Question

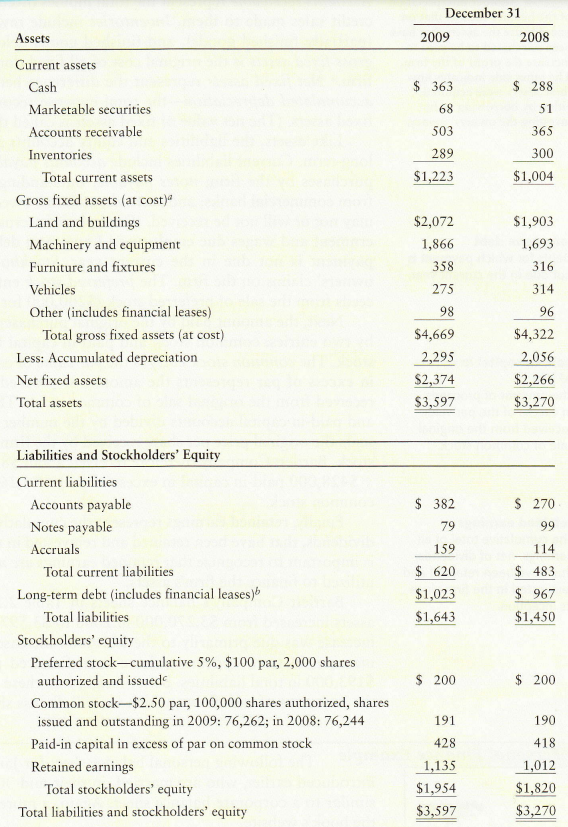

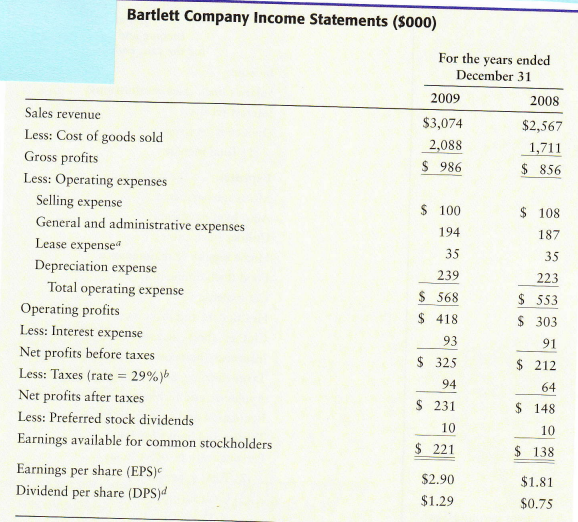

Use the consolidated financial statements for Bartlett Co. that have been posted to compute the financial ratios for Bartlett Company for BOTH 2008 & 2009.

Use the consolidated financial statements for Bartlett Co. that have been posted to compute the financial ratios for Bartlett Company for BOTH 2008 & 2009.

Performance Measure & Profitability Ratios: Return on Total Equity (Industry Ave: 8.5%) Gross Profit Margin (Industry Ave: 30%) EBIT Margin (Industry Ave: 11%) Operating Expense Ratio (Industry Ave: 40%) Return on Invested Capital (Industry Ave: 6%) Resource Management Ratios (incl. working capital management) Fixed Asset Turnover (Industry Ave: 1.25x) Age of Inventory (Industry Ave: 55 days) Age of Receivables ( Industry Ave: 44 days) Age of Payables (Industry Ave: 29 days) Working Capital Gap (Industry Ave: 70 days) Liquidity Ratios: Current Ratio (Industry Ave: 2.05x) Quick Ratio (Industry Ave: 1.43x) Debt Management Ratios Debt to Asset Ratio (Industry Ave: 40%) Debt-to-Equity Ratio (Industry Ave: 140%) Long-term debt to Capital Ratio (Industry Ave: 85%) Interest Coverage Ratio (Industry Ave: 4.3x) Debt Service Coverage (Industry Ave: 3.0x)

Financial statements below.

Bartlett Company Income Statements (\$000)

Bartlett Company Income Statements (\$000) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started