Answered step by step

Verified Expert Solution

Question

1 Approved Answer

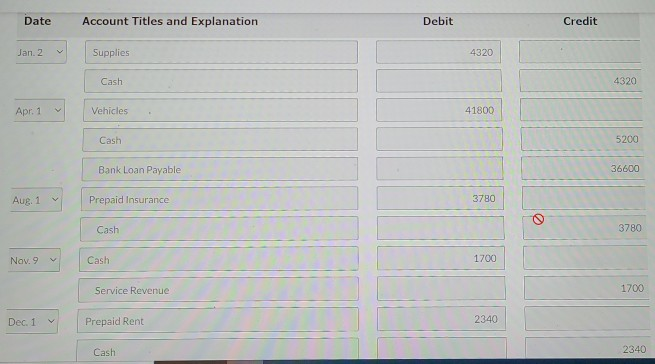

use the first photo to answer the blanks in the 2nd and 3rd photo. as I filled them in but they are outlined in red

use the first photo to answer the blanks in the 2nd and 3rd photo. as I filled them in but they are outlined in red if they are wrong

here is the question

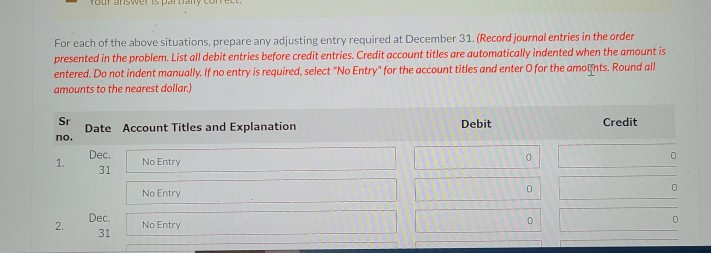

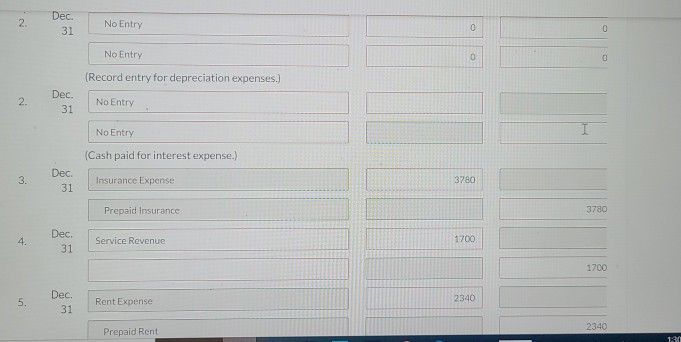

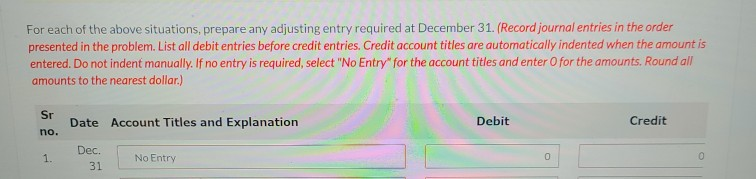

ve is par For each of the above situations, prepare any adjusting entry required at December 31. (Record journal entries in the order presented in the problem. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round all amounts to the nearest dollar) Sr Debit Credit Date Account Titles and Explanation no. 0 1 Dec. 31 No Entry 0 0 No Entry 0 0 N Dec 31 No Entry 2 Dec. 31 No Entry 0 0 No Entry 0 (Record entry for depreciation expenses.) 2. Dec. 31 No Entry No Entry (Cash paid for interest expense. 3. Dec. 31 Insurance Expense 3780 Prepaid Insurance 3780 4. Dec. 31 Service Revenue 1700 1700 5. Dec. 31 Rent Expense 2340 2340 Prepaid Rent 13 For each of the above situations, prepare any adjusting entry required at December 31. (Record journal entries in the order presented in the problem. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts. Round all amounts to the nearest dollar.) Sr Date Account Titles and Explanation Debit Credit no. 1. Dec. 31 No Entry 0 ve is par For each of the above situations, prepare any adjusting entry required at December 31. (Record journal entries in the order presented in the problem. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round all amounts to the nearest dollar) Sr Debit Credit Date Account Titles and Explanation no. 0 1 Dec. 31 No Entry 0 0 No Entry 0 0 N Dec 31 No Entry 2 Dec. 31 No Entry 0 0 No Entry 0 (Record entry for depreciation expenses.) 2. Dec. 31 No Entry No Entry (Cash paid for interest expense. 3. Dec. 31 Insurance Expense 3780 Prepaid Insurance 3780 4. Dec. 31 Service Revenue 1700 1700 5. Dec. 31 Rent Expense 2340 2340 Prepaid Rent 13 For each of the above situations, prepare any adjusting entry required at December 31. (Record journal entries in the order presented in the problem. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts. Round all amounts to the nearest dollar.) Sr Date Account Titles and Explanation Debit Credit no. 1. Dec. 31 No Entry 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started