Answered step by step

Verified Expert Solution

Question

1 Approved Answer

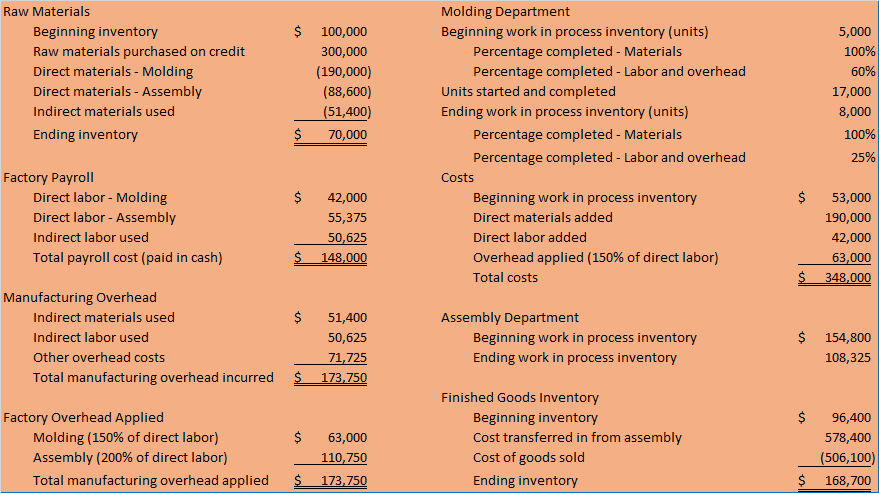

Use the FIFO Method to assign costs. Pirate Manufacturing Company is a maker of plastic figurine collectibles for the sports and entertainment industries, and they

Use the FIFO Method to assign costs. Pirate Manufacturing Company is a maker of plastic figurine collectibles for the sports and entertainment industries, and they use process costing (FIFO Method to assign cost flows).

Pirate Manufacturing produces their goods by having them pass through a molding process and then through an assembly process.Information related to its manufacturing activities for the month July are as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started