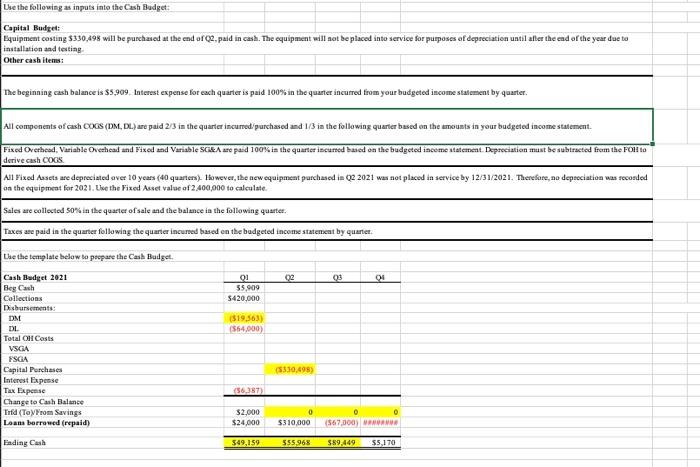

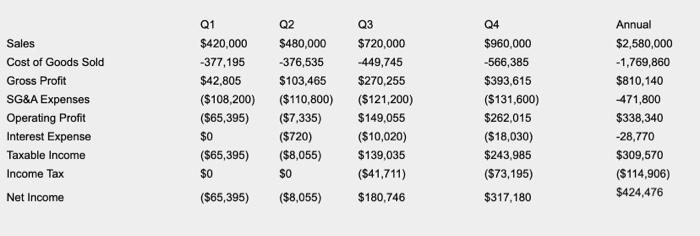

Use the following as inputs into the Cash Budget Capital Budget: Equipment costing 5330,498 will be purchased at the end of 2.paldin cash. The equipment will not be placed into service for purposes of depreciation until after the end of the year due to installation and testing Other cash items: The beginning cash balance is $5.909. Interest expense for each quarter is paid 100% in the quarter incurred from your budgeted income statement by quarter. All components of cash COGS (DOM, DL.) are paid 2/3 is the quarter incurred purchased and 1/3 in the following quartier based on the mounts in your budgeted income statement. Fixed Overhead, Variable Overhead and Fixed and Variable SCBA are pad 100% in the quarter iscursed based on the budgeted income statement. Depreciation must be subtracted from the Foltto derive cash COGS All Fixed Assets are depreciated over 10 years (40 quarters). However, the new equipment purchased in Q2 2021 was not placed in service by 12/31/2021. Therefore, no depreciation was recorded on the equipment for 2021. Use the Fixed Asset value of 2 400,000 to calculate Sales are collected 50% in the quarter ofsale and the balance in the following quarter. Taxes are paid in the quarter following the quarter incurred based on the budgeted income statement by quante Lae the template below to prepare the Cash Budget Q2 03 01 01 55,909 S420,000 (519,563) (564,000) Cash Budget 2021 Bey Cash Collections Disbursements: DM DL Total OH Costs VSGA ESGA Capital Purchases Interest Expense Tax Expense Change to Cash Balance Tifd (Toy From Savings Loans borrowed (repaid) (5310,495) (56.387) $2.000 $24,000 $310,000 (567.000) MAAMME Fading Cash 549,159 555,968 $89.449 $5,170 Q2 Q3 Q4 Sales Cost of Goods Sold Gross Profit SG&A Expenses Operating Profit Interest Expense Taxable income Income Tax Q1 $420,000 -377,195 $42,805 ($108,200) ($65,395) $0 ($65,395) $0 $480,000 -376,535 $103,465 ($110,800) ($7,335) ($720) ($8,055) $0 $720,000 -449,745 $270,255 ($121,200) $149,055 ($10,020) $139,035 ($41,711) $180,746 $960,000 -566,385 $393,615 ($131,600) $262.015 ($18,030) $243,985 ($73,195) Annual $2,580,000 -1,769,860 $810,140 471,800 $338,340 -28,770 $309,570 ($114,906) $424,476 Net Income ($65,395) ($8,055) $317,180