use the data on the charts to answer the following questions

use the data on the charts to answer the following questions

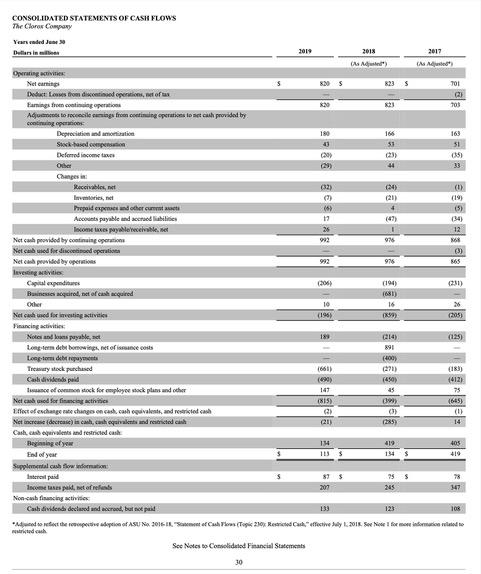

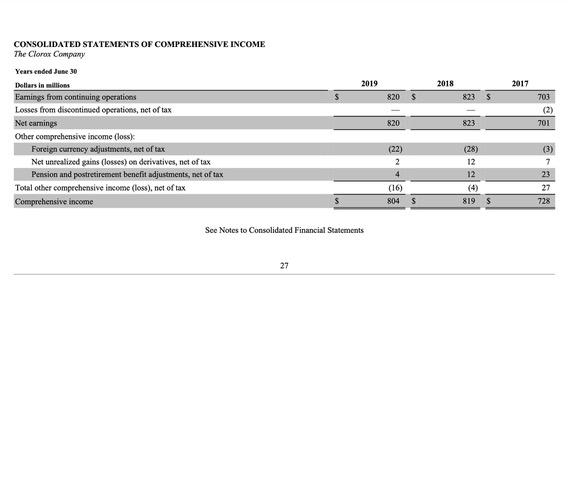

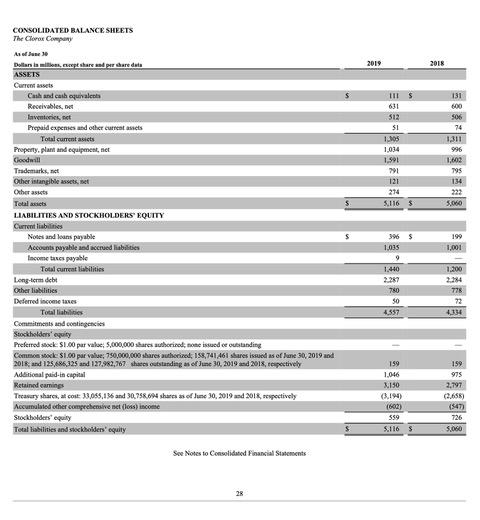

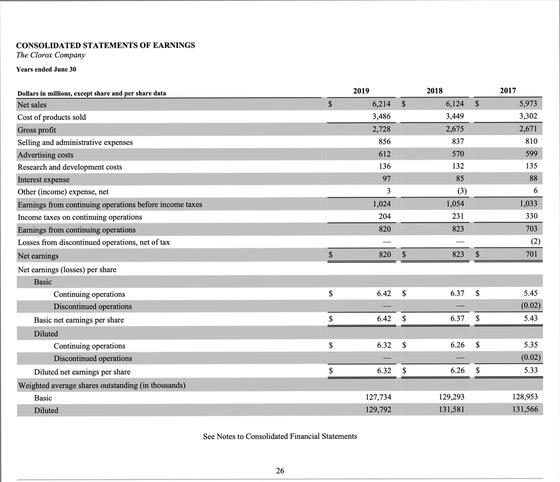

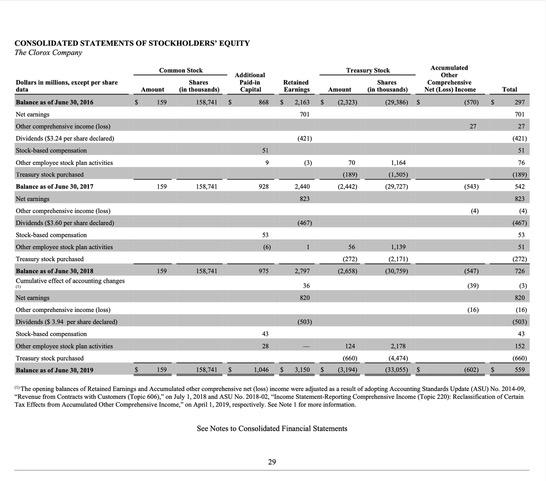

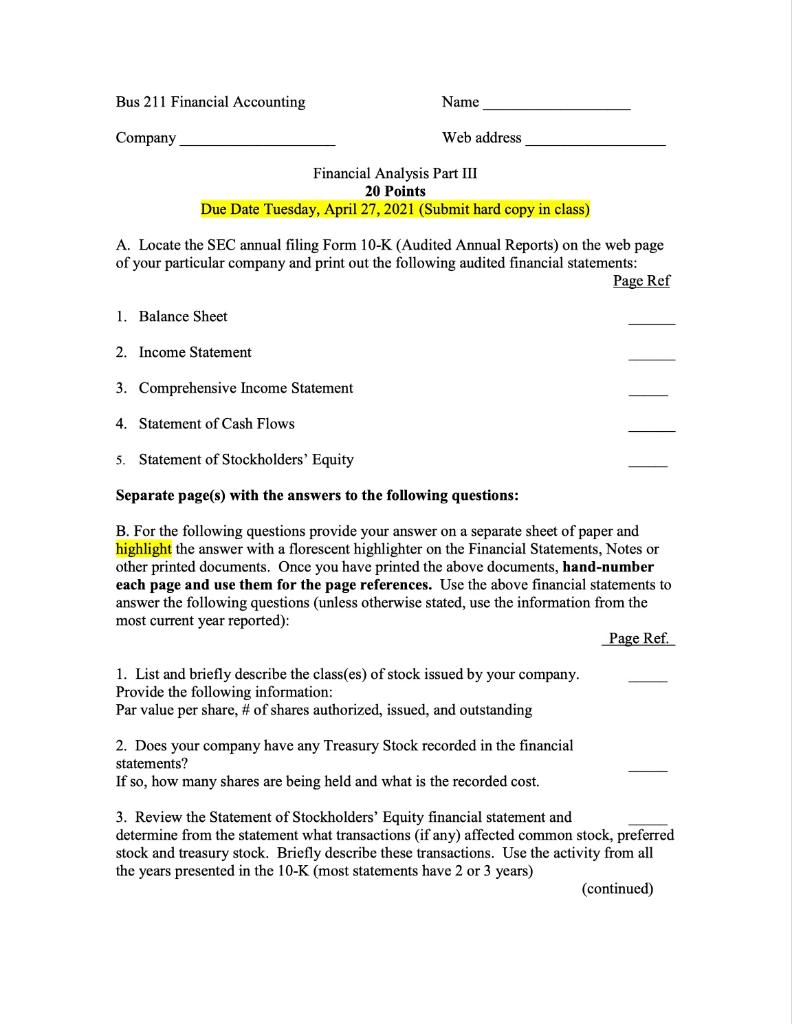

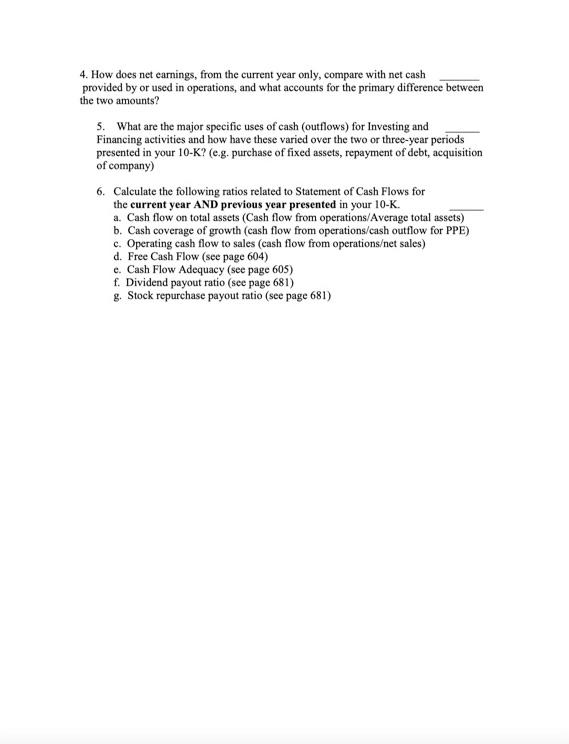

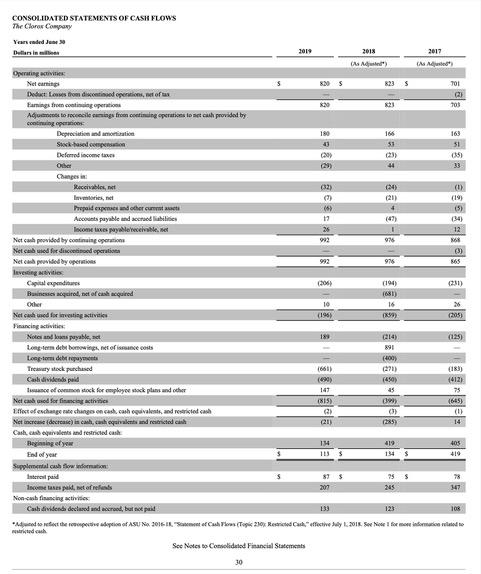

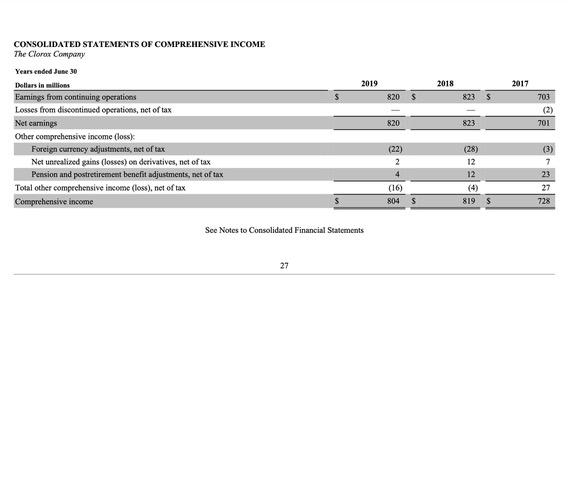

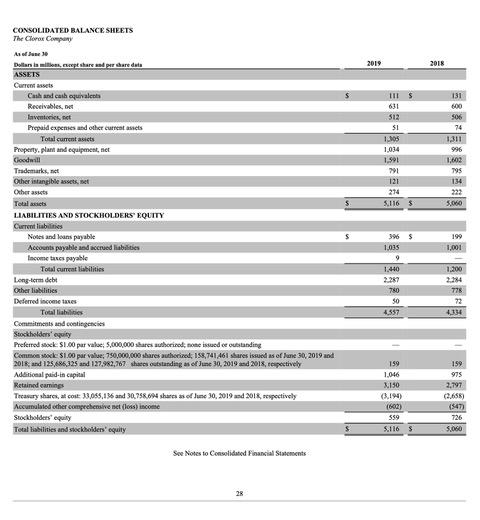

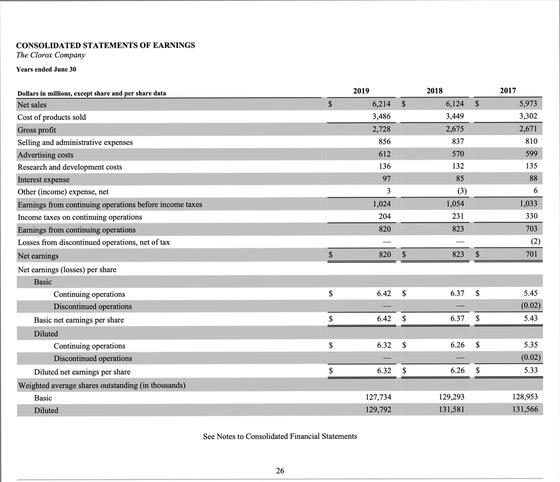

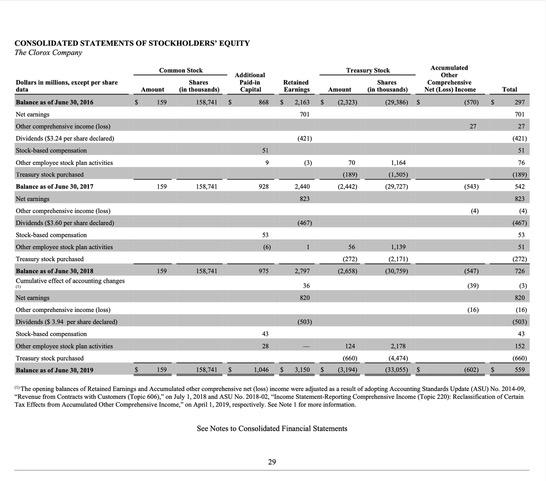

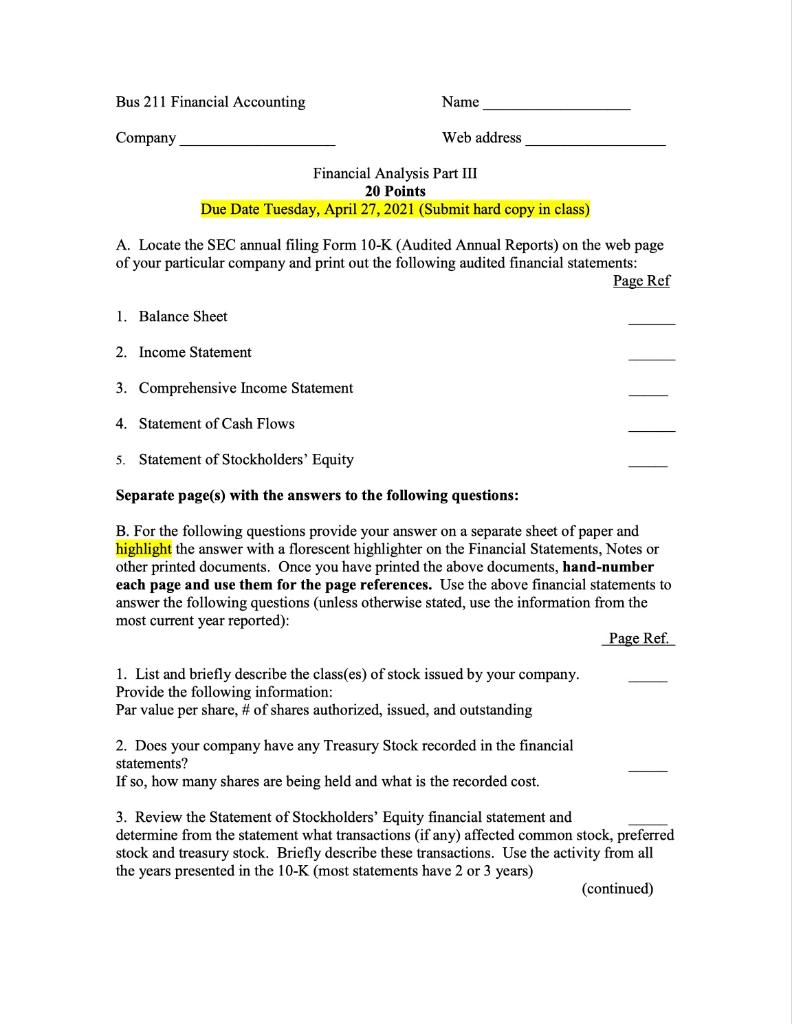

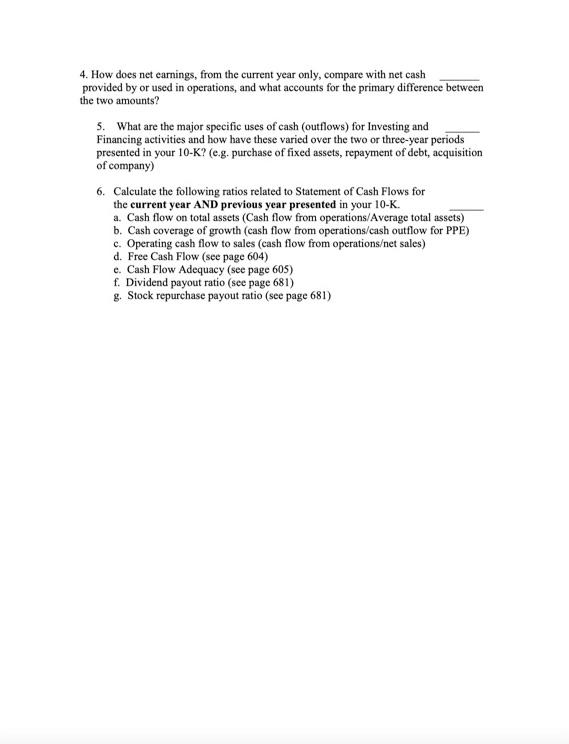

CONSOLIDATED STATEMENTS OF CASH FLOWS The Clorox Company Years waded June 2019 2018 2017 4 992 (3) 992 As Add Operating activities Nel carting 5 823 5 TOI Deduct Loss om dine operations, we of us Faring to contingerti 23 703 Autococci essings from continuing operations to set cat provided by continuing permis Depreciation 180 166 Steckbased compensation 53 51 Deferred income oy (35) Other 2) 4 Changes in Receivables, (32) (24) Invaloties, net (19) Prepaid expres and other current (5) (5) Accounts payable and its (47) (34) Income taxes pobles 26 12 Net can provided by continger 976 68 Net called for discretiedoperation Netca pewided by operations 975 Revesting vities Capital expenditures (205 (194) (231) Business acquired, net of cash acquired 1881) Other Net cash used for resting activities (195) (39) (205) Financing activities Notes des payable (214) (125) Long-term debet bomwings, net of ecosis toep-sorti dhe repayments 00 Trawy stock purchased 1661) (183) Case dividend pold (490) 1450) (412) sunce of common dock for employee stock plans and other 147 75 Net cash used for finance activities 1815) (393 (665) Effect of exchange rate changes on cash cash galvalents, and restricted cash 2) (3) (1) Net increase (decrease) in cah, cashqaivalents and restricted cash (21) (285) Cash, opevalents and restricted cast Beginning of 14 419 Ended year 113 154 Supplemental cash flow donation Interest paid 89 $ 25 78 Incomplete reis 207 245 147 Non-cash facing the Cash dividende declared and crood, but paid 123 108 Med et the pain of ASUNA 2016 ISChboscope 210 Red Caleffective 2016 See Mored to 10 16 45 405 $ See Notes bp Consolidated Financial Statements 30 2019 2018 2017 820 823 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME The Clorox Company Years ended June 30 Istars in millions Eamings from continuing operations Losses from discontinued operations, net of tax Net earnings Other comprehensive income (lossy Foreign currency adjustments, met of tax Net unrealized gains (losses) o derivatives, net of tax Pension and postretirement benefit adjustments, net of tax Total other comprehensive income (loss), net of tax Comprehensive income 703 (2) 701 820 823 (3) (22) 2 4 (28) 12 12 7 (16) 804 27 728 S 819 $ See Notes to Consolidated Financial Statements 27 2019 2018 111 $ 631 512 51 1.105 1,034 1.591 791 121 274 5.116 5 131 600 506 74 1.311 996 1,602 795 134 222 5,060 CONSOLIDATED BALANCE SHEETS The Clorox Company As of use Dollar la mitas, cept share and per dare data ASSETS Current Cash and call equivalents Receivables, lavemories, net Prepaid expenses and other current assets Total current sits Property, plant and equipment, net Goodwill Trademarks, Other intangible assets, et ( Other assets Total LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Notes and loans payable Accounts payable and accrued liabilities Income taxes payable Total current liabilities Long-term debt Other liabilities Deferred income taxes Total liabilities Comments and contingencies Stockholders' equity Preferred stock. S1.00 par valse 5,000,000 Bares stored one issued ce outstanding Commock $1.00 par value 790,000,000 shares authorized, 158,741 461 shares issued as of June 30, 2019 and 2018 and 125,686,325 and 127.962,767 shares outstanding as of June 30, 2019 and 2015, respectively Additional paid-in capital Retained earnings Treasury sharcs, al cost 33,085,196 and 30,758.094 shares of June 30, 2019 and 2018, respectively Accumulated other comprehensive net (los) income Stockholders' equity Total liabilities and stockholders' equity 199 1,001 396 $ 1,035 9 1.440 2.287 780 50 4557 1,200 2.24 778 72 4134 159 1.046 3.150 (3.190) (602) 559 Sullo s 159 975 2,797 2.658) (547) 726 5.066 5 See Notes to Consolidated Financial Statements 28 CONSOLIDATED STATEMENTS OF EARNINGS The Clorox Company Years ended June 30 2019 6,214 $ 3,486 2,728 836 612 136 97 3 1,024 204 2018 6,124 5 3,449 2.675 837 $70 132 85 (3) 1,054 231 2017 5,973 3,302 2,671 810 599 135 88 Dollars le milions, except share and per share data Net sales Cost of products sold Gross profit Selling and administrative expenses Advertising costs Research and development costs Interest expense Other (income) expense, net Eamings from continuing operations before income taxes Income taxes on continuing operations Earnings from continuing operations Losses from discontinued operations, net of tax Net earnings Net earnings (Josses) per share Basic Continuing operations Discontinued operations Basic net camnings per share Diluted Continuing operations Discontinued operations Diluted net camings per share Weighted average shares outstanding (in thousands) Basic Diluted 6 1,033 330 703 (2) 701 $20 s 823S 6.42 s 6.375 5.45 (0.02) 6.42 $ 6.375 5.43 $ 6.32 S 6.26 S 5.35 (0.02) 6.32 6.26 $ 5.33 127,734 129,792 129.293 131,581 128,953 131,566 See Notes to Consolidated Financial Statements 26 Aerundeins| Other Comprehensive Net (Loss) love (570) Total 5 297 701 27 27 (421) 51 76 (18) (543) 542 823 CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY The Clorox Company Commen Stork Treasury Stock Dollars will share Shares Paldin Retained Shares data Am (in the sand Capital Earnings Am in the sandu) Balance of June 21, 2016 5 159 156.741 ** $ 2,161 $ (3,123) 29.965 Netamine 701 Other comprehensive scene oss Dividends (53.24 per sbare declared) Stock-based computin Other employee Neck plan activities (3) 70 Trezory stack purchases (1) 11.305) Balance as of June 30, 2017 159 158,741 928 2.640 (2.442) (29,727) Nel camp Other comprehensive income flow) Dividends (53.60 per stare declared) (467) Steck based compomation Other employee steckplan activities (5) 56 1.139 Tror stock purchased (2.171) Balance of Jan, 2018 159 156,741 975 2.99 2.6581 (10.759) Cumulative effect of accounting changes 36 Net caming 820 Other comprehensive income flow) Dividends ($3.94 per share declared (503) Stock-based compensation 43 Other employee stockpion activities 124 2,178 Treasury stock purchased (660) Malance as of June 28, 2019 199 158,741 1.046 3.1505 (3,190 (33.055) (4) (4) (467) 51 51 1 51 (272) (547) 726 (39) 820 (16) (16) 43 152 (660) 559 (602) The opening balance of Retained Faming and Accumulated other comprehensive set (los) income were adjusted as a result of adopting Accounting Sundada Update (ASU) No 2012-09. "Revenue from Corts with Custom (Topic 606)." ca July 1, 2018 and ASU No. 2018.00.some Sulement Reporting Compecheie come Topic 220: Reclamation of Certain Tax Effects from Accumulated Other Comprehensive Income," on April 1, 2019, respectively. See Notel for more info See Notes to Consolidated Financial Statements 29 Bus 211 Financial Accounting Name Company Web address Financial Analysis Part III 20 Points Due Date Tuesday, April 27, 2021 (Submit hard copy in class) A. Locate the SEC annual filing Form 10-K (Audited Annual Reports) on the web page of your particular company and print out the following audited financial statements: Page Ref 1. Balance Sheet 2. Income Statement 3. Comprehensive Income Statement 4. Statement of Cash Flows 5. Statement of Stockholders' Equity Separate page(s) with the answers to the following questions: B. For the following questions provide your answer on a separate sheet of paper and highlight the answer with a florescent highlighter on the Financial Statements, Notes or other printed documents. Once you have printed the above documents, hand-number each page and use them for the page references. Use the above financial statements to answer the following questions (unless otherwise stated, use the information from the most current year reported): Page Ref. 1. List and briefly describe the class(es) of stock issued by your company. Provide the following information: Par value per share, # of shares authorized, issued, and outstanding 2. Does your company have any Treasury Stock recorded in the financial statements? If so, how many shares are being held and what is the recorded cost. 3. Review the Statement of Stockholders' Equity financial statement and determine from the statement what transactions (if any) affected common stock, preferred stock and treasury stock. Briefly describe these transactions. Use the activity from all the years presented in the 10-K (most statements have 2 or 3 years) (continued) 4. How does net earnings, from the current year only, compare with net cash provided by or used in operations, and what accounts for the primary difference between the two amounts? 5. What are the major specific uses of cash (outflows) for Investing and Financing activities and how have these varied over the two or three-year periods presented in your 10-K? (e.g. purchase of fixed assets, repayment of debt, acquisition of company) 6. Calculate the following ratios related to Statement of Cash Flows for the current year AND previous year presented in your 10-K. a. Cash flow on total assets (Cash flow from operations/Average total assets) b. Cash coverage of growth (cash flow from operations/cash outflow for PPE) c. Operating cash flow to sales (cash flow from operationset sales) d. Free Cash Flow (see page 604) e. Cash Flow Adequacy (see page 605) f. Dividend payout ratio (see page 681) g. Stock repurchase payout ratio (see page 681) CONSOLIDATED STATEMENTS OF CASH FLOWS The Clorox Company Years waded June 2019 2018 2017 4 992 (3) 992 As Add Operating activities Nel carting 5 823 5 TOI Deduct Loss om dine operations, we of us Faring to contingerti 23 703 Autococci essings from continuing operations to set cat provided by continuing permis Depreciation 180 166 Steckbased compensation 53 51 Deferred income oy (35) Other 2) 4 Changes in Receivables, (32) (24) Invaloties, net (19) Prepaid expres and other current (5) (5) Accounts payable and its (47) (34) Income taxes pobles 26 12 Net can provided by continger 976 68 Net called for discretiedoperation Netca pewided by operations 975 Revesting vities Capital expenditures (205 (194) (231) Business acquired, net of cash acquired 1881) Other Net cash used for resting activities (195) (39) (205) Financing activities Notes des payable (214) (125) Long-term debet bomwings, net of ecosis toep-sorti dhe repayments 00 Trawy stock purchased 1661) (183) Case dividend pold (490) 1450) (412) sunce of common dock for employee stock plans and other 147 75 Net cash used for finance activities 1815) (393 (665) Effect of exchange rate changes on cash cash galvalents, and restricted cash 2) (3) (1) Net increase (decrease) in cah, cashqaivalents and restricted cash (21) (285) Cash, opevalents and restricted cast Beginning of 14 419 Ended year 113 154 Supplemental cash flow donation Interest paid 89 $ 25 78 Incomplete reis 207 245 147 Non-cash facing the Cash dividende declared and crood, but paid 123 108 Med et the pain of ASUNA 2016 ISChboscope 210 Red Caleffective 2016 See Mored to 10 16 45 405 $ See Notes bp Consolidated Financial Statements 30 2019 2018 2017 820 823 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME The Clorox Company Years ended June 30 Istars in millions Eamings from continuing operations Losses from discontinued operations, net of tax Net earnings Other comprehensive income (lossy Foreign currency adjustments, met of tax Net unrealized gains (losses) o derivatives, net of tax Pension and postretirement benefit adjustments, net of tax Total other comprehensive income (loss), net of tax Comprehensive income 703 (2) 701 820 823 (3) (22) 2 4 (28) 12 12 7 (16) 804 27 728 S 819 $ See Notes to Consolidated Financial Statements 27 2019 2018 111 $ 631 512 51 1.105 1,034 1.591 791 121 274 5.116 5 131 600 506 74 1.311 996 1,602 795 134 222 5,060 CONSOLIDATED BALANCE SHEETS The Clorox Company As of use Dollar la mitas, cept share and per dare data ASSETS Current Cash and call equivalents Receivables, lavemories, net Prepaid expenses and other current assets Total current sits Property, plant and equipment, net Goodwill Trademarks, Other intangible assets, et ( Other assets Total LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Notes and loans payable Accounts payable and accrued liabilities Income taxes payable Total current liabilities Long-term debt Other liabilities Deferred income taxes Total liabilities Comments and contingencies Stockholders' equity Preferred stock. S1.00 par valse 5,000,000 Bares stored one issued ce outstanding Commock $1.00 par value 790,000,000 shares authorized, 158,741 461 shares issued as of June 30, 2019 and 2018 and 125,686,325 and 127.962,767 shares outstanding as of June 30, 2019 and 2015, respectively Additional paid-in capital Retained earnings Treasury sharcs, al cost 33,085,196 and 30,758.094 shares of June 30, 2019 and 2018, respectively Accumulated other comprehensive net (los) income Stockholders' equity Total liabilities and stockholders' equity 199 1,001 396 $ 1,035 9 1.440 2.287 780 50 4557 1,200 2.24 778 72 4134 159 1.046 3.150 (3.190) (602) 559 Sullo s 159 975 2,797 2.658) (547) 726 5.066 5 See Notes to Consolidated Financial Statements 28 CONSOLIDATED STATEMENTS OF EARNINGS The Clorox Company Years ended June 30 2019 6,214 $ 3,486 2,728 836 612 136 97 3 1,024 204 2018 6,124 5 3,449 2.675 837 $70 132 85 (3) 1,054 231 2017 5,973 3,302 2,671 810 599 135 88 Dollars le milions, except share and per share data Net sales Cost of products sold Gross profit Selling and administrative expenses Advertising costs Research and development costs Interest expense Other (income) expense, net Eamings from continuing operations before income taxes Income taxes on continuing operations Earnings from continuing operations Losses from discontinued operations, net of tax Net earnings Net earnings (Josses) per share Basic Continuing operations Discontinued operations Basic net camnings per share Diluted Continuing operations Discontinued operations Diluted net camings per share Weighted average shares outstanding (in thousands) Basic Diluted 6 1,033 330 703 (2) 701 $20 s 823S 6.42 s 6.375 5.45 (0.02) 6.42 $ 6.375 5.43 $ 6.32 S 6.26 S 5.35 (0.02) 6.32 6.26 $ 5.33 127,734 129,792 129.293 131,581 128,953 131,566 See Notes to Consolidated Financial Statements 26 Aerundeins| Other Comprehensive Net (Loss) love (570) Total 5 297 701 27 27 (421) 51 76 (18) (543) 542 823 CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY The Clorox Company Commen Stork Treasury Stock Dollars will share Shares Paldin Retained Shares data Am (in the sand Capital Earnings Am in the sandu) Balance of June 21, 2016 5 159 156.741 ** $ 2,161 $ (3,123) 29.965 Netamine 701 Other comprehensive scene oss Dividends (53.24 per sbare declared) Stock-based computin Other employee Neck plan activities (3) 70 Trezory stack purchases (1) 11.305) Balance as of June 30, 2017 159 158,741 928 2.640 (2.442) (29,727) Nel camp Other comprehensive income flow) Dividends (53.60 per stare declared) (467) Steck based compomation Other employee steckplan activities (5) 56 1.139 Tror stock purchased (2.171) Balance of Jan, 2018 159 156,741 975 2.99 2.6581 (10.759) Cumulative effect of accounting changes 36 Net caming 820 Other comprehensive income flow) Dividends ($3.94 per share declared (503) Stock-based compensation 43 Other employee stockpion activities 124 2,178 Treasury stock purchased (660) Malance as of June 28, 2019 199 158,741 1.046 3.1505 (3,190 (33.055) (4) (4) (467) 51 51 1 51 (272) (547) 726 (39) 820 (16) (16) 43 152 (660) 559 (602) The opening balance of Retained Faming and Accumulated other comprehensive set (los) income were adjusted as a result of adopting Accounting Sundada Update (ASU) No 2012-09. "Revenue from Corts with Custom (Topic 606)." ca July 1, 2018 and ASU No. 2018.00.some Sulement Reporting Compecheie come Topic 220: Reclamation of Certain Tax Effects from Accumulated Other Comprehensive Income," on April 1, 2019, respectively. See Notel for more info See Notes to Consolidated Financial Statements 29 Bus 211 Financial Accounting Name Company Web address Financial Analysis Part III 20 Points Due Date Tuesday, April 27, 2021 (Submit hard copy in class) A. Locate the SEC annual filing Form 10-K (Audited Annual Reports) on the web page of your particular company and print out the following audited financial statements: Page Ref 1. Balance Sheet 2. Income Statement 3. Comprehensive Income Statement 4. Statement of Cash Flows 5. Statement of Stockholders' Equity Separate page(s) with the answers to the following questions: B. For the following questions provide your answer on a separate sheet of paper and highlight the answer with a florescent highlighter on the Financial Statements, Notes or other printed documents. Once you have printed the above documents, hand-number each page and use them for the page references. Use the above financial statements to answer the following questions (unless otherwise stated, use the information from the most current year reported): Page Ref. 1. List and briefly describe the class(es) of stock issued by your company. Provide the following information: Par value per share, # of shares authorized, issued, and outstanding 2. Does your company have any Treasury Stock recorded in the financial statements? If so, how many shares are being held and what is the recorded cost. 3. Review the Statement of Stockholders' Equity financial statement and determine from the statement what transactions (if any) affected common stock, preferred stock and treasury stock. Briefly describe these transactions. Use the activity from all the years presented in the 10-K (most statements have 2 or 3 years) (continued) 4. How does net earnings, from the current year only, compare with net cash provided by or used in operations, and what accounts for the primary difference between the two amounts? 5. What are the major specific uses of cash (outflows) for Investing and Financing activities and how have these varied over the two or three-year periods presented in your 10-K? (e.g. purchase of fixed assets, repayment of debt, acquisition of company) 6. Calculate the following ratios related to Statement of Cash Flows for the current year AND previous year presented in your 10-K. a. Cash flow on total assets (Cash flow from operations/Average total assets) b. Cash coverage of growth (cash flow from operations/cash outflow for PPE) c. Operating cash flow to sales (cash flow from operationset sales) d. Free Cash Flow (see page 604) e. Cash Flow Adequacy (see page 605) f. Dividend payout ratio (see page 681) g. Stock repurchase payout ratio (see page 681)

use the data on the charts to answer the following questions

use the data on the charts to answer the following questions