Answered step by step

Verified Expert Solution

Question

1 Approved Answer

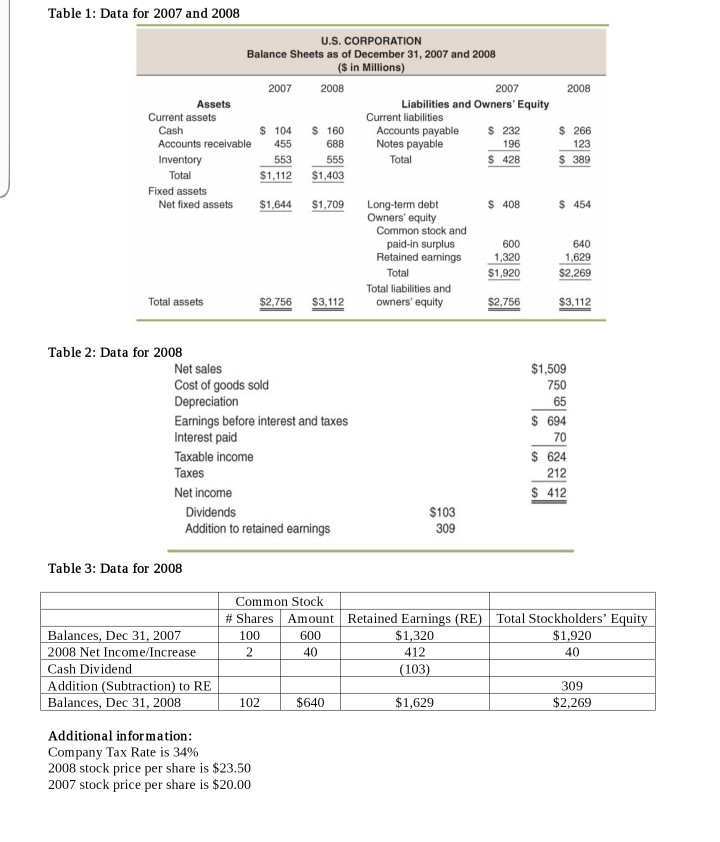

use the FCF formula & solve for 2008 FCF Table 1: Data for 2007 and 2008 U.S. CORPORATION Balance Sheets as of December 31, 2007

use the FCF formula & solve for 2008 FCF

Table 1: Data for 2007 and 2008 U.S. CORPORATION Balance Sheets as of December 31, 2007 and 2008 (S in Millions) 2007 2008 2007 2008 Liabilities and Owners' Equity Assets Current liabilities Accounts payable Notes payable Total Current assets S 232 $ 266 Cash $104 $160 Accounts receivable 455 688 196 123 $ 389 $ 428 Inventory 553 555 Total $1,112 $1,403 Fixed assets S 408 S 454 Net fixed assets $1,644 $1,709 Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings 600 640 1,320 1,629 $1,920 Total $2,269 Total liabilities and Total assets $2,756 $3,112 owners' equity $2,756 $3,112 Table 2: Data for 2008 $1,509 Net sales Cost of goods sold Depreciation 750 65 Earnings before interest and taxes Interest paid $ 694 70 $624 212 Taxable income Taxes $412 Net income $103 309 Dividends Addition to retained earnings Table 3: Data for 2008 Common Stock Amount Retained Earnings (RE) $1,320 Total Stockholders' Equity $1,920 # Shares Balances, Dec 31, 2007 2008 Net Income/Increase Cash Dividend Addition (Subtraction) to RE Balances, Dec 31, 2008 100 600 2 40 412 40 (103) 309 $640 $1,629 $2,269 102 Additional information: Company Tax Rate is 34% 2008 stock price per share is $23.50 2007 stock price per share is $20.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started