Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use the EDGAR website to access the most recent 10-K annual report for a merchandising company of their choice. Examples include: Target, Home Depot, Walgreens,

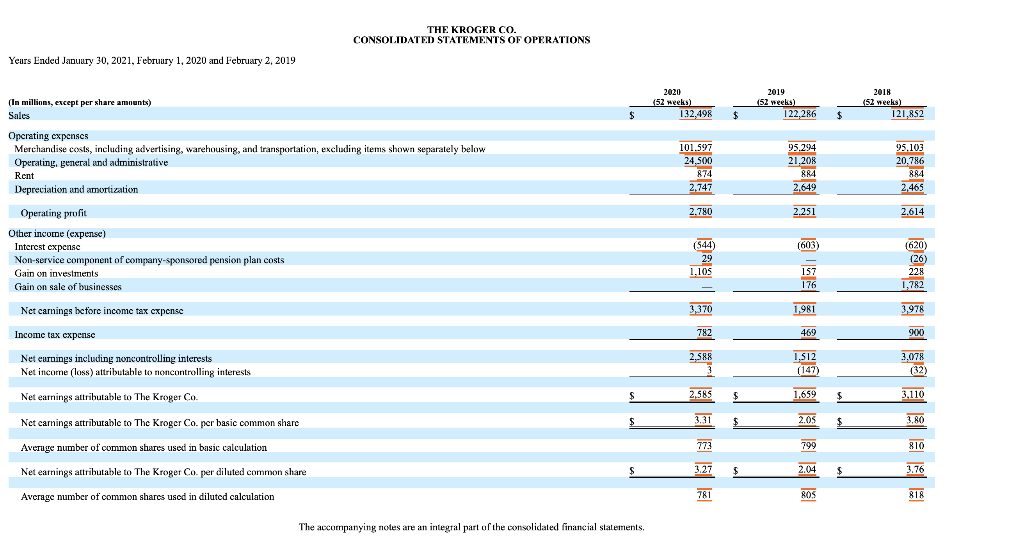

use the EDGAR website to access the most recent 10-K annual report for a merchandising company of their choice. Examples include: Target, Home Depot, Walgreens, Best Buy, The Kroger Co or Walmart.

use the EDGAR website to access the most recent 10-K annual report for a merchandising company of their choice. Examples include: Target, Home Depot, Walgreens, Best Buy, The Kroger Co or Walmart.

- Market Performance Ratios Calculate the current and prior year ratios. (2 pts)

| Ratio | Current | Prior |

| Earnings Per Share | ||

| Supporting calculations (numerator / denominator) | ||

| Price Earnings Ratio | ||

| Supporting calculations (numerator / denominator) |

Comment on what you learned about the company from the market performance ratios.

THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Yeurs Ended Januury 30, 2021, February 1, 2020 and February 2, 2019 2019 (In millions, except per share amounts) Sales 2020 (52 weeks) 132,498 (52 weeks) 122,286 2018 (52 weeks) 121,852 $ $ $ Operating expenses Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below Operating, general und auministrative 95.103 101.597 24,500 874 95.294 21.208 884 20,786 Rent 884 Depreciation and amortization 2.747 2,649 2,465 2.780 2.251 2.614 (544) (603) Operating profit Other income (expense) Interest expense Non-service component of company-sponsored pension plan costs Gain on investments Gain on sale of businesses 29 1,105 (620) ( (26) 228 1,782 157 176 Net carnings before income tax expense 3,370 1,981 3,978 Income tax expense 782 469 WO 2.588 Net eurnings including noncontrolling interests Net income (loss) attributable to noncontrolling interests 1.S12 (147) 3,078 (32 Net earnings attributable to The Kroger Co $ 2,585 $ 1,659 $ 3,110 3.31 $ Net carnings attributable to The Kroger Coper basic common share $ 2.05 $ 3.80 Averuge number of common shares used in basic calculation 773 799 810 Net earrings attributable to The Kroger Co. per diluted common share $ 3.27 $ 2.04 $ 3.76 Average number of common shares used in diluted calculation 781 BOS 818 The accompanying notes are an integral part of the consolidated financial statements, THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Yeurs Ended Januury 30, 2021, February 1, 2020 and February 2, 2019 2019 (In millions, except per share amounts) Sales 2020 (52 weeks) 132,498 (52 weeks) 122,286 2018 (52 weeks) 121,852 $ $ $ Operating expenses Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below Operating, general und auministrative 95.103 101.597 24,500 874 95.294 21.208 884 20,786 Rent 884 Depreciation and amortization 2.747 2,649 2,465 2.780 2.251 2.614 (544) (603) Operating profit Other income (expense) Interest expense Non-service component of company-sponsored pension plan costs Gain on investments Gain on sale of businesses 29 1,105 (620) ( (26) 228 1,782 157 176 Net carnings before income tax expense 3,370 1,981 3,978 Income tax expense 782 469 WO 2.588 Net eurnings including noncontrolling interests Net income (loss) attributable to noncontrolling interests 1.S12 (147) 3,078 (32 Net earnings attributable to The Kroger Co $ 2,585 $ 1,659 $ 3,110 3.31 $ Net carnings attributable to The Kroger Coper basic common share $ 2.05 $ 3.80 Averuge number of common shares used in basic calculation 773 799 810 Net earrings attributable to The Kroger Co. per diluted common share $ 3.27 $ 2.04 $ 3.76 Average number of common shares used in diluted calculation 781 BOS 818 The accompanying notes are an integral part of the consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started