Answered step by step

Verified Expert Solution

Question

1 Approved Answer

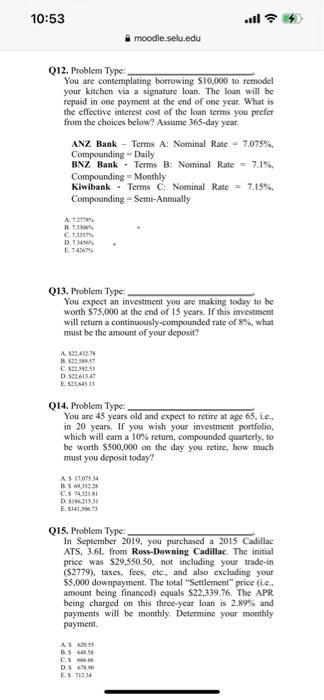

use the eqation approach , show work 10:53 moodle.selu.edu Q12. Problem Type: You are contemplating borrowing $10,000 to remodel your kitchen via a signature loan.

use the eqation approach , show work

10:53 moodle.selu.edu Q12. Problem Type: You are contemplating borrowing $10,000 to remodel your kitchen via a signature loan. The loan will be repaid in one payment at the end of one year. What is the effective interest cost of the loan terms you prefer from the choices below? Assume 365-day year ANZ Bank - Terms A: Nominal Rate 7.075% Compounding - Daily BNZ Bank Terms B: Nominal Rate = 7.1% Compounding Monthly Kiwibank Terms & Nominal Rate = 7.15%, Compounding - Semi-Annually A. 12 117.30 C.735 1.450 LTA Q13. Problem Type: You expect an investment you are making today to be worth $75,000 at the end of 15 years. If this investment will return a continuously-compounded rate of 8%, what must be the amount of your deposit? 1.59242 1.522.590.57 C. $22.923 D53261147 E53,633 Q14. Problem Type: You are 45 years old and expect to retire at age 65, 1.c.. in 20 years. If you wish your investment portfolio, which will cam a 10% rly, be worth $500,000 on the day you retire, how much must you deposit today! AS IT04 I$ 35 C.SI DS E $4.50.13 Q15. Problem Type: In September 2019, you purchased a 2015 Cadillac ATS, 3.61 from Ross-Downing Cadillac. The initial price was $29,550.50. not including your trade-in (52779), taxes, fees, etc., and also excluding your $5,000 downpayment. The total "Settlement price i.c. amount being financed) equals 22,339.76. The APR being charged on this three-year loan is 2.89% and payments will be monthly Determine your monthly payment AS BS C.S. DI ILS 91214 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started