Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use the EDGAR website to access the most recent 10-K annual report for a merchandising company of their choice. Examples include: Target, Home Depot, Walgreens,

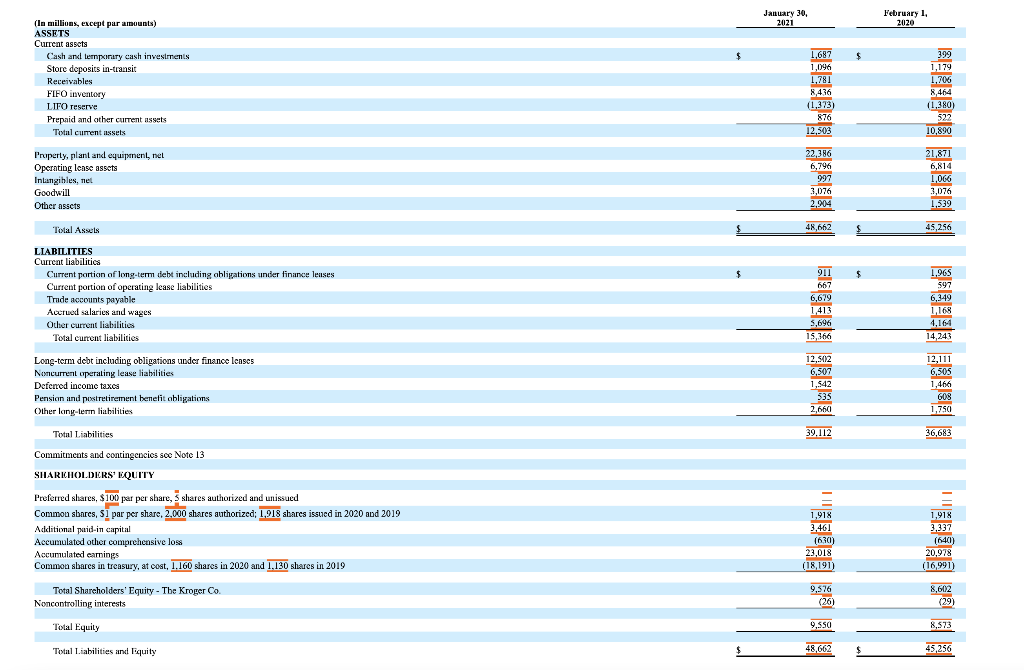

use the EDGAR website to access the most recent 10-K annual report for a merchandising company of their choice. Examples include: Target, Home Depot, Walgreens, Best Buy, The Kroger Co or Walmart.

use the EDGAR website to access the most recent 10-K annual report for a merchandising company of their choice. Examples include: Target, Home Depot, Walgreens, Best Buy, The Kroger Co or Walmart.

- Liquidity Ratios Calculate the current and prior year ratios. (2 pts)

| Ratio | Current | Prior |

| Current Ratio | ||

| Supporting calculations (numerator / denominator) | ||

| Acid-Test Ratio | ||

| Supporting calculations (numerator / denominator) |

Comment on what you learned about the company from the liquidity ratios.

January 30, 2021 February 1, 2020 (la millions, except pur amounts) ASSETS Current assets Cash and lernpximary cash investments Store deposits in-transit Receivables 399 1,179 1,687 1,096 1,781 8,436 (1,373) 1,706 8,464 FIFO inventory LIFO reserve (1,380) 522 Prepaid and other current assets 876 Total curent assets 12,503 10,890 22,386 6,796 Property, plant and equipment, nel Operating lease assets Intangibles, met Goodwill Other assets 997 21,871 6,814 1,066 3,076 1,539 3,076 2.904 Total Assets 48,662 45,256 $ 911 $ 667 LIABILITIES Current Liabilitics Current portion of long-term diebt including abligations under finance lenses Current portion of operating lease liabilities Trude accounts payable Accrued salaries and wages Other current liabilities Total current liabilities 6,679 1,413 5,696 15,366 1,965 597 6,349 1,168 4,164 14,243 12,111 6,505 Long-term debt including obligations under finance lenses Noncurrent operating lease liabilities Defened income taxes Pension and postretirement benefit obligations Other long-lern liabilities 12.512 6,507 1,542 535 1,466 608 2,6601 1,750 Total Liabilities 39,112 36,683 Commitments and contingencies soc Note 13 SHLARICHOLDERS' EQUITY Preferred shares, $100 per per share, shares authorized and unissued Common sbarcs, 51 par per share, 2.000 shares authorized; 1,918 sharcs issued in 2020 and 2019 1,918 Additional puid-in capital Accumulated other comprehensive loss Accumulated earnings Common sbares in treasury, at cost, 1.160 shares in 2020 and 1.130 shares in 2019 1,918 3,461 (630) 23,018 (18,191) 3,337 (640) 20.928 (16,991) Total Shareholders' Equity - The Kroger Co. Noncontrolling interests 9,576 (26) 8,602 (29) Total Equity 9,550 8,573 Total Liabilities and Equity 48,662 45,256Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started