Answered step by step

Verified Expert Solution

Question

1 Approved Answer

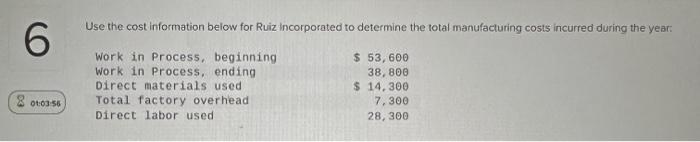

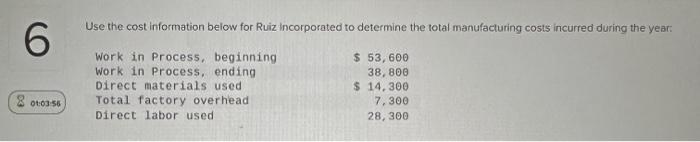

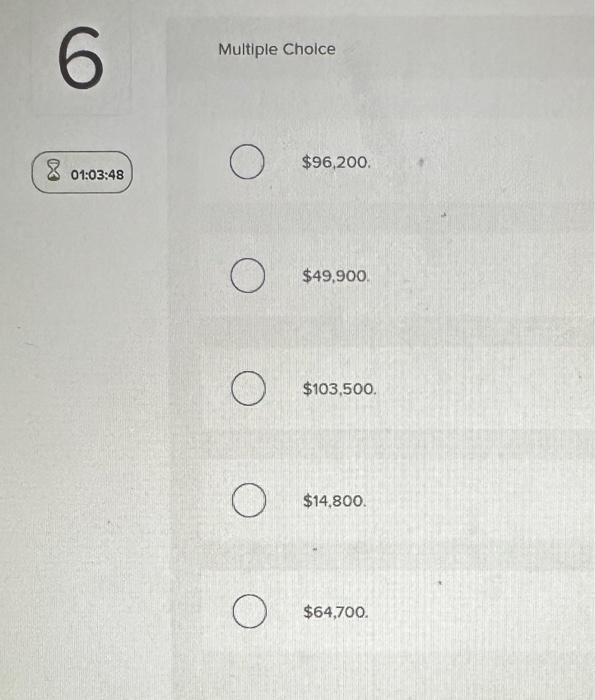

Use the cost information below for Ruiz incorporated to determine the total manufacturing costs incurred during the year: Multiple Choice $96,200. $49,900. $103,500. $14,800. $64,700.

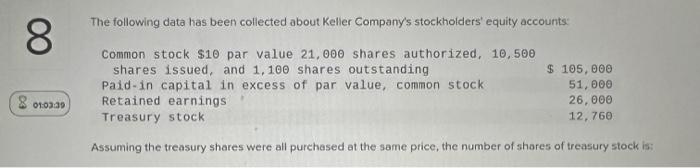

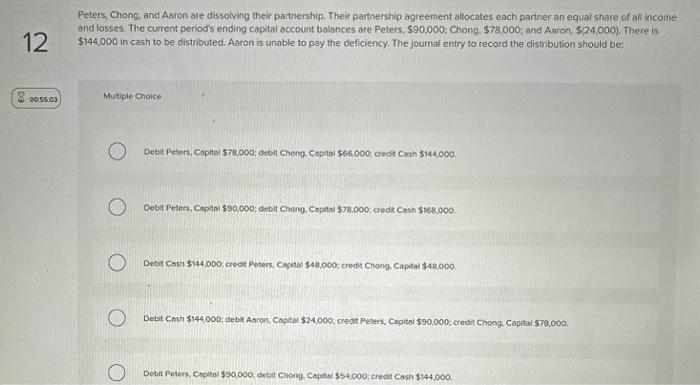

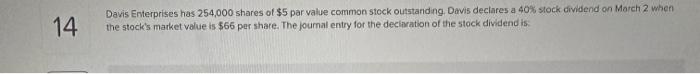

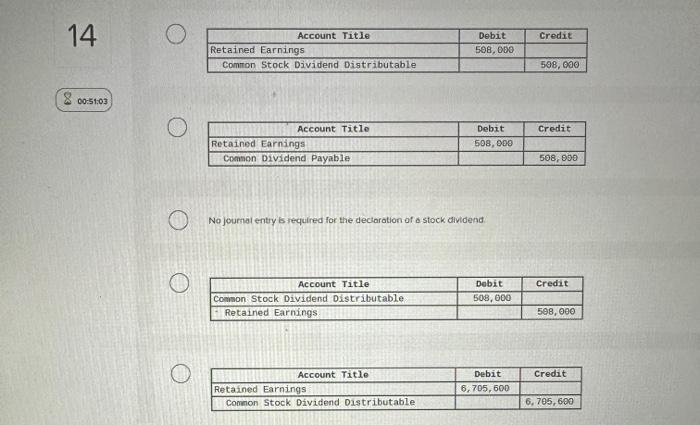

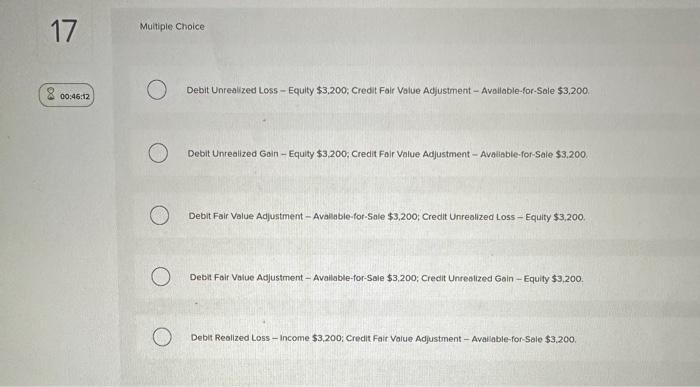

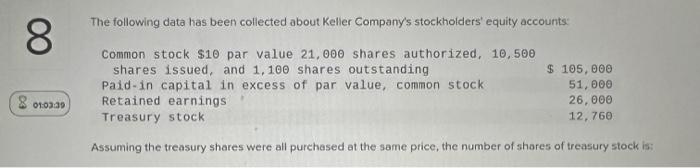

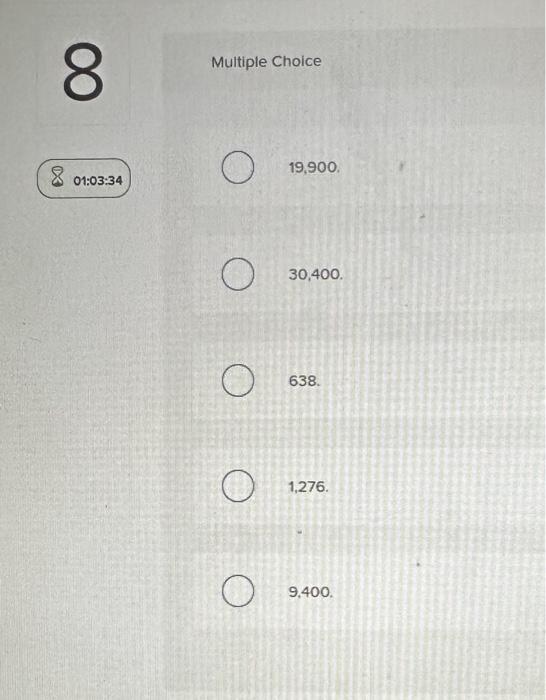

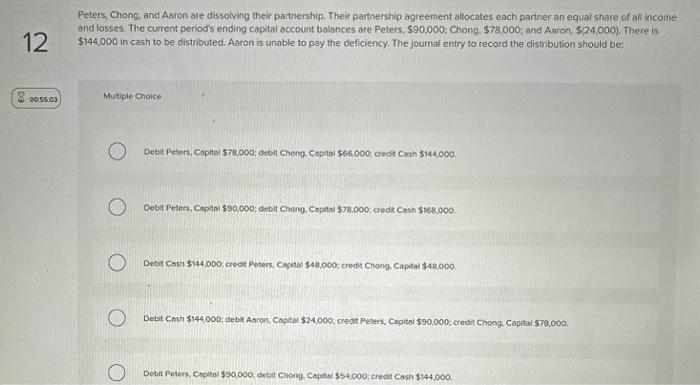

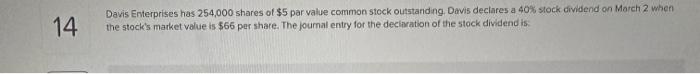

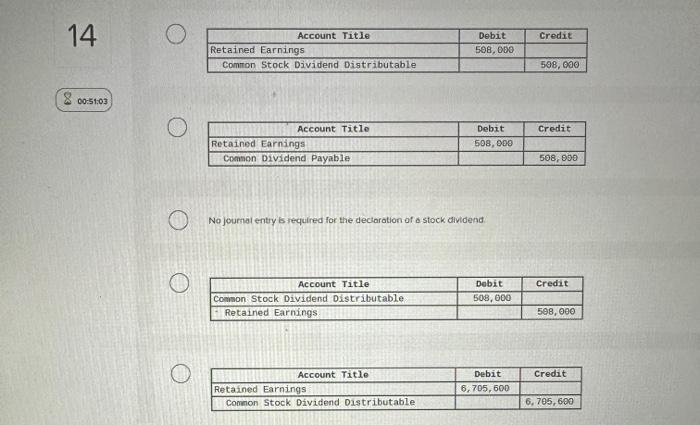

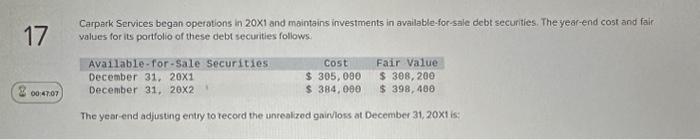

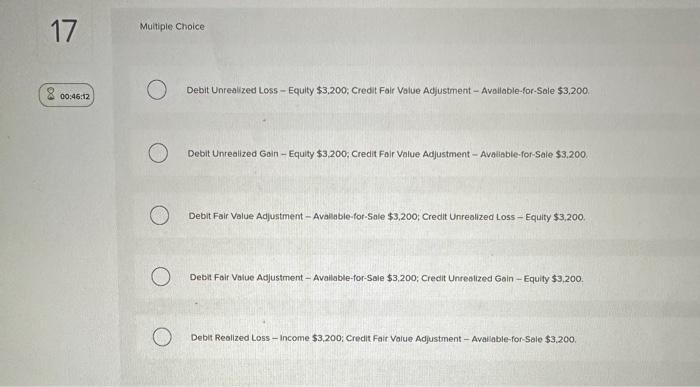

Use the cost information below for Ruiz incorporated to determine the total manufacturing costs incurred during the year: Multiple Choice $96,200. $49,900. $103,500. $14,800. $64,700. The following data has been collected about Keller Company's stockholders' equity accounts: Assuming the treasury shares were all purchesed at the same price, the number of shores of treasury stock is: Multiple Choice 19,900 . 30,400 . 638. 1,276. 9,400 . Peters, Chong, and Aaron are dissolving their partnership. Their parthership agreement allocates each partner an equal share of all income and losses. The current period's ending capital account balances are Peters, $90,000; Chong, $78,000, and Aaron, $24,000), There is $144,000 in cash to be distributed. Aaron is unable to pay the deficiency. The journal entry to record the distribution should be: Mulipie Choice Detit Peters, Copitol 578,000 , debit Chong, Coptal 566,000 , credi Cosh $144.000. Debit Peters, Copitol \$90,000; debit Cheng. Copita \$78,000, credir Cosn $168.000 Debit Cosh \$144,000, debin Asron, Capieil \$24,000, creot Peters, Capital \$90,000, credit Chong. Capital $78,000 Detit Peter3, Cepital $30,000, debt Chong. Cepta/ $54,000; creat Cash $144,000. Davis Enterprises has 254,000 shares of $5 par value common stock outstanding. Davis declares a 40% stock dividend on March 2 when the stock's market volue is $66 per share. The journal entry for the declivation of the stock dividend is: No joumal entry b required for the deciaration of a stock dividend Carpark Services began operations in 201 and maintains investments in available-for-sale debt securities. The year-end cost and fair values for its portfolio of these debt securities follows: The year-end adjusting entry to record the unrealized gair/loss at December 31,201 is: Muitiple Choice Debit Unrealized Loss - Equity $3,200, Credit Foir Value Adjustment - Avallable-for-Sale $3,200. Debit Unrealized Gain - Equity $3,200, Credit Foir Value Adjustment - Avaliable-for-Sale $3.200 Debit Fair Volue Adjustment - Avalible-for-Sale $3,200; Credit Unrealized Loss - Equity $3,200. Debit Fair Value Adjustment - Available-for-Sale $3,200; Credit Unrealized Gain - Equity $3,200. Debit Realized Loss - income $3.200; Credit Fair Value Adjustment - Avallable-for-Sale $3,200

Use the cost information below for Ruiz incorporated to determine the total manufacturing costs incurred during the year: Multiple Choice $96,200. $49,900. $103,500. $14,800. $64,700. The following data has been collected about Keller Company's stockholders' equity accounts: Assuming the treasury shares were all purchesed at the same price, the number of shores of treasury stock is: Multiple Choice 19,900 . 30,400 . 638. 1,276. 9,400 . Peters, Chong, and Aaron are dissolving their partnership. Their parthership agreement allocates each partner an equal share of all income and losses. The current period's ending capital account balances are Peters, $90,000; Chong, $78,000, and Aaron, $24,000), There is $144,000 in cash to be distributed. Aaron is unable to pay the deficiency. The journal entry to record the distribution should be: Mulipie Choice Detit Peters, Copitol 578,000 , debit Chong, Coptal 566,000 , credi Cosh $144.000. Debit Peters, Copitol \$90,000; debit Cheng. Copita \$78,000, credir Cosn $168.000 Debit Cosh \$144,000, debin Asron, Capieil \$24,000, creot Peters, Capital \$90,000, credit Chong. Capital $78,000 Detit Peter3, Cepital $30,000, debt Chong. Cepta/ $54,000; creat Cash $144,000. Davis Enterprises has 254,000 shares of $5 par value common stock outstanding. Davis declares a 40% stock dividend on March 2 when the stock's market volue is $66 per share. The journal entry for the declivation of the stock dividend is: No joumal entry b required for the deciaration of a stock dividend Carpark Services began operations in 201 and maintains investments in available-for-sale debt securities. The year-end cost and fair values for its portfolio of these debt securities follows: The year-end adjusting entry to record the unrealized gair/loss at December 31,201 is: Muitiple Choice Debit Unrealized Loss - Equity $3,200, Credit Foir Value Adjustment - Avallable-for-Sale $3,200. Debit Unrealized Gain - Equity $3,200, Credit Foir Value Adjustment - Avaliable-for-Sale $3.200 Debit Fair Volue Adjustment - Avalible-for-Sale $3,200; Credit Unrealized Loss - Equity $3,200. Debit Fair Value Adjustment - Available-for-Sale $3,200; Credit Unrealized Gain - Equity $3,200. Debit Realized Loss - income $3.200; Credit Fair Value Adjustment - Avallable-for-Sale $3,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started