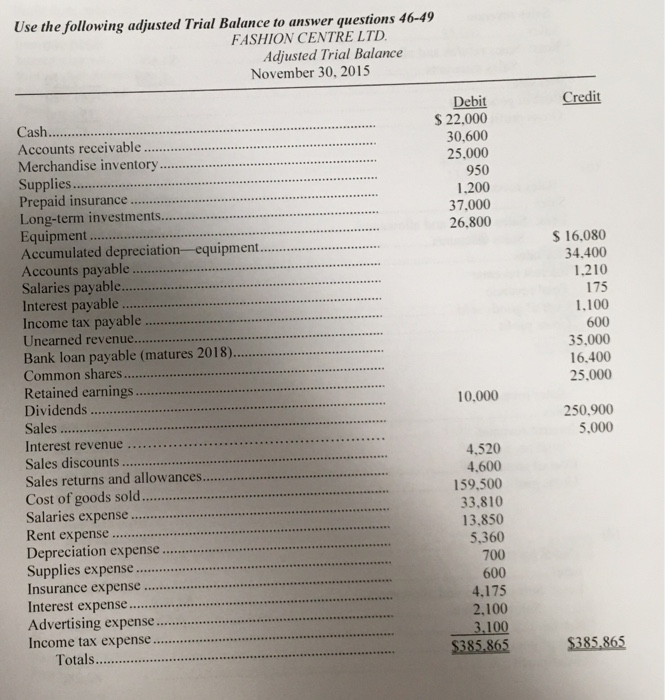

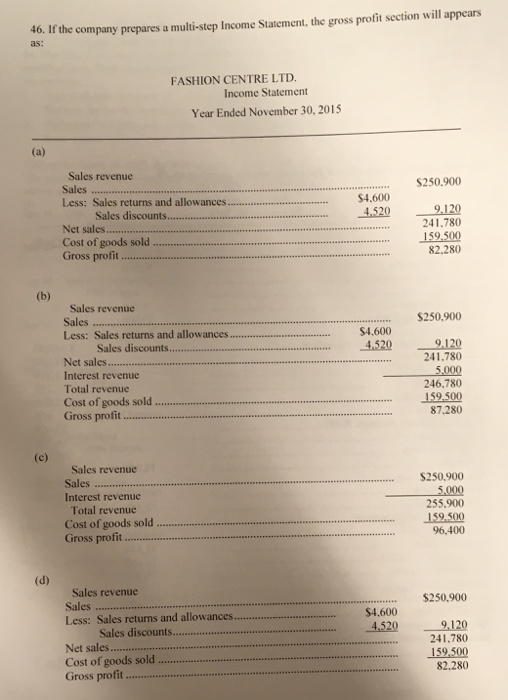

Use the following adjusted Trial Balance to answer questions 46-49 FASHION CENTRE LTD. Adjusted Trial Balance November 30, 2015 Credit Debit $ 22,000 30,600 25,000 950 1.200 37.000 26.800 Cash.. Accounts receivable Merchandise inventory.. Supplies................ Prepaid insurance .................... Long-term investments.................. Equipment ............. Accumulated depreciation equipment. Accounts payable... Salaries payable............ Interest payable ... Income tax payable ................... Unearned revenue............ Bank loan payable (matures 2018).... Common shares....... Retained earnings Dividends ................. Sales ................. Interest revenue ...................... Sales discounts ....................... Sales returns and allowances. Cost of goods sold.... Salaries expense Rent expense. Depreciation expense ........ Supplies expense. Insurance expense .. Interest expense......... Advertising expense..... Income tax expense. Totals................ $ 16.080 34,400 1.210 175 1,100 600 35,000 16.400 25.000 10,000 250,900 5,000 4.520 4.600 159.500 33,810 13,850 5,360 700 600 4.175 2,100 3.100 $385.865 $385.865 40. If the company prepares a multi-step Income Statement, the gross profit section will appears as: FASHION CENTRE LTD. Income Statement Year Ended November 30, 2015 $250,900 Sales revenue Sales Less: Sales returns and allowances. Sales discounts...... Net sales .................... Cost of goods sold ........ Gross profit ........ 54.600 4.520 9.120 241.780 159.500 82.280 (b) $250.900 $4,600 4.520 Sales revenue Sales ... Less: Sales returns and allowances........ Sales discounts........ Net sales...... Interest revenue Total revenue Cost of goods sold ..... Gross profit... 9.120 241.780 5.000 246.780 159.500 87.280 Sales revenue Sales .............. Interest revenue Total revenue Cost of goods sold .. Gross profit ........... $250.900 5.000 255.900 159.500 96.400 (d) $250.900 $4,600 4,520 Sales revenue Sales ... Less: Sales returns and allowances.... Sales discounts......... Net sales ............... ... Cost of goods sold ...................... Gross profit............. 9,120 241.780 159.500 82.280