Use the Excel Spreadsheet ONLY to solve the problems. The 1st problem requires to use IRR and GOAL SEEK.

Please HELP. Thanks.

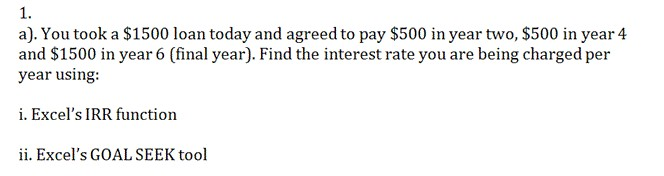

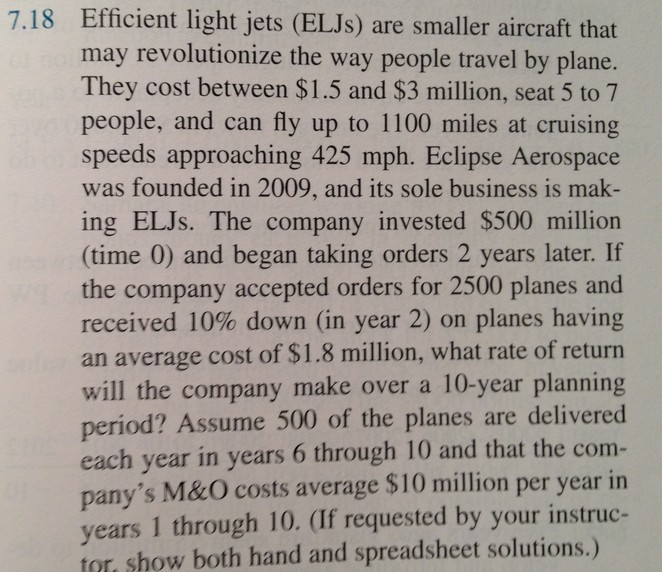

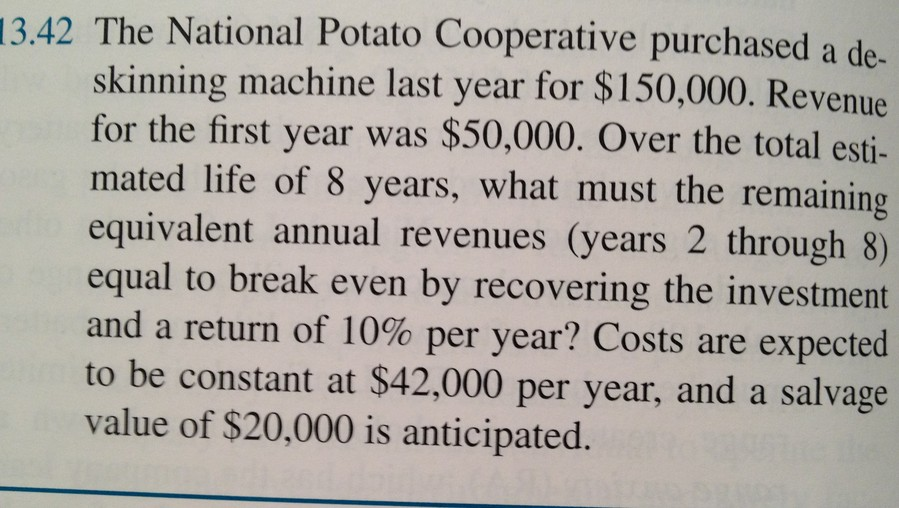

You took a $1500 loan today and agreed to pay $500 in year two, $500 in year 4 and $1500 in year 6 (final year). Find the interest rate you are being charged per year using: Excel's IRR function Excel's GOAL SEEK tool Efficient light jets (ELJs) are smaller aircraft that may revolutionize the way people travel by plane. They cost between $1.5 and $3 million, seat 5 to 7 people, and can fly up to 1100 miles at cruising speeds approaching 425 mph. Eclipse Aerospace was founded in 2009, and its sole business is making ELJs. The company invested $500 million (time 0) and began taking orders 2 years later. If the company accepted orders for 2500 planes and received 10% down (in year 2) on planes having an average cost of $1.8 million, what rate of return will the company make over a 10-year planning period? Assume 500 of the planes are delivered each year in years 6 through 10 and that the company's M&O costs average $10 million per year in years 1 through 10. (If requested by your instructor show both hand and spreadsheet solutions.) The National Potato Cooperative purchased a de- skinning machine last year for $ 150,000. Revenue for the first year was $50,000. Over the total estimated life of 8 years, what must the remaining equivalent annual revenues (years 2 through 8) equal to break even by recovering the investment and a return of 10% per year? Costs are expected to be constant at $42,000 per year, and a salvage value of $20,000 is anticipated. You took a $1500 loan today and agreed to pay $500 in year two, $500 in year 4 and $1500 in year 6 (final year). Find the interest rate you are being charged per year using: Excel's IRR function Excel's GOAL SEEK tool Efficient light jets (ELJs) are smaller aircraft that may revolutionize the way people travel by plane. They cost between $1.5 and $3 million, seat 5 to 7 people, and can fly up to 1100 miles at cruising speeds approaching 425 mph. Eclipse Aerospace was founded in 2009, and its sole business is making ELJs. The company invested $500 million (time 0) and began taking orders 2 years later. If the company accepted orders for 2500 planes and received 10% down (in year 2) on planes having an average cost of $1.8 million, what rate of return will the company make over a 10-year planning period? Assume 500 of the planes are delivered each year in years 6 through 10 and that the company's M&O costs average $10 million per year in years 1 through 10. (If requested by your instructor show both hand and spreadsheet solutions.) The National Potato Cooperative purchased a de- skinning machine last year for $ 150,000. Revenue for the first year was $50,000. Over the total estimated life of 8 years, what must the remaining equivalent annual revenues (years 2 through 8) equal to break even by recovering the investment and a return of 10% per year? Costs are expected to be constant at $42,000 per year, and a salvage value of $20,000 is anticipated