Answered step by step

Verified Expert Solution

Question

1 Approved Answer

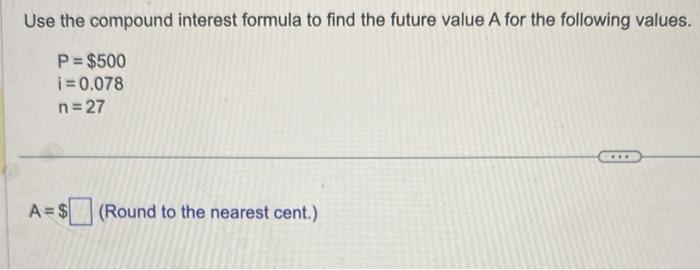

Use the compound interest formula to find the future value A for the following values. P= $500 i=0.078 n=27 A=$ (Round to the nearest

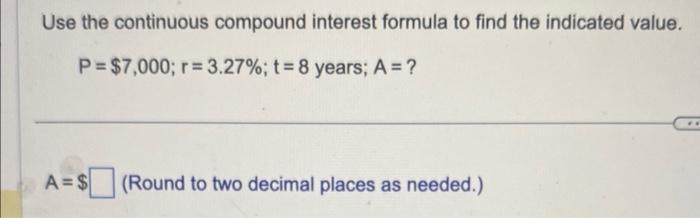

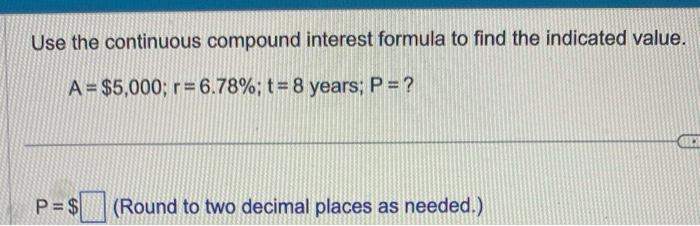

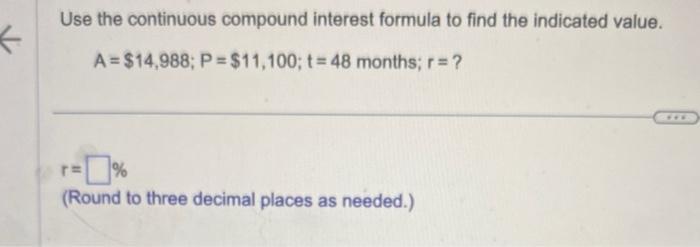

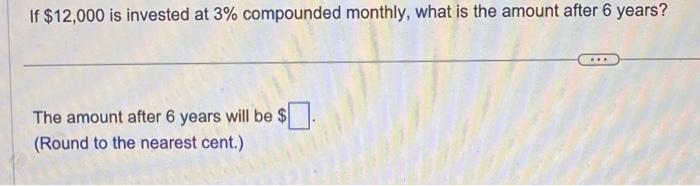

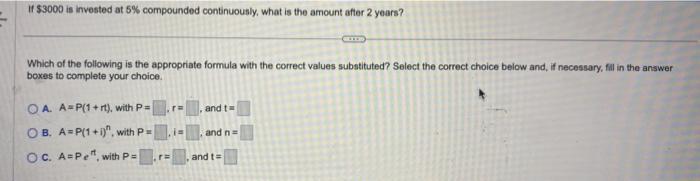

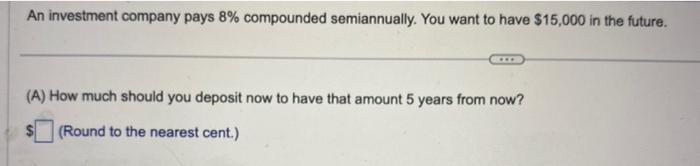

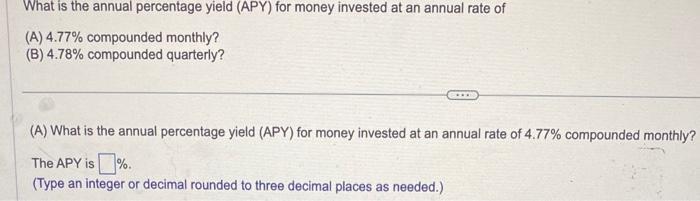

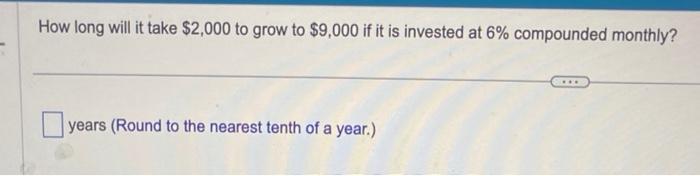

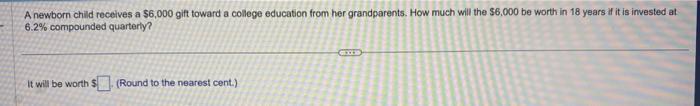

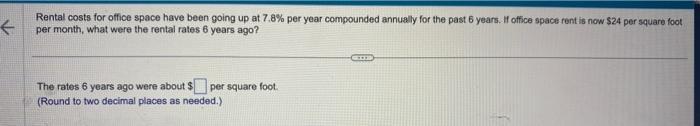

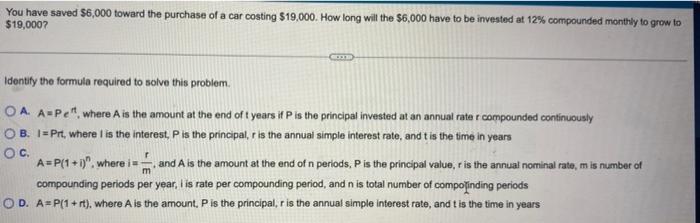

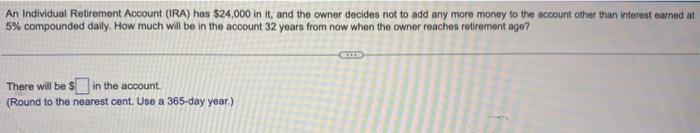

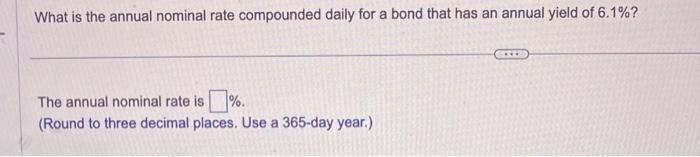

Use the compound interest formula to find the future value A for the following values. P= $500 i=0.078 n=27 A=$ (Round to the nearest cent.) Use the continuous compound interest formula to find the indicated value. P=$7,000; r = 3.27%; t = 8 years; A = ? A=$ (Round to two decimal places as needed.) .. Use the continuous compound interest formula to find the indicated value. A=$5,000; r= 6.78%; t = 8 years; P = ? P=$ (Round to two decimal places as needed.) an < Use the continuous compound interest formula to find the indicated value. A=$14,988; P=$11,100; t=48 months; r = ? r= % (Round to three decimal places as needed.) If $12,000 is invested at 3% compounded monthly, what is the amount after 6 years? The amount after 6 years will be $ (Round to the nearest cent.) If $3000 is invested at 5% compounded continuously, what is the amount after 2 years? Which of the following is the appropriate formula with the correct values substituted? Select the correct choice below and, if necessary, fill in the answer boxes to complete your choice. OA A-P(1+rt), with P= OB. A=P(1+i), with P= OC. A=Pet, with P= r= ra i= , and t and n= and t= An investment company pays 8% compounded semiannually. You want to have $15,000 in the future. (A) How much should you deposit now to have that amount 5 years from now? (Round to the nearest cent.) What is the annual percentage yield (APY) for money invested at an annual rate of (A) 4.77% compounded monthly? (B) 4.78% compounded quarterly? ****** (A) What is the annual percentage yield (APY) for money invested at an annual rate of 4.77% compounded monthly? The APY is%. (Type an integer or decimal rounded to three decimal places as needed.) How long will it take $2,000 to grow to $9,000 if it is invested at 6% compounded monthly? years (Round to the nearest tenth of a year.) A newborn child receives a $6,000 gift toward a college education from her grandparents. How much will the $6,000 be worth in 18 years if it is invested at 6.2% compounded quarterly? It will be worth $ (Round to the nearest cent.) GXD F Rental costs for office space have been going up at 7.8% per year compounded annually for the past 6 years. If office space rent is now $24 per square foot per month, what were the rental rates 6 years ago? The rates 6 years ago were about $ per square foot. (Round to two decimal places as needed.) COP You have saved $6,000 toward the purchase of a car costing $19,000. How long will the $6,000 have to be invested at 12% compounded monthly to grow to $19,000? Identify the formula required to solve this problem. OA. A Pet, where A is the amount at the end of t years if P is the principal invested at an annual rate r compounded continuously OB. I=Prt, where I is the interest, P is the principal, r is the annual simple interest rate, and t is the time in years OC. A=P(1+i)", where i== and A is the amount at the end of n periods, P is the principal value, r is the annual nominal rate, mis number of compounding periods per year, i is rate per compounding period, and in is total number of compofinding periods OD. A=P(1 + rt), where A is the amount, P is the principal, r is the annual simple interest rate, and it is the time in years An Individual Retirement Account (IRA) has $24,000 in it, and the owner decides not to add any more money to the account other than interest earned at 5% compounded daily. How much will be in the account 32 years from now when the owner reaches retirement age? There will be in the account. (Round to the nearest cent. Use a 365-day year.) What is the annual nominal rate compounded daily for a bond that has an annual yield of 6.1%? The annual nominal rate is %. (Round to three decimal places. Use a 365-day year.)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The provided images contain a series of questions related to compound interest and continuous compound interest To solve these problems we will use different variations of the compound interest formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started