1.18 June 70 Put costs R1.50 June 80 Call costs R2.73 June 80 Put costs R3.50 June 90 Call costs R2.09 June 90 Put costs R7.50 WRITE THE NUMERICAL VALUE ONLY (INCLUDING A NEGATIVE SIGN IF IS A LOSS) AND ROUND OFF YOUR ANSWER TO TWO DECIMAL PLACES. Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Debra C. Jeter, Paul Chaney

5th Edition

1118022297, 9781118214169, 9781118022290, 1118214161, 978-1118098615

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App