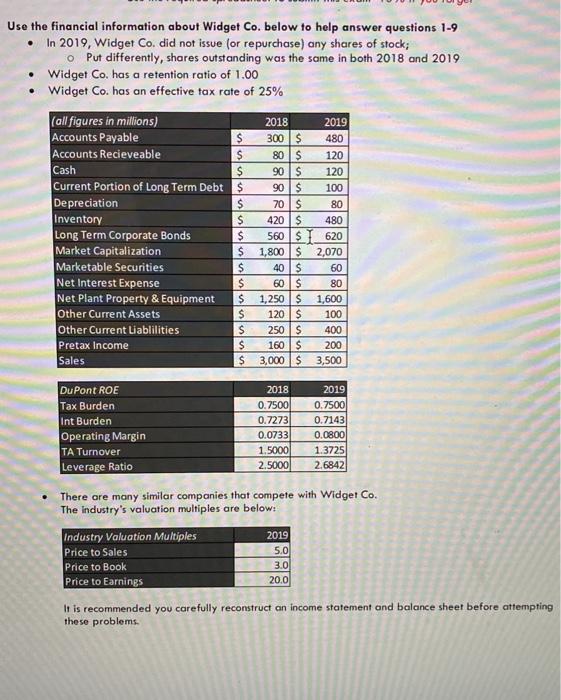

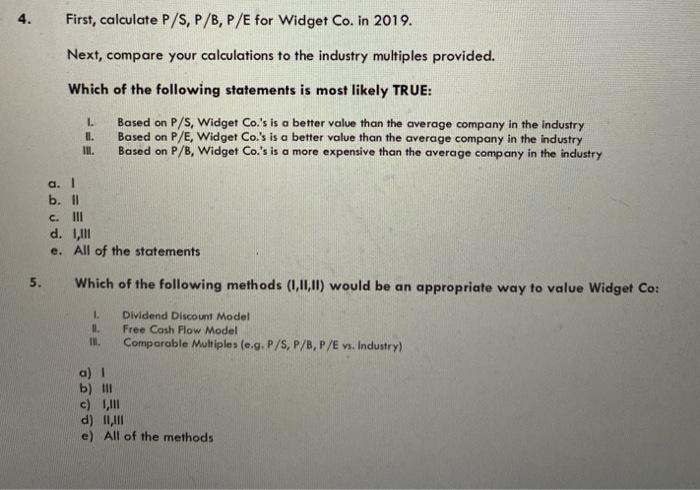

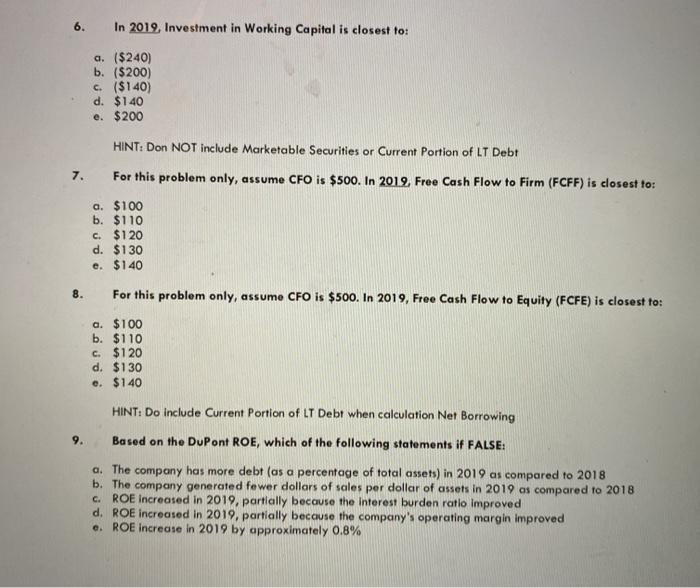

. Use the financial information about Widget Co. below to help answer questions 1-9 In 2019, Widger Co. did not issue (or repurchase) any shares of stock; o Put differently, shares outstanding was the same in both 2018 and 2019 Widget Co. has a retention ratio of 1.00 Widget Co. has an effective tax rate of 25% (all figures in millions) 2018 2019 Accounts Payable $ 300$ 480 Accounts Recieveable $ 80S 120 Cash S 90S 120 Current Portion of Long Term Debt $ 90$ 100 Depreciation $ 70$ 80 Inventory $ 420 $ 480 Long Term Corporate Bonds $ 560 SI 620 Market Capitalization $ 1,800 $ 2,070 Marketable Securities 40 $ 60 Net Interest Expense $ 60 $ 80 Net Plant Property & Equipment 1,250 $ 1,600 Other Current Assets $ 120$ 100 Other Current Liablilities 250S Pretax Income 160 $ 200 Sales 3,000 $ 3,500 uuuuuuuuuuu 400 DuPont ROE 2018 2019 Tax Burden 0.7500 0.7500 Int Burden 0.7273 0.7143 Operating Margin 0.0733 0.0800 TA Turnover 1.5000 1.3725 Leverage Ratio 2.5000 2.6842 There are many similar companies that compete with Widget Co. The Industry's valuation multiples are below! Industry Valuation Multiples 2019 Price to Sales 5.0 Price to Book 3.0 Price to Earnings 20.0 It is recommended you carefully reconstruct an income statement and balance sheet before attempting these problems. 4. First, calculate P/S, P/B, P/E for Widget Co. in 2019. Next, compare your calculations to the industry multiples provided. Which of the following statements is most likely TRUE: L II. INI. Based on P/S, Widget Co.'s is a better value than the average company in the industry Based on P/E, Widget Co.'s is a better value than the average company in the industry Based on P/B, Widget Co.'s is a more expensive than the average company in the industry a. b. 1 C. III d. 1,111 e. All of the statements 5. Which of the following methods (1,11,11) would be an appropriate way to value Widget Co: 1. . II. Dividend Discount Model Free Cash Flow Model Comparable Multiples (e.g. P/S, P/B, P/E v. Industry) a) 1 b) III c) III d) III e) All of the methods 6. In 2019. Investment in Working Capital is closest to: a. ($240) b. ($200) c. ($140) d. $140 e. $200 HINT: Don NOT include Marketable Securities or Current Portion of LT Debt 7. For this problem only, assume CFO is $500. In 2019. Free Cash Flow to Firm (FCFF) is closest to: a. $100 b. $110 C. $120 d. $130 e. $140 8. For this problem only, assume CFO is $500. In 2019, Free Cash Flow to Equity (FCFE) is closest to: a. $100 b. $110 c. $120 d. $130 e. $140 HINT: Do include Current Portion of LT Debt when calculation Net Borrowing 9. Based on the DuPont ROE, which of the following statements if FALSE: a. The company has more debt (as a percentage of total assets) in 2019 as compared to 2018 b. The company generated fewer dollars of sales per dollar of assets in 2019 as compared to 2018 c. ROE Increased in 2019, partially because the interest burden ratlo improved d. ROE increased in 2019, partially because the company's operating margin improved e. ROE increase in 2019 by approximately 0.8% . Use the financial information about Widget Co. below to help answer questions 1-9 In 2019, Widger Co. did not issue (or repurchase) any shares of stock; o Put differently, shares outstanding was the same in both 2018 and 2019 Widget Co. has a retention ratio of 1.00 Widget Co. has an effective tax rate of 25% (all figures in millions) 2018 2019 Accounts Payable $ 300$ 480 Accounts Recieveable $ 80S 120 Cash S 90S 120 Current Portion of Long Term Debt $ 90$ 100 Depreciation $ 70$ 80 Inventory $ 420 $ 480 Long Term Corporate Bonds $ 560 SI 620 Market Capitalization $ 1,800 $ 2,070 Marketable Securities 40 $ 60 Net Interest Expense $ 60 $ 80 Net Plant Property & Equipment 1,250 $ 1,600 Other Current Assets $ 120$ 100 Other Current Liablilities 250S Pretax Income 160 $ 200 Sales 3,000 $ 3,500 uuuuuuuuuuu 400 DuPont ROE 2018 2019 Tax Burden 0.7500 0.7500 Int Burden 0.7273 0.7143 Operating Margin 0.0733 0.0800 TA Turnover 1.5000 1.3725 Leverage Ratio 2.5000 2.6842 There are many similar companies that compete with Widget Co. The Industry's valuation multiples are below! Industry Valuation Multiples 2019 Price to Sales 5.0 Price to Book 3.0 Price to Earnings 20.0 It is recommended you carefully reconstruct an income statement and balance sheet before attempting these problems. 4. First, calculate P/S, P/B, P/E for Widget Co. in 2019. Next, compare your calculations to the industry multiples provided. Which of the following statements is most likely TRUE: L II. INI. Based on P/S, Widget Co.'s is a better value than the average company in the industry Based on P/E, Widget Co.'s is a better value than the average company in the industry Based on P/B, Widget Co.'s is a more expensive than the average company in the industry a. b. 1 C. III d. 1,111 e. All of the statements 5. Which of the following methods (1,11,11) would be an appropriate way to value Widget Co: 1. . II. Dividend Discount Model Free Cash Flow Model Comparable Multiples (e.g. P/S, P/B, P/E v. Industry) a) 1 b) III c) III d) III e) All of the methods 6. In 2019. Investment in Working Capital is closest to: a. ($240) b. ($200) c. ($140) d. $140 e. $200 HINT: Don NOT include Marketable Securities or Current Portion of LT Debt 7. For this problem only, assume CFO is $500. In 2019. Free Cash Flow to Firm (FCFF) is closest to: a. $100 b. $110 C. $120 d. $130 e. $140 8. For this problem only, assume CFO is $500. In 2019, Free Cash Flow to Equity (FCFE) is closest to: a. $100 b. $110 c. $120 d. $130 e. $140 HINT: Do include Current Portion of LT Debt when calculation Net Borrowing 9. Based on the DuPont ROE, which of the following statements if FALSE: a. The company has more debt (as a percentage of total assets) in 2019 as compared to 2018 b. The company generated fewer dollars of sales per dollar of assets in 2019 as compared to 2018 c. ROE Increased in 2019, partially because the interest burden ratlo improved d. ROE increased in 2019, partially because the company's operating margin improved e. ROE increase in 2019 by approximately 0.8%