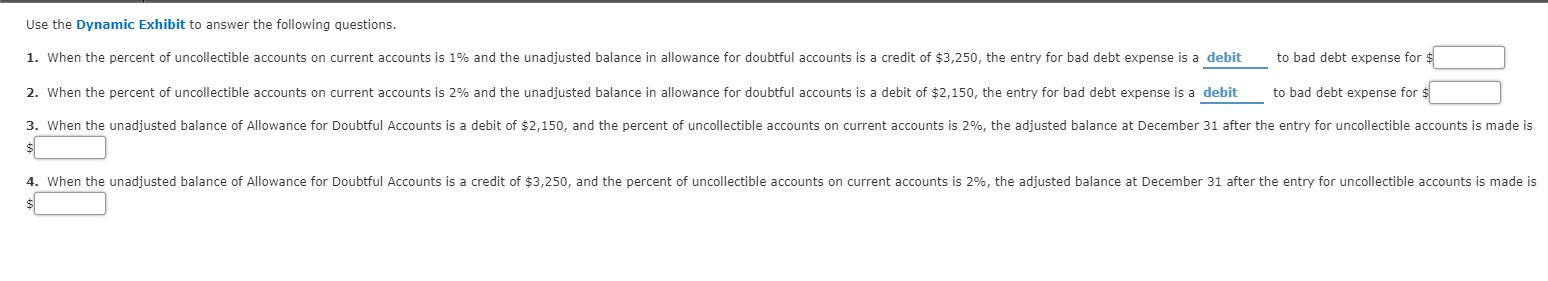

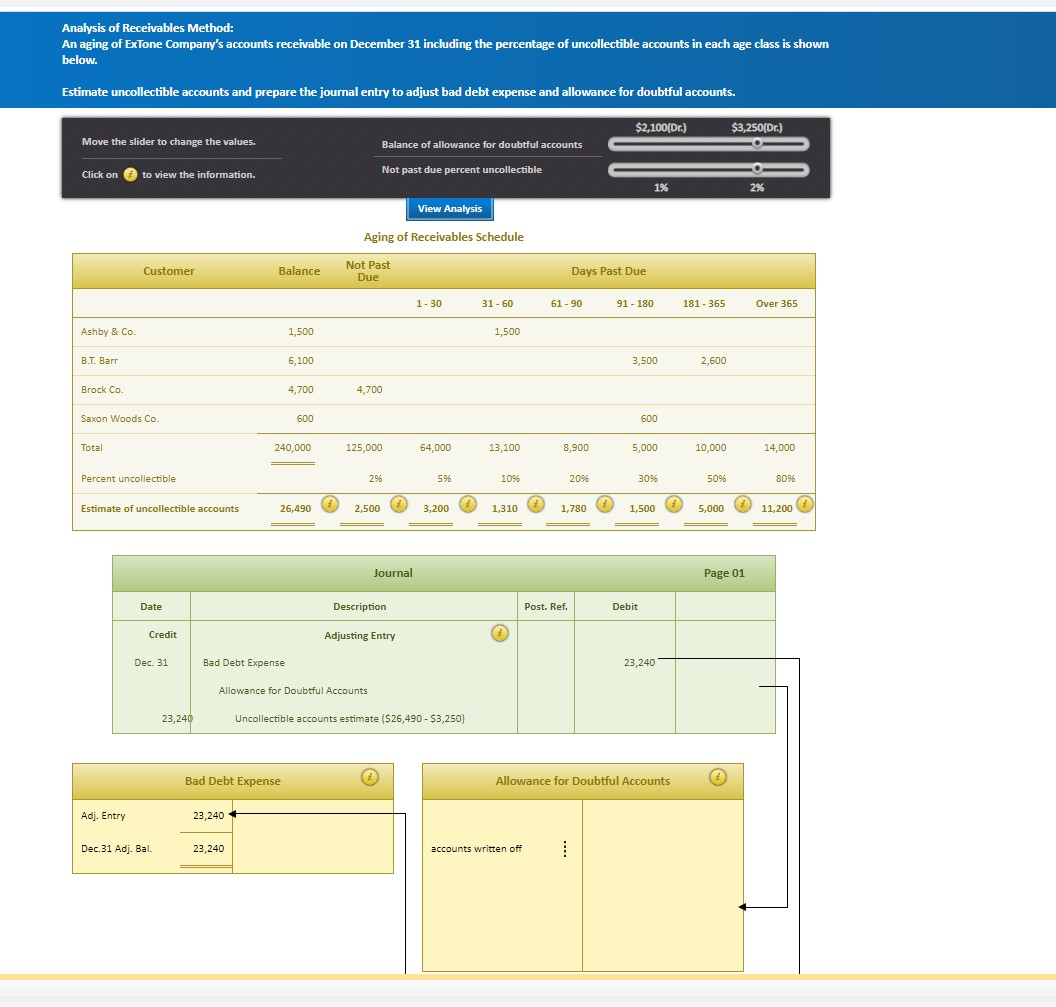

Use the Dynamic Exhibit to answer the following questions. 1. When the percent of uncollectible accounts on current accounts is 1% and the unadjusted balance in allowance for doubtful accounts is a credit of $3,250, the entry for bad debt expense is a debit to bad debt expense for $ 2. When the percent of uncollectible accounts on current accounts is 2% and the unadjusted balance in allowance for doubtful accounts is a debit of $2,150, the entry for bad debt expense is a debit to bad debt expense for $ debit of $2,150, and the percent of uncollectible accounts on current accounts is 2%, the adjusted balance at December 31 after the entry for uncollectible accounts is made is 3. When the unadjusted balance of Allowance for Doubtful Accounts is $ 4. When the unadjusted balance of Allowance for Doubtful Accounts is credit of $3,250, and the percent of uncollectible accounts on current accounts is 2%, the adjusted balance at December 31 after the entry for uncollectible accounts is made is Analysis of Receivables Method: An aging of ExTone Company's accounts receivable on December 31 including the percentage of uncollectible accounts in each age class is shown below. Estimate uncollectible accounts and prepare the journal entry to adjust bad debt expense and allowance for doubtful accounts. $2,100(Dr.) $3,250[Dr.) Move the slider to change the values. Balance of allowance for doubtful accounts Click on to view the information. Not past due percent uncollectible 1% 2% View Analysis Aging of Receivables Schedule Customer Balance Not Past Due Days Past Due 1 - 30 31-60 61 - 90 91 - 180 181 - 365 Over 365 Ashby & Co. 1,500 1,500 B.T. Barr 6,100 3,500 2,600 Brock Co. 4,700 4,700 Saxon Woods Co. 600 600 Total 240,000 125,000 64,000 13,100 8,900 5,000 10,000 14,000 Percent uncollectible 296 596 1096 2096 3096 5096 8096 Estimate of uncollectible accounts 26,490 2,500 3,200 1,310 1,780 1,500 5,000 11,200 Journal Page 01 Date Description Post. Ref. Debit Credit Adjusting Entry (2 Dec 31 Bad Debt Expense 23,240 Allowance for Doubtful Accounts 23,240 Uncollectible accounts estimate ($26,490 - $3,250) Bad Debt Expense Allowance for Doubtful Accounts Adj. Entry 23,240 Dec.31 Adj. Ball 23,240 accounts written off