Answered step by step

Verified Expert Solution

Question

1 Approved Answer

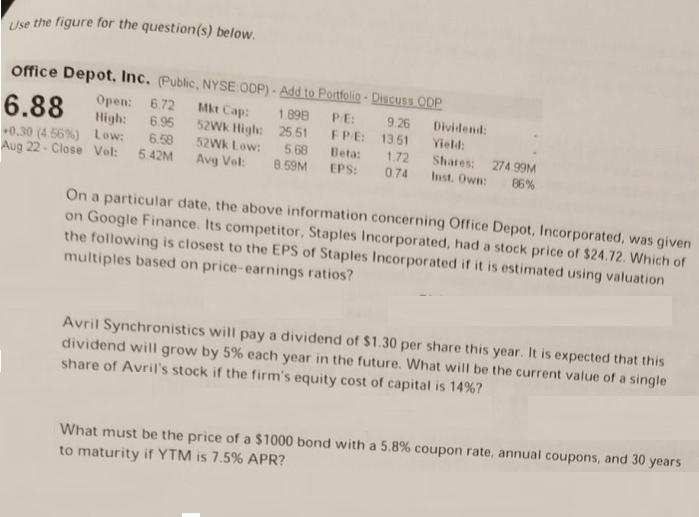

Use the figure for the question(s) below. Office Depot, Inc. (Public, NYSE ODP)- Add to Portfolio - Discuss ODP Dividend: PE: 9.26 FPE: 13.51

Use the figure for the question(s) below. Office Depot, Inc. (Public, NYSE ODP)- Add to Portfolio - Discuss ODP Dividend: PE: 9.26 FPE: 13.51 Yield: Mkt Cap: 52Wk High: 25.51 1.898 5.68 Avg Vol: 8.59M 52Wk Low: Beta: 1.72 Shares: 274.99M EPS: 0.74 Inst. Own: 86% Open: 6.72 6.88 High: 6.95 +0.30 (4.56%) Low: 6.58 Aug 22 Close Vol: 5.42M On a particular date, the above information concerning Office Depot, Incorporated, was given on Google Finance. Its competitor, Staples Incorporated, had a stock price of $24.72. Which of the following is closest to the EPS of Staples Incorporated if it is estimated using valuation multiples based on price-earnings ratios? Avril Synchronistics will pay a dividend of $1.30 per share this year. It is expected that this dividend will grow by 5% each year in the future. What will be the current value of a single share of Avril's stock if the firm's equity cost of capital is 14%? What must be the price of a $1000 bond with a 5.8 % coupon rate, annual coupons, and 30 years to maturity if YTM is 7.5% APR?

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1The given figure does not provide the PE ratio for Staples Incorporated so it is impossible to esti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started