Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use The biggest variable in the amount of taxes you pay is how much you make. Nerdwallet's Federal Income Tax Calculator to compare the

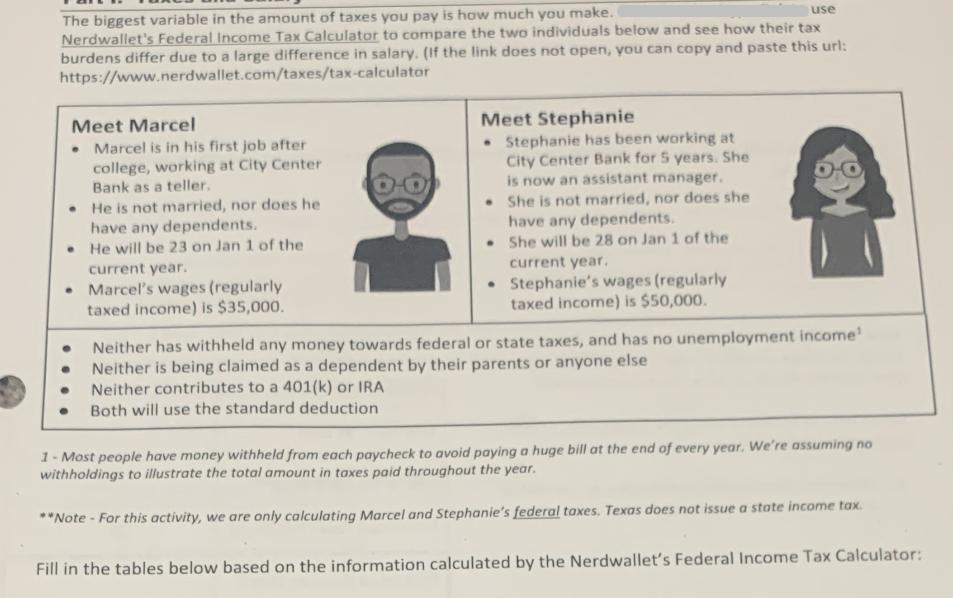

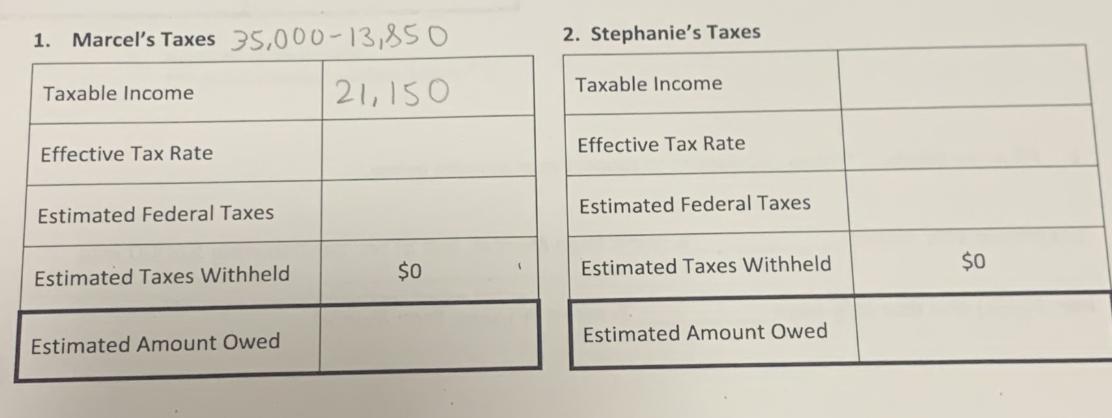

use The biggest variable in the amount of taxes you pay is how much you make. Nerdwallet's Federal Income Tax Calculator to compare the two individuals below and see how their tax burdens differ due to a large difference in salary. (If the link does not open, you can copy and paste this url: https://www.nerdwallet.com/taxes/tax-calculator . Meet Marcel Marcel is in his first job after college, working at City Center Bank as a teller. He is not married, nor does he have any dependents. He will be 23 on Jan 1 of the current year. Marcel's wages (regularly taxed income) is $35,000. Meet Stephanie Stephanie has been working at City Center Bank for 5 years. She is now an assistant manager. She is not married, nor does she have any dependents. She will be 28 on Jan 1 of the current year. Stephanie's wages (regularly taxed income) is $50,000. Neither has withheld any money towards federal or state taxes, and has no unemployment income Neither is being claimed as a dependent by their parents or anyone else Neither contributes to a 401(k) or IRA Both will use the standard deduction 1- Most people have money withheld from each paycheck to avoid paying a huge bill at the end of every year. We're assuming no withholdings to illustrate the total amount in taxes paid throughout the year. **Note - For this activity, we are only calculating Marcel and Stephanie's federal taxes. Texas does not issue a state income tax. Fill in the tables below based on the information calculated by the Nerdwallet's Federal Income Tax Calculator: 1. Marcel's Taxes 35,000-13,850 Taxable Income 21, 150 Effective Tax Rate Estimated Federal Taxes 2. Stephanie's Taxes Taxable Income Effective Tax Rate Estimated Federal Taxes Estimated Taxes Withheld $0 Estimated Taxes Withheld $0 Estimated Amount Owed Estimated Amount Owed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started