Answered step by step

Verified Expert Solution

Question

1 Approved Answer

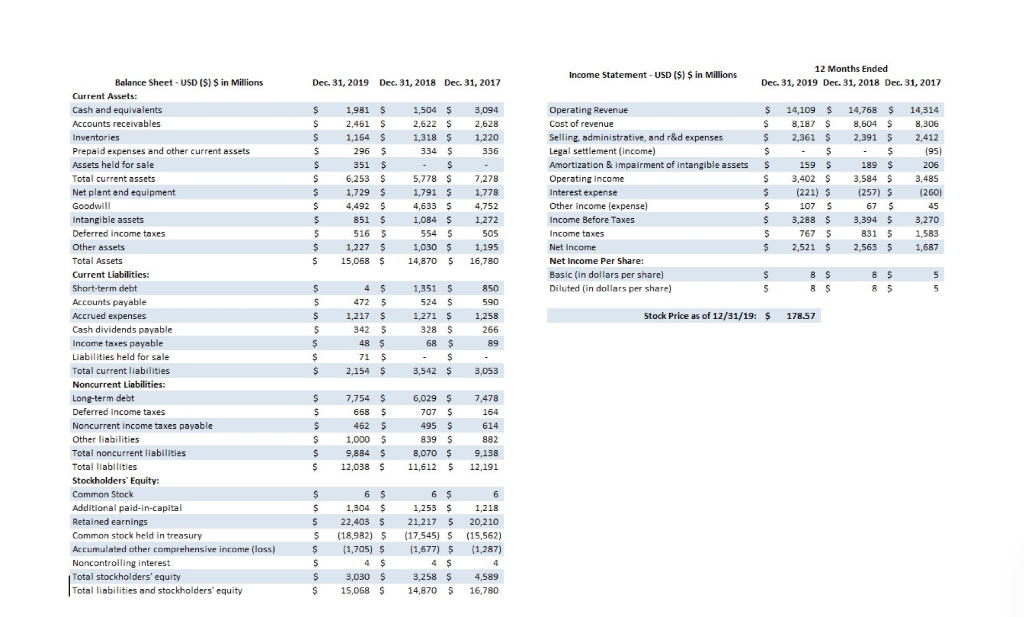

Use the financial information for Illinois Tool Works (ticker: ITW) shown below. You want to better understand the profitability of ITW's operations. What is their

Use the financial information for Illinois Tool Works (ticker: ITW) shown below. You want to better understand the profitability of ITW's operations. What is their Economic Value Added (EVA) for 2019? Assume an ROA Spread of 8.25%, that all Current Liabilities are non-interest bearing other than short-term debt, and that the amount of excess cash is unknown (which means what for the excess cash portion of the calculation?). State your answer in millions (as shown on the Financial Statements) with one decimal place of accuracy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started