Question

Use the financial statements/asset size you received for your group to determine what type of organizational structure you will create for your business. I gave

Use the financial statements/asset size you received for your group to determine what type of organizational structure you will create for your business. I gave you an income and Balance Sheet amount to use for this part of the milestone (MS). Make sure to consider any legal requirements that may impact your entity choice based on the current tax policy discussed in the readings and in class. We will not venture very far into the U.S. tax code.

Explain the organization structure of your development/construction firm. Is this an LLC, C-Corp, S-Corp?

Please thoroughly explain each question.

- Is the firm a single entity?

- Is it two entities with a common ownership?

- What is the formal and legal ownership of the firm?

- What is the justification for your entity choice?

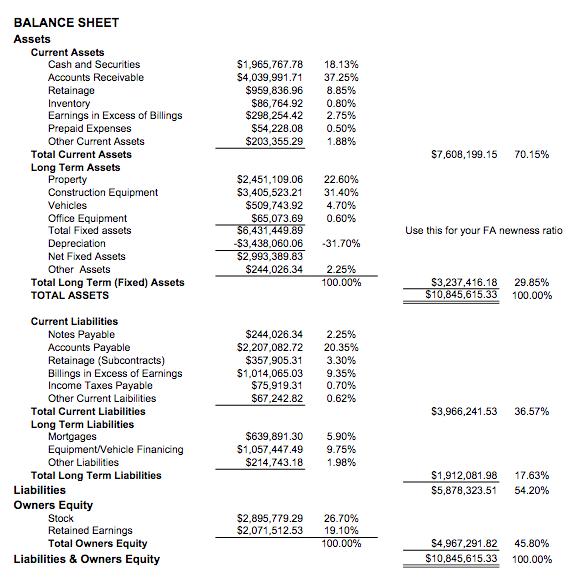

BALANCE SHEET Assets Current Assets Cash and Securities Accounts Receivable Retainage Inventory Earnings in Excess of Billings Prepaid Expenses Other Current Assets Total Current Assets Long Term Assets Property Construction Equipment Vehicles Office Equipment Total Fixed assets Depreciation Net Fixed Assets Other Assets Total Long Term (Fixed) Assets TOTAL ASSETS Current Liabilities Notes Payable Accounts Payable Retainage (Subcontracts) Billings in Excess of Earnings Income Taxes Payable Other Current Laibilities Total Current Liabilities Long Term Liabilities. Mortgages Equipment/Vehicle Finanicing Other Liabilities Total Long Term Liabilities Liabilities Owners Equity Stock Retained Earnings Total Owners Equity Liabilities & Owners Equity $1,965,767.78 18.13% $4,039,991.71 37.25% $959,836.96 8.85% $86,764.92 0.80% $298,254.42 2.75% $54,228.08 0.50% $203,355.29 1.88% $2,451,109.06 22.60% $3,405,523.21 31.40% $509,743.92 4.70% $65,073.69 0.60% $6,431,449.89 -$3,438,060.06 -31.70% $2,993,389.83 $244,026.34 2.25% 100.00% $244,026.34 2.25% $2,207,082.72 20.35% $357,905.31 3.30% $1,014,065.03 9.35% $75,919.31 0.70% $67,242.82 0.62% $639,891.30 5.90% $1,057,447.49 9.75% $214,743.18 1.98% $2,895,779.29 $2,071,512.53 26.70% 19.10% 100.00% $7,608,199.15 70.15% Use this for your FA newness ratio $3,237,416.18 29.85% $10,845,615.33 100.00% $3,966,241.53 36.57% $1,912,081.98 17.63% $5,878,323.51 54.20% $4,967,291.82 45.80% $10,845,615.33 100.00%

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER The organization structure of the developmentconstruction firm is an SCorp This is because the size and legal complexity of the business requir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started