Use the capital mandates to compute the coverage period, turnover coefficient, and the working

capital needed for accounts receivables, inventory of final products, inventory of raw material, and

accounts payable. Report your calculations in a table, then compute the new working capital required

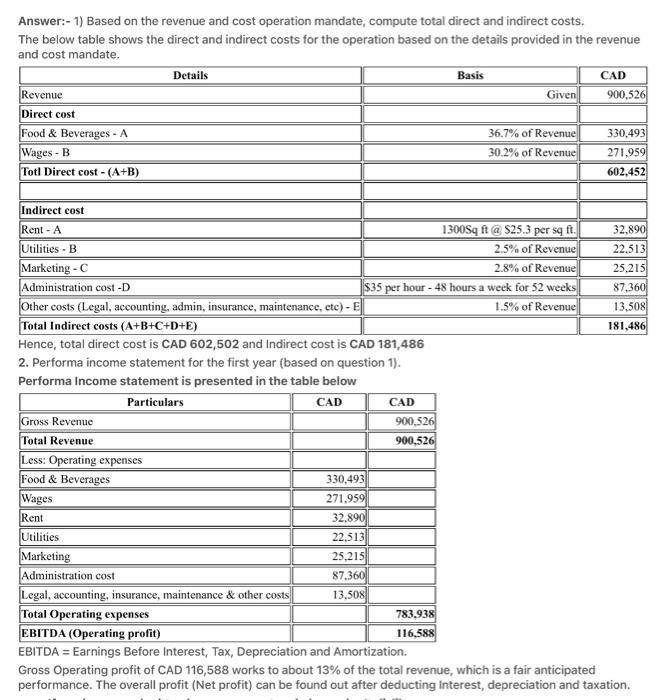

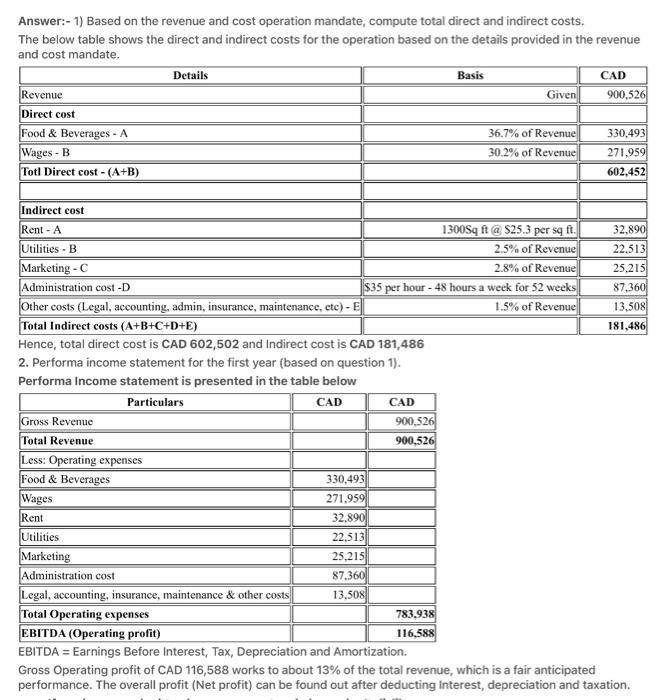

Answer:- 1) Based on the revenue and cost operation mandate, compute total direct and indirect costs. The below table shows the direct and indirect costs for the operation based on the details provided in the revenue and cost mandate. Details Basis CAD Revenue Given 900,526 Direct cost Food & Beverages - A 36.7% of Revenue 330,493 Wages - B 30.2% of Revenue 271,959 Totl Direct cost - (A+B) 602,452 Indirect cost Rent - A 1300Sq ft @ $25.3 per sq ft. 32,890 Utilities - B 2.5% of Revenue 22,513 Marketing - C 2.8% of Revenue 25,215 Administration cost-D $35 per hour - 48 hours a week for 52 weeks 87,360 Other costs (Legal, accounting, admin, insurance, maintenance, etc) - E 1.5% of Revenue 13,508 181,486 Total Indirect costs (A+B+C+D+E) Hence, total direct cost is CAD 602,502 and Indirect cost is CAD 181,486 2. Performa income statement for the first year (based on question 1). Performa Income statement is presented in the table below Particulars CAD CAD Gross Revenue Total Revenue Less: Operating expenses Food & Beverages 330,493 Wages 271,959 Rent 32,890 Utilities 22,513 Marketing 25,215 Administration cost 87,360 Legal, accounting, insurance, maintenance & other costs 13,508 Total Operating expenses 783,938 116,588 EBITDA (Operating profit) EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization. Gross Operating profit of CAD 116,588 works to about 13% of the total revenue, which is a fair anticipated performance. The overall profit (Net profit) can be found out after deducting Interest, depreciation and taxation. 900,526 900,526 Answer:- 1) Based on the revenue and cost operation mandate, compute total direct and indirect costs. The below table shows the direct and indirect costs for the operation based on the details provided in the revenue and cost mandate. Details Basis CAD Revenue Given 900,526 Direct cost Food & Beverages - A 36.7% of Revenue 330,493 Wages - B 30.2% of Revenue 271,959 Totl Direct cost - (A+B) 602,452 Indirect cost Rent - A 1300Sq ft @ $25.3 per sq ft. 32,890 Utilities - B 2.5% of Revenue 22,513 Marketing - C 2.8% of Revenue 25,215 Administration cost-D $35 per hour - 48 hours a week for 52 weeks 87,360 Other costs (Legal, accounting, admin, insurance, maintenance, etc) - E 1.5% of Revenue 13,508 181,486 Total Indirect costs (A+B+C+D+E) Hence, total direct cost is CAD 602,502 and Indirect cost is CAD 181,486 2. Performa income statement for the first year (based on question 1). Performa Income statement is presented in the table below Particulars CAD CAD Gross Revenue Total Revenue Less: Operating expenses Food & Beverages 330,493 Wages 271,959 Rent 32,890 Utilities 22,513 Marketing 25,215 Administration cost 87,360 Legal, accounting, insurance, maintenance & other costs 13,508 Total Operating expenses 783,938 116,588 EBITDA (Operating profit) EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization. Gross Operating profit of CAD 116,588 works to about 13% of the total revenue, which is a fair anticipated performance. The overall profit (Net profit) can be found out after deducting Interest, depreciation and taxation. 900,526 900,526