Use the DuPont Identity to calculate Lex Corporation's ROE and the Industry Average ROE. Then, write a comparison of Lex Corporation's ROE to the industry

- Use the DuPont Identity to calculate Lex Corporation's ROE and the Industry Average ROE.

- Then, write a comparison of Lex Corporation's ROE to the industry average ROE, using the DuPont information you calculated in your explanation.

- Be sure to explain why Lex's ROE is lower than the industry average. Be clear and concise, use full sentences, and proper grammar and punctuation.

| Industry Average: | ||

| 1 Operating Cash Flow $ | $13,370 | |

| 2 Current ratio | 2.39 | 2.00 |

| 3 Quick Ratio | 1.39 | 1.00 |

| 4 Total Debt Ratio | 0.33 | 0.50 |

| 5 Equity multiplier | 1.50 | 2.00 |

| 6 Accounts Receivable Turnover Ratio | 8.00 | 7.00 |

| 7 Total Asset Turnover | 0.89 | 0.80 |

| 8 Profit Margin | 9.59% | 8.50% |

| 9 Return on Assets (ROA) | 8.54% | 6.80% |

| 10 Return on Equity (ROE) | 12.82% | 13.60% |

| 11 Times Interest Earned | 17.86% | 13 |

| 12 Sustainable Growth Rate | 5% | 10% |

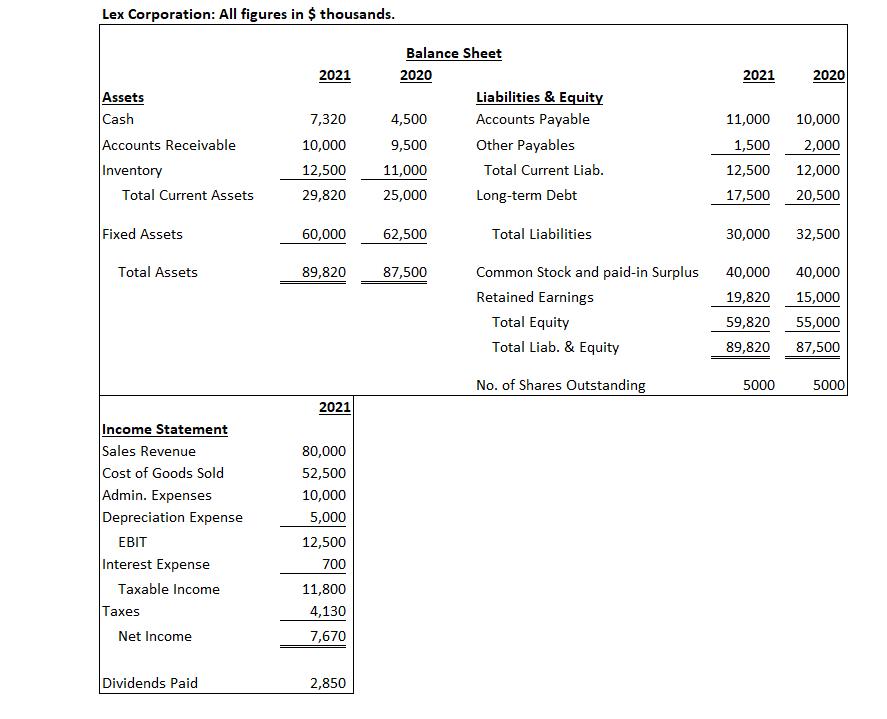

Lex Corporation: All figures in $ thousands. Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Total Assets Income Statement Sales Revenue Cost of Goods Sold Admin. Expenses Depreciation Expense EBIT Interest Expense Taxable Income Taxes Net Income Dividends Paid 2021 7,320 10,000 12,500 29,820 60,000 89,820 2021 80,000 52,500 10,000 5,000 12,500 700 11,800 4,130 7,670 2,850 Balance Sheet 2020 4,500 9,500 11,000 25,000 62,500 87,500 Liabilities & Equity Accounts Payable Other Payables Total Current Liab. Long-term Debt Total Liabilities Common Stock and paid-in Surplus Retained Earnings Total Equity Total Liab. & Equity No. of Shares Outstanding 2021 11,000 1,500 12,500 17,500 30,000 2020 5000 10,000 2,000 12,000 20,500 32,500 40,000 40,000 19,820 15,000 59,820 55,000 89,820 87,500 5000

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Lex Corporations ROE and the Industry Average ROE we will use the DuPont Identity formula which decomposes ROE into three components Prof...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started