Question

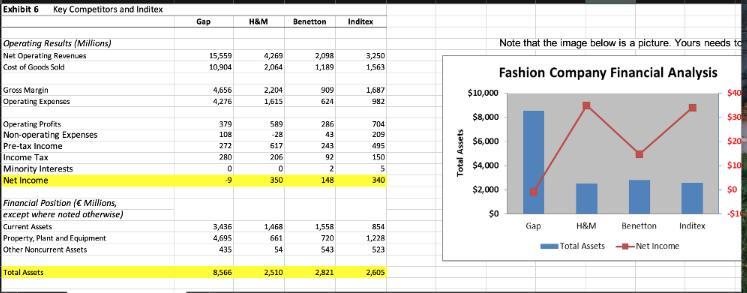

Use the Combination Chart Fashion worksheet to create and format a combination chart exactly as illustrated in the picture provided in the Excel worksheet. The

Use the Combination Chart Fashion worksheet to create and format a combination chart exactly as illustrated in the picture provided in the Excel worksheet. The two data series are net income and total assets.

a) First create a 2D column chart of Total Assets. Please enter the series name.

b) Second click the chart area to make it active then click Select Data under the Design tab, and then add the Net Income as a data series. Please enter the series name. Also, add the fashion company names to the horizontal axis by using the Select Data menu - under Horizontal (Category) Axis Labels, hit Edit and highlight the company names.

c) Third, you can plot data on a secondary vertical axis, in this case Net Income. But first change net income to a line graph with markers. In the graph, left click the Net Income series. In the Design tab above, choose Change Chart Type. Find and select the option Line with Markers and select the box for Secondary Axis.

d) Now, format the axis to the desired scale. Right click on the left axis to make it active then select Format Axis. In Axis Options, choose 0, 10,000, and 2,000 for minimum, maximum and major unit respectively. Repeat on the right axis using the appropriate values from the figure.

e) Finish formatting the graph to match the given picture: Legend location, chart title, axis titles, format axis, remove gridlines, and format the plot area. Hint: Under the Design tab and on the left there is a dropdown titled Quick Layout. Under this dropdown look for Layout 3.

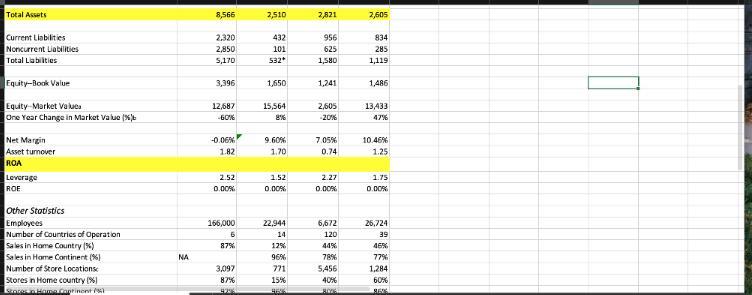

f) Finally, Calculate the Return on Assets (ROA) for each firm and enter the values in B37, C37, D37, and E37 (ROA is defined as the ratio of Net Income to Assets). Format values with a % sign. Why might a manager care about ROA?

Return on Assets (ROA) = Net Income / Total Assets.

Exhibit 6 Key Competitors and Inditex Operating Results (Millions) Net Operating Revenues Cost of Goods Sold Gross Margin Operating Expenses Operating Profits Non-operating Expenses Pre-tax Income Income Tax Minority Interests Net Income Financial Position ( Millions, except where noted otherwise) Current Assets Property, Plant and Equipment Other Noncurrent Assets Total Assets Gap 15,559 10,904 4,656 4,276 379 108 272 280 0 -9 3,436 4,695 435 8,566 H&M 4,269 2,064 2,204 1,615 589 -28 617 206 0 350 1,468 661 54 2,510 Benetton Inditex 2,098 1,189 909 624 286 43 243 92 2 148 1,558 720 543 2,821 3,250 1,563 1,687 982 704 209 495 150 5 340 854 1,228 523 2,605 Total Assets $10,000 $8,000 $6,000 Note that the image below is a picture. Yours needs to Fashion Company Financial Analysis $4,000 $2,000 $0 M H&M Gap Total Assets Benetton Inditex --Net Income $40 $30 $20 $10 $0 -$1

Step by Step Solution

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Sol V Rsh P VxI 220 200 201000 220 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started