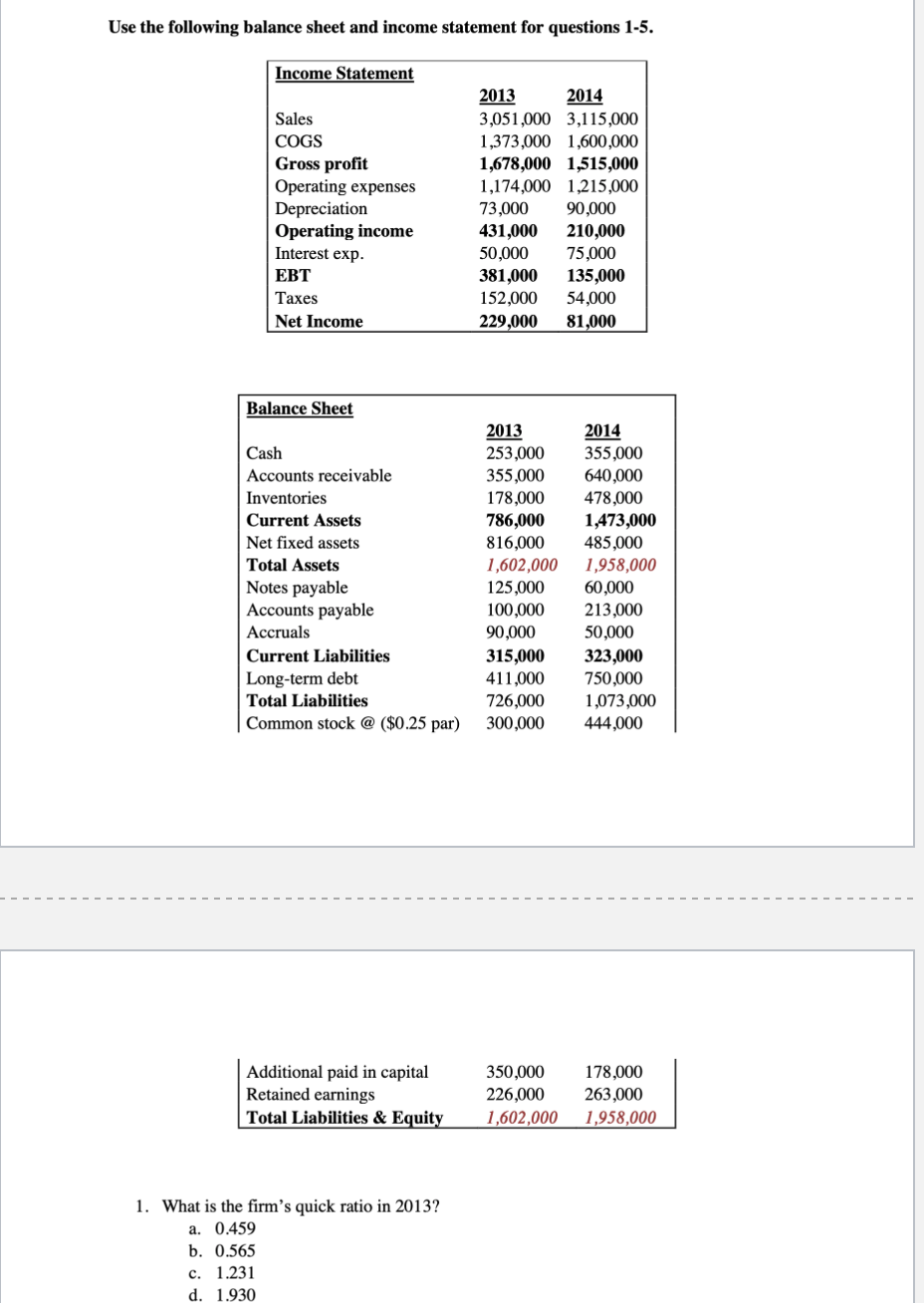

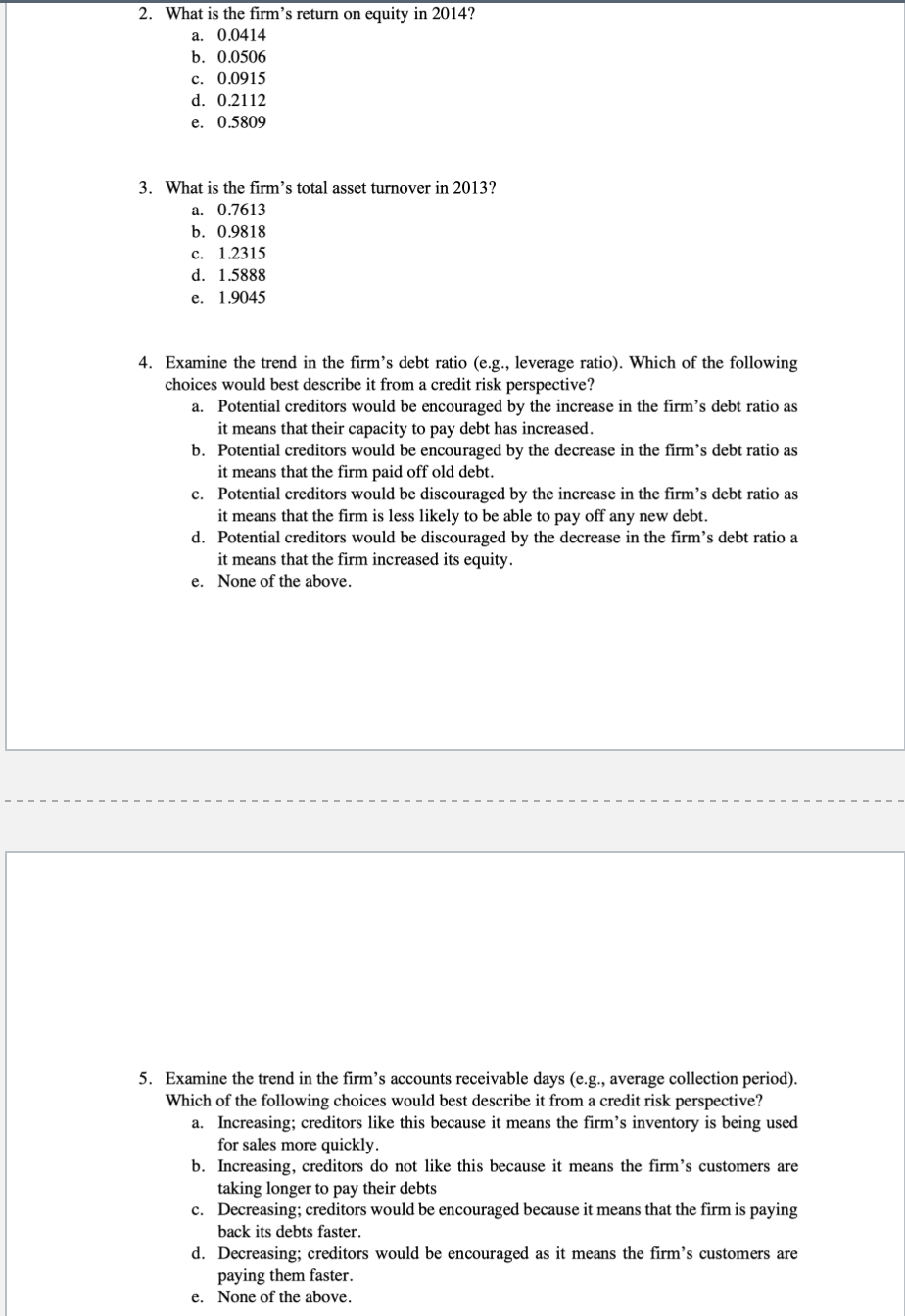

Use the following balance sheet and income statement for questions 1-5. Income Statement Sales COGS Gross profit Operating expenses Depreciation Operating income Interest exp. EBT Taxes Net Income 2013 2014 3,051,000 3,115,000 1,373,000 1,600,000 1,678,000 1,515,000 1,174,000 1,215,000 73,000 90,000 431,000 210,000 50,000 75.000 381,000 135,000 152,000 54,000 229,000 81,000 Balance Sheet Cash Accounts receivable Inventories Current Assets Net fixed assets Total Assets Notes payable Accounts payable Accruals Current Liabilities Long-term debt Total Liabilities Common stock @ ($0.25 par) 2013 253,000 355,000 178,000 786,000 816,000 1,602,000 125,000 100,000 90,000 315,000 411,000 726,000 300,000 2014 355,000 640,000 478,000 1,473,000 485,000 1,958,000 60,000 213,000 50,000 323,000 750,000 1,073,000 444,000 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Additional paid in capital Retained earnings Total Liabilities & Equity 350,000 226,000 1,602,000 178,000 263,000 1,958,000 1. What is the firm's quick ratio in 2013? a. 0.459 b. 0.565 c. 1.231 d. 1.930 2. What is the firm's return on equity in 2014? a. 0.0414 b. 0.0506 c. 0.0915 d. 0.2112 e. 0.5809 3. What is the firm's total asset turnover in 2013? a. 0.7613 b. 0.9818 c. 1.2315 d. 1.5888 e. 1.9045 4. Examine the trend in the firm's debt ratio (e.g., leverage ratio). Which of the following choices would best describe it from a credit risk perspective? a. Potential creditors would be encouraged by the increase in the firm's debt ratio as it means that their capacity to pay debt has increased. b. Potential creditors would be encouraged by the decrease in the firm's debt ratio as it means that the firm paid off old debt. c. Potential creditors would be discouraged by the increase in the firm's debt ratio as it means that the firm is less likely to be able to pay off any new debt. d. Potential creditors would be discouraged by the decrease in the firm's debt ratio a it means that the firm increased its equity. e. None of the above. 5. Examine the trend in the firm's accounts receivable days (e.g., average collection period). Which of the following choices would best describe it from a credit risk perspective? a. Increasing; creditors like this because it means the firm's inventory is being used for sales more quickly. b. Increasing, creditors do not like this because it means the firm's customers are taking longer to pay their debts c. Decreasing; creditors would be encouraged because it means that the firm is paying back its debts faster. d. Decreasing; creditors would be encouraged as it means the firm's customers are paying them faster. e. None of the above