Answered step by step

Verified Expert Solution

Question

1 Approved Answer

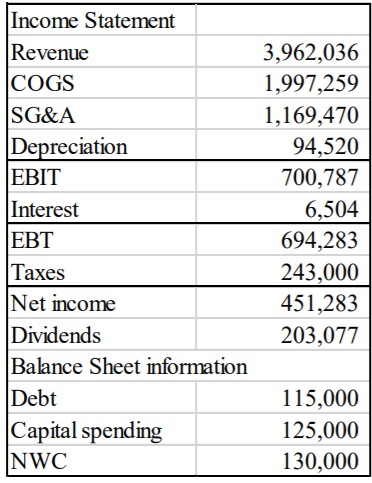

Use the Financial statement attached Assume that there are 125,000 shares outstanding and the firms P/E ratio is 8.0. The estimated growth rate of the

Use the Financial statement attached

Assume that there are 125,000 shares outstanding and the firms P/E ratio is 8.0. The estimated growth rate of the company is 3%, and its WACC is 9%.

Calculate EPS and use the P/E ratio.

Calculate FCF and a constant growth rate model. (Remember to subtract the value of debt to find your estimate of equity value.)

Income Statement Revenue COGS SG&A Depreciation EBIT Interest EBT Taxes Net income Dividends Balance Sheet information Debt Capital spending NWC 3,962,036 1,997,259 1,169,470 94,520 700,787 6,504 694,283 243,000 451,283 203,077 115,000 125,000 130,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started