Question

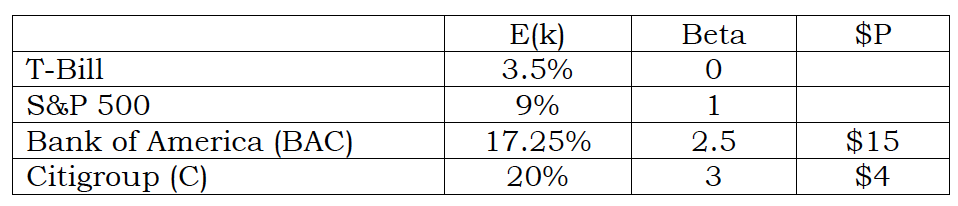

Use the data in the table to answer the question that follows. You are the portfolio manager of the Sholo Hedge Fund. Sholo specializes in

Use the data in the table to answer the question that follows.

You are the portfolio manager of the Sholo Hedge Fund. Sholo specializes in the long/short strategy: buying long equities that are expected to increase in value and selling short equities that are expected to decrease in value. You expect that Bank of America is going to rise in value and that Citigroup is going to fall in value. You want to construct a market neutral position in the two stocks (with a Beta of zero). You have $1M of equity to invest in the position. What is the equilibrium expected return, E(k), for your portfolio?

Looking for the process work to understand how the solution of 3.5% was determined.

$P Beta 0 T-Bill S&P 500 Bank of America (BAC) Citigroup (C) Elk) 3.5% 9% 17.25% 20% $15 2.5 3 $4 % 0% *3.5 9 % 18% 19%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started