Answered step by step

Verified Expert Solution

Question

1 Approved Answer

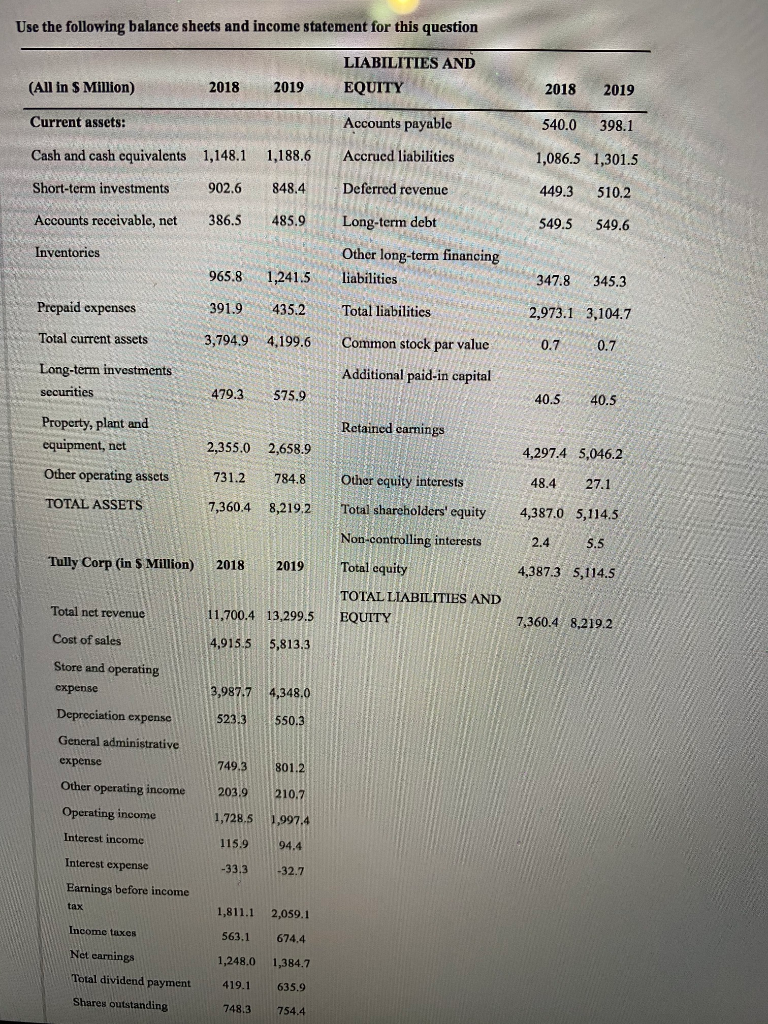

Use the following balance sheets and income statement for this question Calculate the firm's Economic Value Added (EVA) during 2019 given the firm's cost of

Use the following balance sheets and income statement for this question

Calculate the firm's Economic Value Added (EVA) during 2019 given the firm's cost of capital (WACC) is 10% and interpret the meaning of EVA for this firm investors.

Use the following balance sheets and income statement for this question LIABILITIES AND EQUITY (All in S Million) 2018 2019 2018 2019 Current assets: Accounts payable 540.0 398.1 Cash and cash equivalents 1,148.1 1,188.6 Accrued liabilities 1,086.5 1,301.5 Short-term investments 902.6 848.4 Deferred revenue 449.3 510.2 Accounts receivable, net 386.5 485.9 Long-term debt 549.5 549.6 Inventories Other long-term financing liabilities 965.8 1,241.5 347.8 345.3 Prepaid expenses 391.9 435.2 Total liabilities 2,973.1 3,104.7 Total current assets 3,794.9 4.199.6 Common stock par value 0.7 0.7 Long-term investments securities Additional paid-in capital 479.3 575.9 40.5 40.5 Property, plant and equipment, net Retained earnings 2,355.0 2,658.9 4,297.4 5,046.2 Other operating assets 731.2 784.8 Other equity interests 48.4 27.1 TOTAL ASSETS 7,360.4 8,219,2 Total shareholders' equity 4,387.0 5,114.5 Non-controlling interests 2.4 5.5 Tully Corp (in Million) 2018 2019 Total equity 4,387.3 5,114.5 Total net revenue 11,700.4 13,299.5 TOTAL LIABILITIES AND EQUITY 7,360.4 8,219.2 Cost of sales 4,915.5 5,813.3 3,987.7 4,348.0 523.3 550.3 Store and operating expense Depreciation expense General administrative expense Other operating income Operating income 749.3 801.2 203.9 210.7 1,728.5 1,997.4 Interest income 115.9 94.4 Interest expense -33.3 -32.7 Earnings before income tax 1,811.1 2,059.1 Income taxes 674.4 Net earnings 563.1 1,248.0 1,384.7 Total dividend payment Shares outstanding 419.1 635.9 748.3 754.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started