Answered step by step

Verified Expert Solution

Question

1 Approved Answer

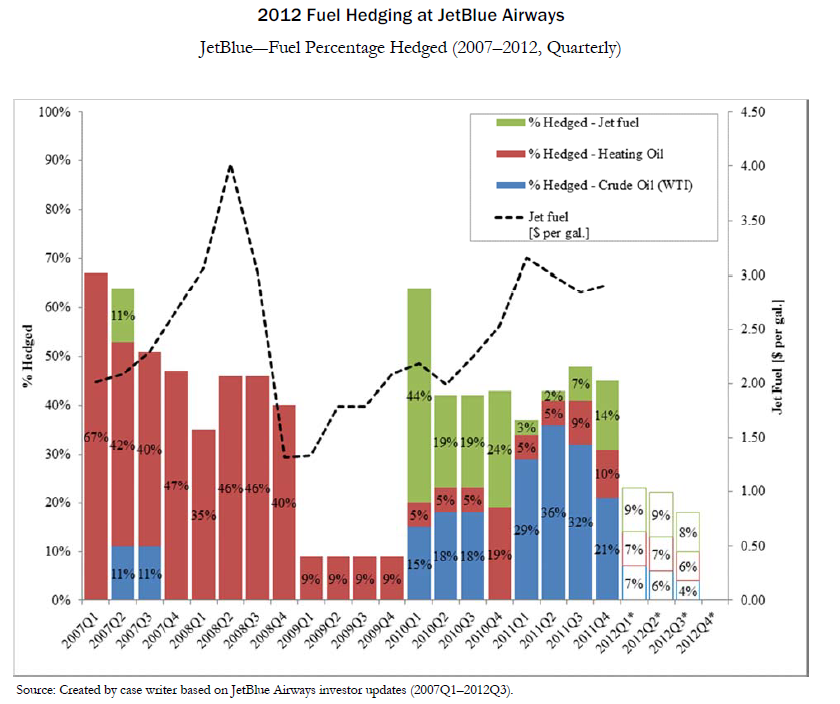

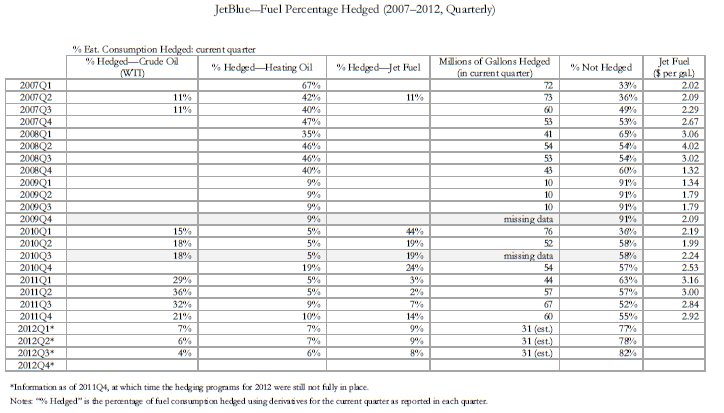

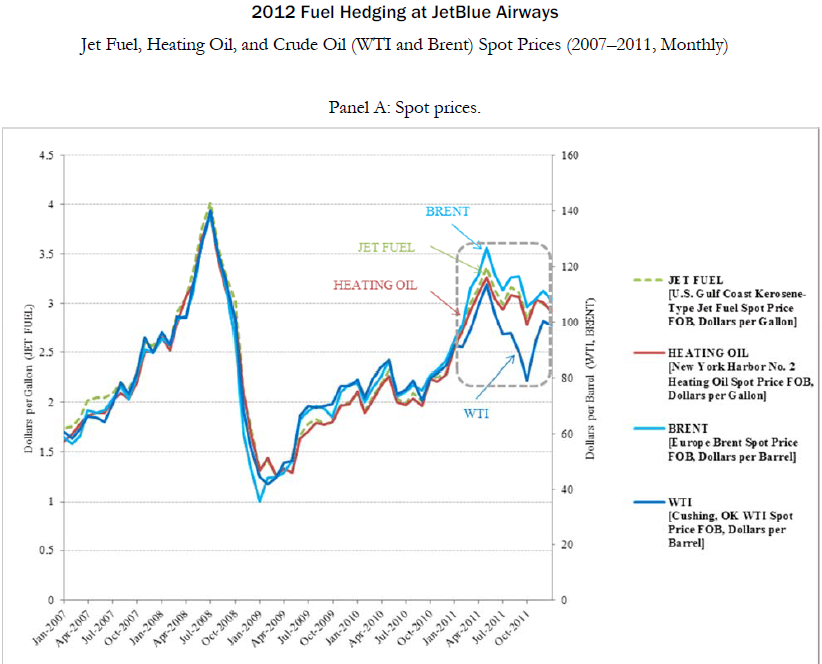

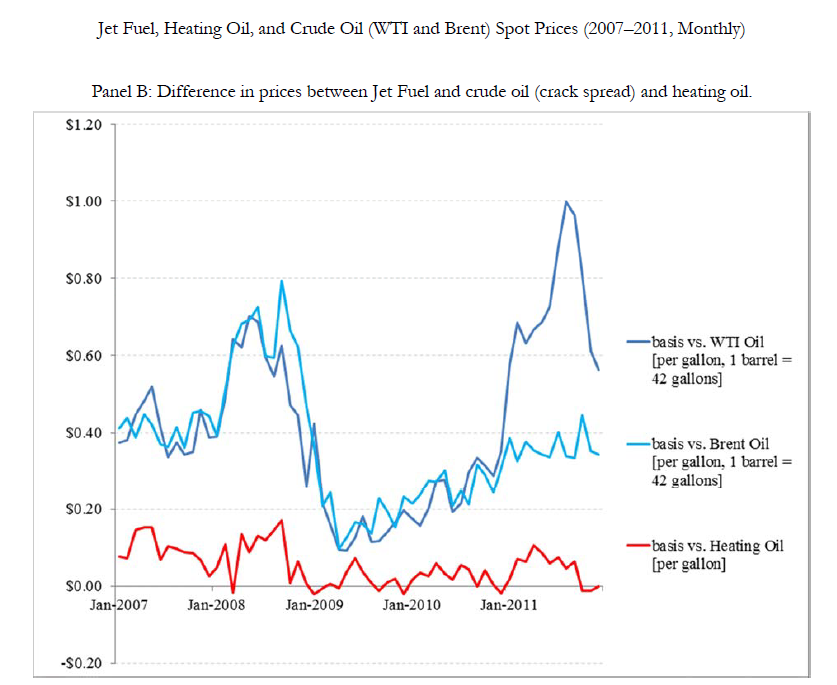

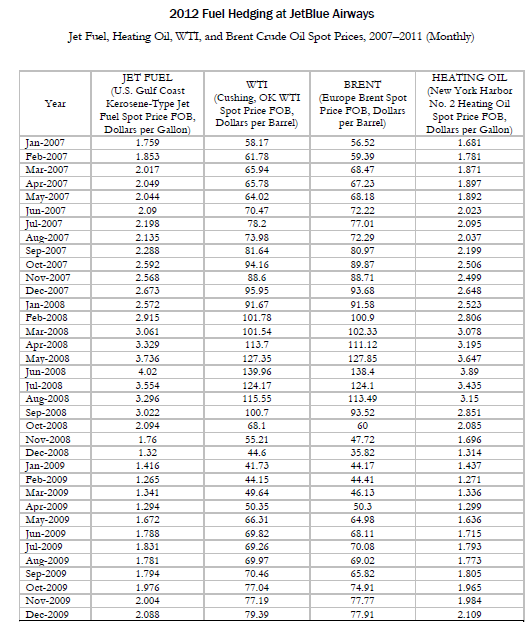

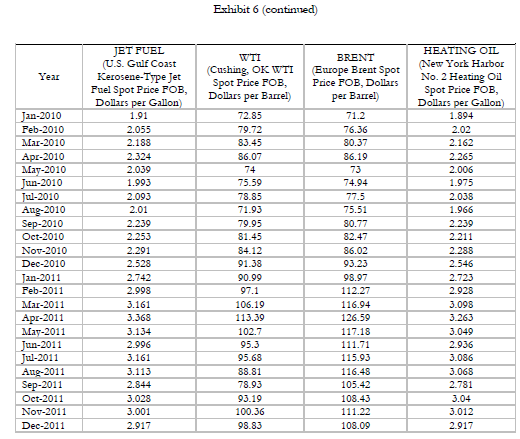

Use the data below on WTI, Brent, heating oil and RBOB gasoline in any combination and back-test them against jet fuel to determine the best

- Use the data below on WTI, Brent, heating oil and RBOB gasoline in any combination and back-test them against jet fuel to determine the best correlation. Will have to try a multiple regression to see if using two variables or more make it more efficient. Basis risk and the weights of each variable will come into play here. For example:

Determine the correlation between the following:

1. WTI vs Jet fuel 2. Brent vs Jet fuel 3. Heating oil vs Jet fuel 4. RBOB Gasoline vs Jet fuel (briefly)

And then back-test them to find the best correlation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started