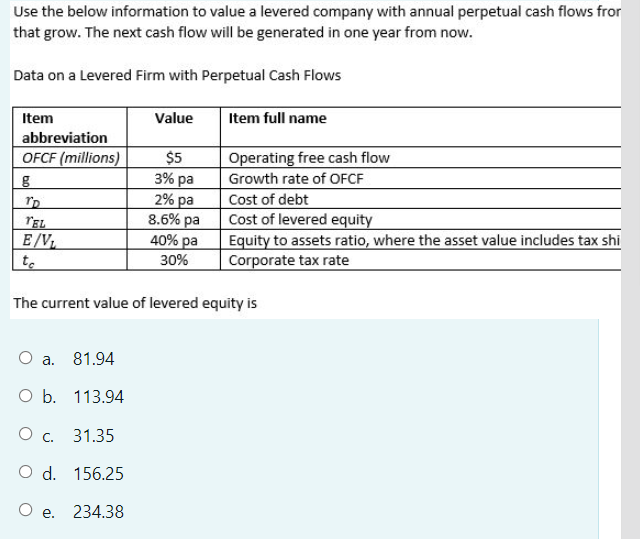

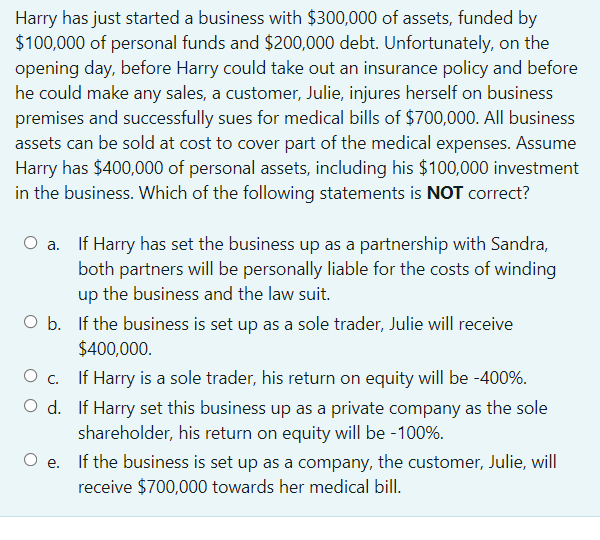

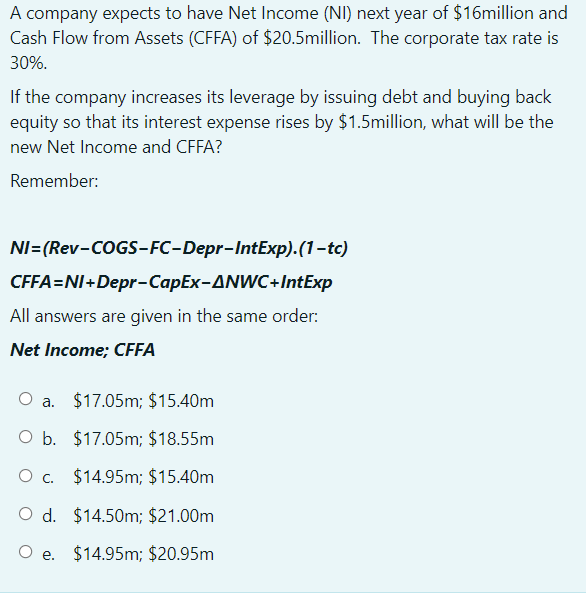

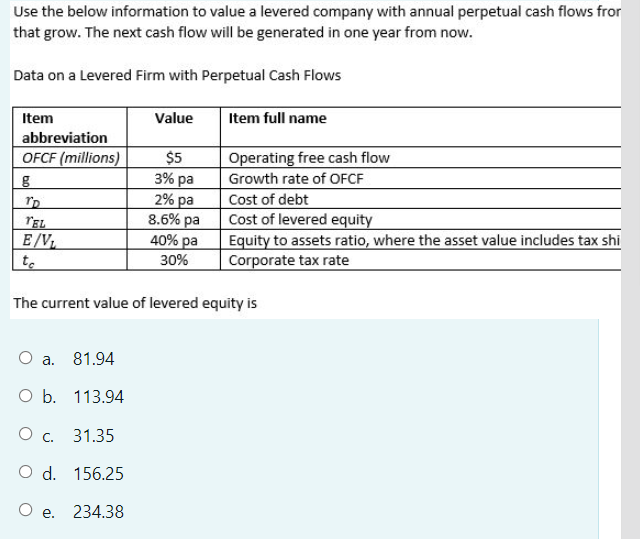

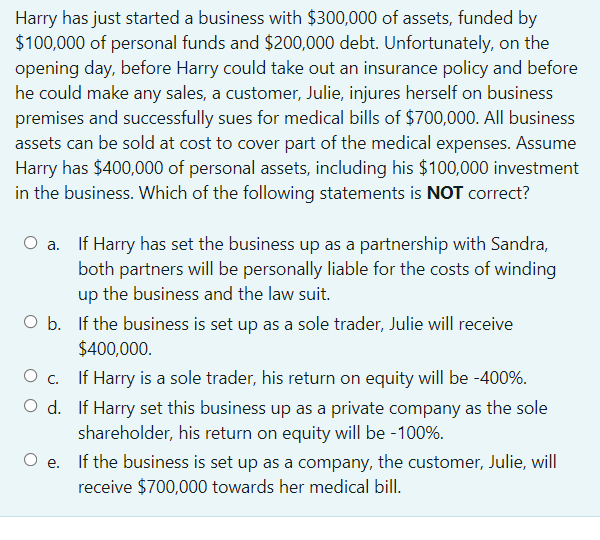

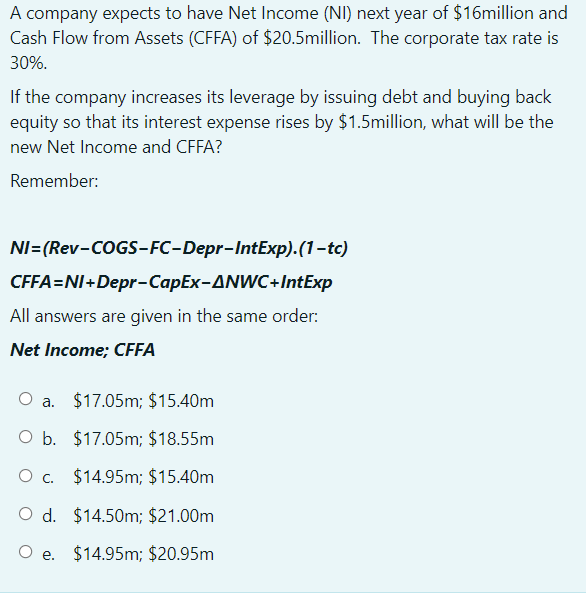

Use the below information to value a levered company with annual perpetual cash flows fror that grow. The next cash flow will be generated in one year from now. Data on a Levered Firm with Perpetual Cash Flows Value Item full name Item abbreviation OFCF (millions) g $5 3% pa 2% pa Operating free cash flow Growth rate of OFCF Cost of debt Cost of levered equity Equity to assets ratio, where the asset value includes tax shi Corporate tax rate rez EV to 8.6% 6 pa 40% pa 30% The current value of levered equity is a. 81.94 O b. 113.94 . 31.35 O d. 156.25 O e. 234.38 Harry has just started a business with $300,000 of assets, funded by $100,000 of personal funds and $200,000 debt. Unfortunately, on the opening day, before Harry could take out an insurance policy and before he could make any sales, a customer, Julie, injures herself on business premises and successfully sues for medical bills of $700,000. All business assets can be sold at cost to cover part of the medical expenses. Assume Harry has $400,000 of personal assets, including his $100,000 investment in the business. Which of the following statements is NOT correct? O a. If Harry has set the business up as a partnership with Sandra, both partners will be personally liable for the costs of winding up the business and the law suit. O b. If the business is set up as a sole trader, Julie will receive $400,000. O c. If Harry is a sole trader, his return on equity will be -400%. O d. If Harry set this business up as a private company as the sole shareholder, his return on equity will be - 100%. e. If the business is set up as a company, the customer, Julie, will receive $700,000 towards her medical bill. A company expects to have Net Income (NI) next year of $16million and Cash Flow from Assets (CFFA) of $20.5million. The corporate tax rate is 30%. If the company increases its leverage by issuing debt and buying back equity so that its interest expense rises by $1.5million, what will be the new Net Income and CFFA? Remember: NI=(Rev-COGS-FC-Depr-IntExp). (1-tc) CFFA=N/+Depr-CapEx-ANWC+IntExp All answers are given in the same order: Net Income; CFFA O a $17.05m; $15.40m O b. $17.05m; $18.55m O c. $14.95m; $15.40m O d. $14.50m; $21.00m O e. $14.95m; $20.95m