Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the data shown in the following table: a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression).

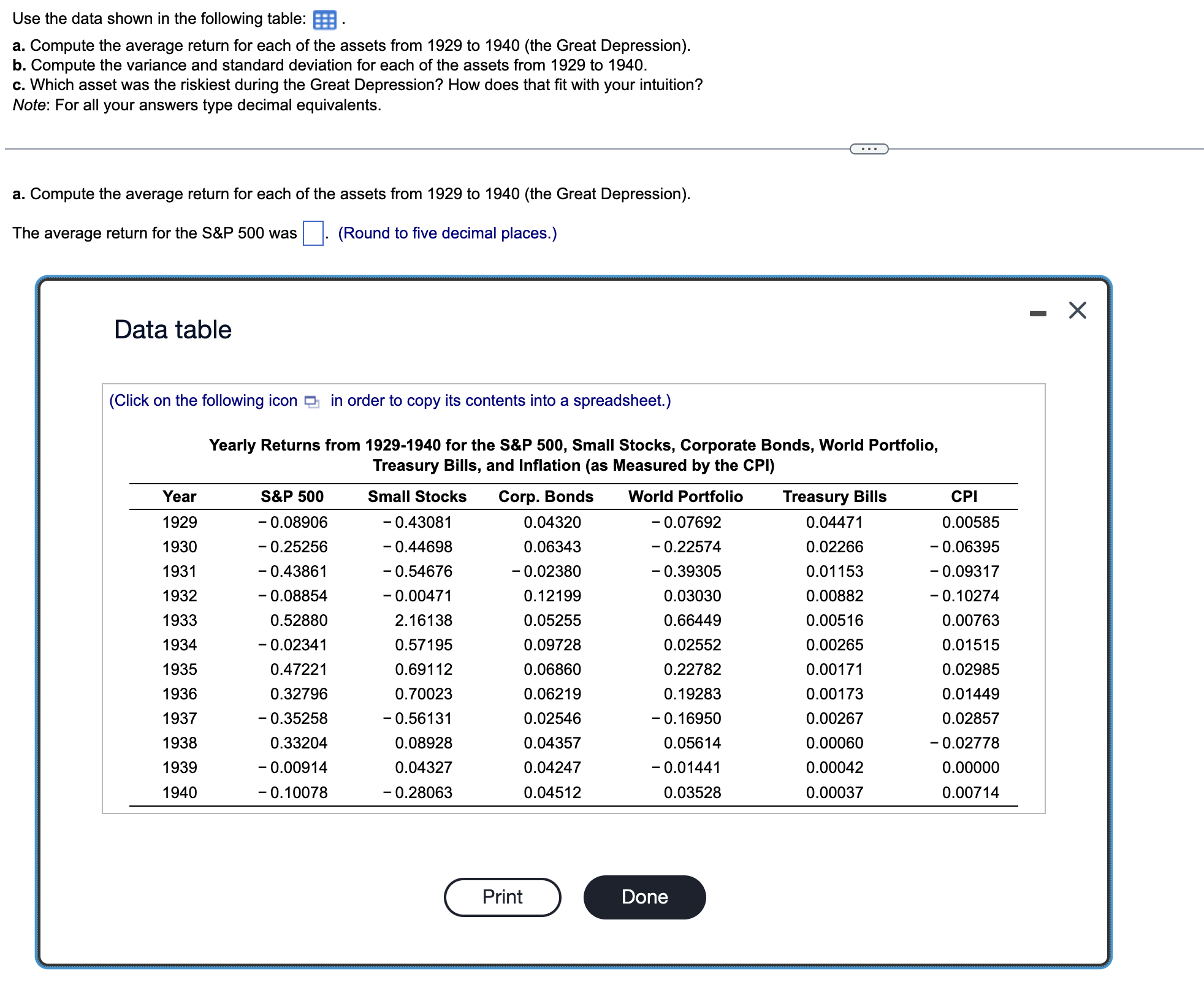

Use the data shown in the following table: a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). b. Compute the variance and standard deviation for each of the assets from 1929 to 1940. c. Which asset was the riskiest during the Great Depression? How does that fit with your intuition? Note: For all your answers type decimal equivalents. a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). The average return for the S\&P 500 was (Round to five decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Yearly Returns from 1929-1940 for the S\&P 500, Small Stocks, Corporate Bonds, World Portfolio, Treasury Bills, and Inflation (as Measured by the CPI) Use the data shown in the following table: a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). b. Compute the variance and standard deviation for each of the assets from 1929 to 1940. c. Which asset was the riskiest during the Great Depression? How does that fit with your intuition? Note: For all your answers type decimal equivalents. a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). The average return for the S\&P 500 was (Round to five decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Yearly Returns from 1929-1940 for the S\&P 500, Small Stocks, Corporate Bonds, World Portfolio, Treasury Bills, and Inflation (as Measured by the CPI)

Use the data shown in the following table: a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). b. Compute the variance and standard deviation for each of the assets from 1929 to 1940. c. Which asset was the riskiest during the Great Depression? How does that fit with your intuition? Note: For all your answers type decimal equivalents. a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). The average return for the S\&P 500 was (Round to five decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Yearly Returns from 1929-1940 for the S\&P 500, Small Stocks, Corporate Bonds, World Portfolio, Treasury Bills, and Inflation (as Measured by the CPI) Use the data shown in the following table: a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). b. Compute the variance and standard deviation for each of the assets from 1929 to 1940. c. Which asset was the riskiest during the Great Depression? How does that fit with your intuition? Note: For all your answers type decimal equivalents. a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). The average return for the S\&P 500 was (Round to five decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Yearly Returns from 1929-1940 for the S\&P 500, Small Stocks, Corporate Bonds, World Portfolio, Treasury Bills, and Inflation (as Measured by the CPI) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started