Question

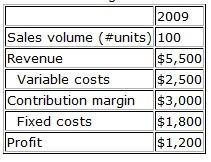

Use the following contribution margin statement for 2009: Required: a) How much is the price per unit, unit variable cost and unit contribution margin? price=

Use the following contribution margin statement for 2009:

Required: a) How much is the price per unit, unit variable cost and unit contribution margin? price= unit VC= unit CM= b) Write down the CVP relation: profit as a function of sales volume in units (fill in the missing numbers in an equation like: Profit = 2 *Volume - 50). Profit = *Volume - c) If sales volume increases by 20% (from 100 to 120), how much is the $ change in profits? d) What is the sales volume required to achieve target profit of $2,100? e) How much is the breakeven volume? Breakeven revenue? f) How much is the margin of safety (at current sales volume of 100 units)? (enter percentages as a fraction of 1, i.e., enter 23.47% as 0.2347) g) Based on the margin of safety computed in (f), will you start making a loss if sales drop by 30%? (enter 1 for yes, 2 for no) h) How much is the operating leverage (at current sales volume of 100 units)? (enter percentages as a fraction of 1, i.e., enter 23.47% as 0.2347) If fixed costs increase, will it increase or decrease the operating risk? (enter 1=increase, 2=decrease)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started