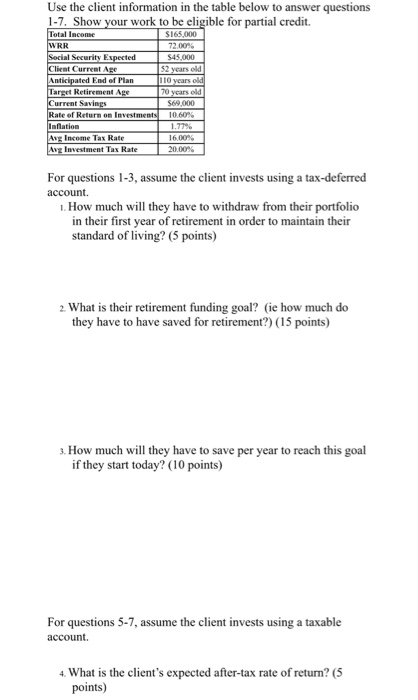

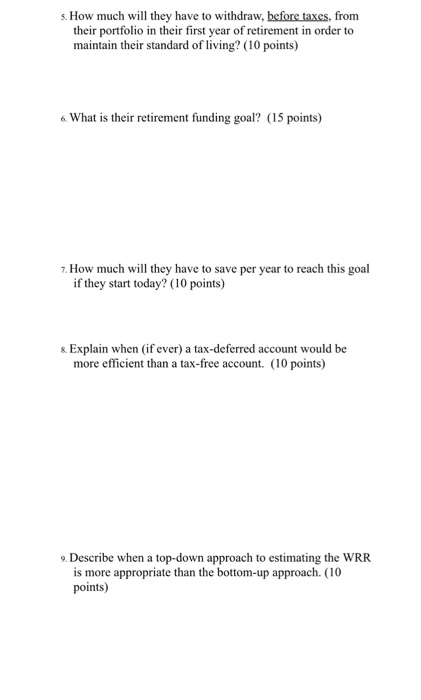

Use the client information in the table below to answer questions 1-7. Show your work to be eligible for partial credit. Total Inconse S165,000 45,000 l Security E Client Current A s old End of Plan 69,000 Rate ef Return on Investment nflation Income Tax Rate Investment Tax Rate 1600% 20.00% For questions 1-3, assume the client invests using a tax-deferred account . How much will they have to withdraw from their portfolio in their first year of retirement in order to maintain their standard of living? (5 points) 2. What is their retirement funding goal? (ie how much do they have to have saved for retirement?) (15 points) s. How much will they have to save per year to if they start today? (10 points) For questions 5-7, assume the client invests using a taxable account. 4. What is the client's expected after-tax rate of return? (5 points) s. How much will they have to withdraw, before taxes, from their portfolio in their first year of retirement in order to maintain their standard of living? (10 points) What is their retirement funding goal? (15 points) 7. How much will they have to save per year to reach this goal if they start today? (10 points) s.Explain when (if ever) a tax-deferred account would be more efficient than a tax-free account. (10 points) 9. Describe when a top-down approach to estimating the WRR is more appropriate than the bottom-up approach. (10 points) Use the client information in the table below to answer questions 1-7. Show your work to be eligible for partial credit. Total Inconse S165,000 45,000 l Security E Client Current A s old End of Plan 69,000 Rate ef Return on Investment nflation Income Tax Rate Investment Tax Rate 1600% 20.00% For questions 1-3, assume the client invests using a tax-deferred account . How much will they have to withdraw from their portfolio in their first year of retirement in order to maintain their standard of living? (5 points) 2. What is their retirement funding goal? (ie how much do they have to have saved for retirement?) (15 points) s. How much will they have to save per year to if they start today? (10 points) For questions 5-7, assume the client invests using a taxable account. 4. What is the client's expected after-tax rate of return? (5 points) s. How much will they have to withdraw, before taxes, from their portfolio in their first year of retirement in order to maintain their standard of living? (10 points) What is their retirement funding goal? (15 points) 7. How much will they have to save per year to reach this goal if they start today? (10 points) s.Explain when (if ever) a tax-deferred account would be more efficient than a tax-free account. (10 points) 9. Describe when a top-down approach to estimating the WRR is more appropriate than the bottom-up approach. (10 points)