Answered step by step

Verified Expert Solution

Question

1 Approved Answer

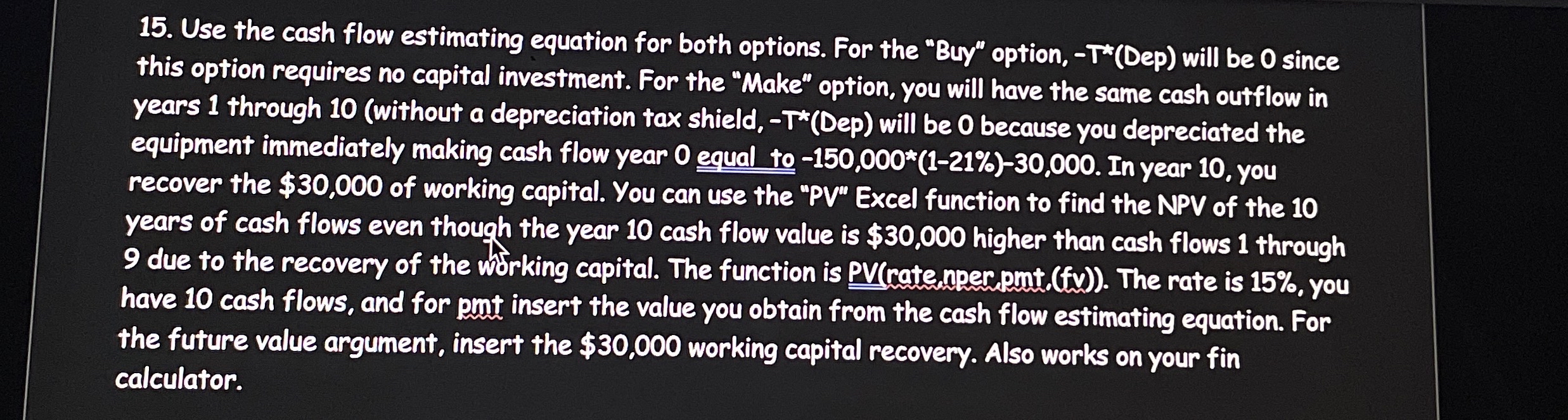

Use the cash flow estimating equation for both options. For the Buy option, - T * ( Dep ) will be 0 since this option

Use the cash flow estimating equation for both options. For the "Buy" option, TDep will be since

this option requires no capital investment. For the "Make" option, you will have the same cash outflow in

years through without a depreciation tax shield, Dep will be because you depreciated the

equipment immediately making cash flow year equal to In year you

recover the $ of working capital. You can use the PV Excel function to find the NPV of the

years of cash flows even though the year cash flow value is $ higher than cash flows through

due to the recovery of the working capital. The function is PV catemperpunt.fy The rate is you

have cash flows, and for put insert the value you obtain from the cash flow estimating equation. For

the future value argument, insert the $ working capital recovery. Also works on your fin

calculator.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started